Agritech Funding Heats Up 🌱, China’s EV Surge⚡, GoTo Bets Big on Fintech 💰

Dear Subscribers,

This week, we bring you the latest highlights shaping the startup landscape—from the revival of agritech funding in Indonesia to the latest global AI initiatives and GoTo’s strategic push towards profitability, now backed by its fintech arm.

As the digital economy continues to evolve, we hope this update helps you navigate the fast-changing market dynamics and uncover new opportunities.

Enjoy this week’s insights.

Best regards,

The DailySocial Team

🚨 Indonesia’s Startup Ecosystem: Key Updates

Agritech Funding Heats Up Again. Two Indonesia-based agritech startups have secured fresh funding:

Elevarm, a startup focused on improving the productivity and sustainability of horticulture farmers, raised a US$4.25 million pre-Series A round led by Intudo Ventures, with participation from Insignia Ventures Partners and 500 Global. [Read More]

Agros, which develops solar-powered irrigation solutions for the agricultural sector, secured US$4.25 million in Series A funding led by Gaia Impact Fund, Schneider Electric Energy Access Asia, and Wavemaker Impact, with additional backing from Global Innovation Fund, Silverstrand Capital, and PropertyGuru Founder Steve Melhuish. [Read More]

India’s TVS Motor has fully acquired ION Mobility, a two-wheeler EV startup. The entire ION Mobility team will integrate into TVS Motor starting April 1, 2025, with Founder & CEO James Chan appointed as Senior Vice President, leading TVS Motor ASEAN and Platform ION M1-S. TVS Motor, which previously held a 34.5% stake in ION Mobility after its Series A funding in 2023, now consolidates its EV presence in Southeast Asia. This move reinforces the push for EV adoption in key markets, including Indonesia, where the government is actively accelerating electric two-wheeler adoption through subsidies and infrastructure expansion. [Read More]

Microsoft’s Indonesia Central cloud region (data center) is slated for launch in Q2 2025, joining Microsoft’s global Azure network of 60+ cloud regions worldwide. Other international cloud providers that already have data centers in Indonesia include AWS, Alibaba, Tencent, and Google Cloud Platform (GCP). [Read More]

👏 Regional & Global Tech Highlights

PvX Partners Secures $3.8M to Support Gaming & App Companies

PvX Partners, a financing platform for consumer applications, has raised US$3.8 million in seed funding, led by Play Ventures and General Catalyst, with participation from angel investors. The funds will accelerate the development of PvX Capital, a non-dilutive funding product based on Cohort Financing, designed to fuel the growth of gaming and app companies while distributing financial risk.

Grab Explores Autonomous Vehicles in Southeast Asia

Grab has signed an MoU with Autonomous A2Z, Motional, WeRide, and Zelos to explore autonomous vehicle (AV) applications in Southeast Asia. The collaboration will assess AV use cases in mobility and delivery services while ensuring integration with human drivers. Grab’s CEO Anthony Tan emphasized the need to evaluate the technology’s impact on the transport ecosystem while maintaining driver-partner involvement.

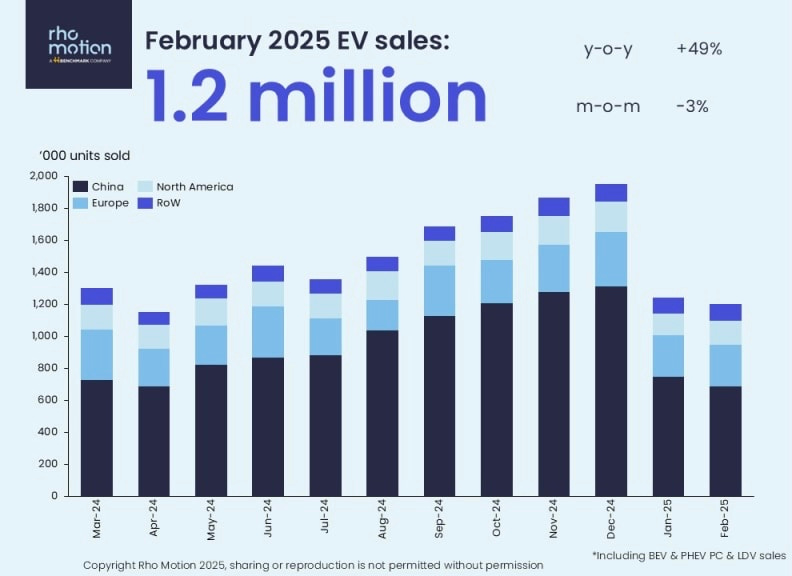

China’s EV Boom Accelerates

Global EV and hybrid sales hit 1.2 million units in February 2025, up 50% YoY, with China driving 75% of the total market. China’s EV sales surged 76%, led by new models from BYD, Xiaomi, Xpeng, and Zeekr. In January-February 2025, China sold 1.4 million EVs, accounting for 60% of global sales, while plug-in hybrid sales grew 22% YoY. Indonesia aims to deploy 2 million EVs and 12 million electric two-wheelers by 2030 to cut emissions and boost sustainability, with car sales rising 2.2% YoY in February 2025—the first growth since June 2023—driven by the increasing adoption of affordable EVs from Chinese brands like BYD and Chery.

Salesforce Commits $1B Investment in Singapore by 2030

Salesforce plans to invest $1 billion in Singapore by 2030 to boost AI adoption and workforce development. The initiative includes:

Expanding Agentforce and Hyperforce services to comply with local data regulations

Establishing AI training hubs and demo centers

Strengthening Salesforce’s AI Research division, which has been active in Singapore since 2019

🚀 What’s Next: Fintech Power Play, GOTO’s Bold Move Toward Full Profitability

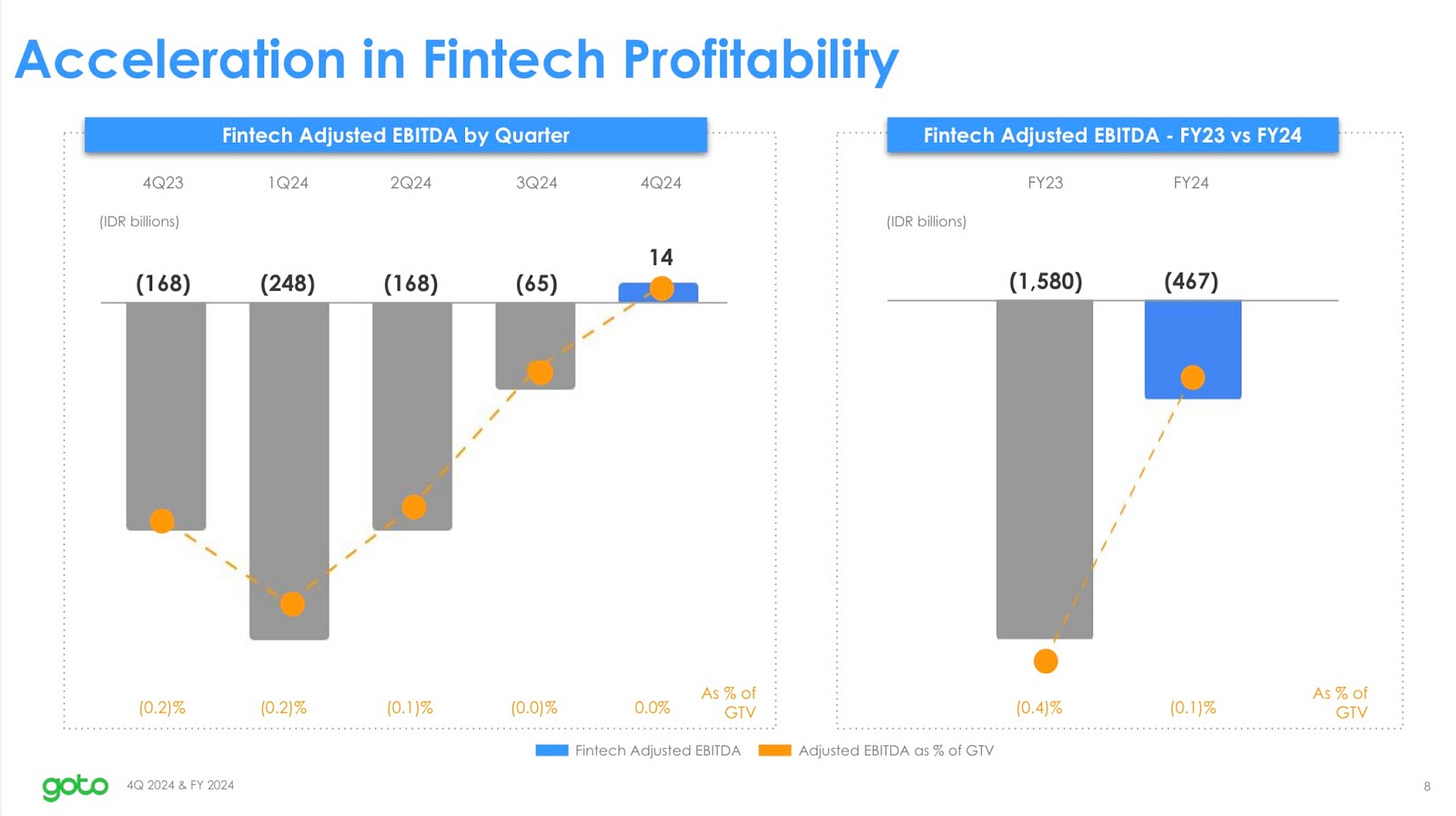

Following its sale of Tokopedia to TikTok, GoTo has fully shifted its focus to fintech, and the results are starting to show.

In Q4 2024, GoTo’s Financial Technology segment became profitable for the first time, with adjusted EBITDA reaching IDR 14 billion.

GoPay, now a standalone app, has driven this growth, with Monthly Transacting Users (MTUs) surging 35% YoY to 20.2 million.

Lending services boomed, with outstanding loans skyrocketing 172% YoY to IDR 5.2 trillion.

Fintech gross revenue nearly doubled (95% YoY) to IDR 3.7 trillion, fueled by increased transaction volumes and lending expansion.

Looking Ahead

GoTo aims to scale its lending business to IDR 8 trillion by end-2025, optimize digital payments, and cut costs through cloud migration. With a 30% YoY rise in total gross revenue (IDR 18.1 trillion) and improving EBITDA, the company is on track to hit its 2025 profitability target of IDR 1.4–1.6 trillion.

By making fintech its core business, GoTo has successfully transitioned from rapid expansion to a profit-driven model, positioning itself for long-term sustainable growth in Indonesia’s digital economy.

Download Indonesia Tech Startup Report 2025

Get the insights of what happened in 2024 and what to expect in 2025, this report summarizes everything you need to know about Indonesia’s tech Industry. Download now!