Bukalapak $39M consolidation 💼. ZUS Coffee expands 🌏. D2C funding rebounds 🚀

Dear subscribers,

We’re back with a roundup of key updates from Indonesia and the Southeast Asian startup ecosystem. From Bukalapak’s major consolidation move, shifts in food delivery trends, new ownership in fintech, regional expansion stories, to the rising promise of the D2C sector — here’s everything you need to stay ahead this week.

Best regards,

The DailySocial Team

🚨 What’s New

Here’s a roundup of notable developments from Indonesia’s startup ecosystem last week:

PT Bukalapak.com Tbk (IDX: BUKA) announced a capital injection of IDR 657.65 billion (~US$39 million) into nine subsidiaries to strengthen their competitiveness. The largest funding went to PT Buka Usaha Indonesia (BUI) with IDR 241.72 billion, followed by PT Anugerah Bisnis Cakrabuana (ABC) with IDR 220.34 billion, PT Buka Mitra Indonesia (BMI) with IDR 50.05 billion, and PT Buka Bangunan Indonesia (BBI) with IDR 30 billion. [Read More]

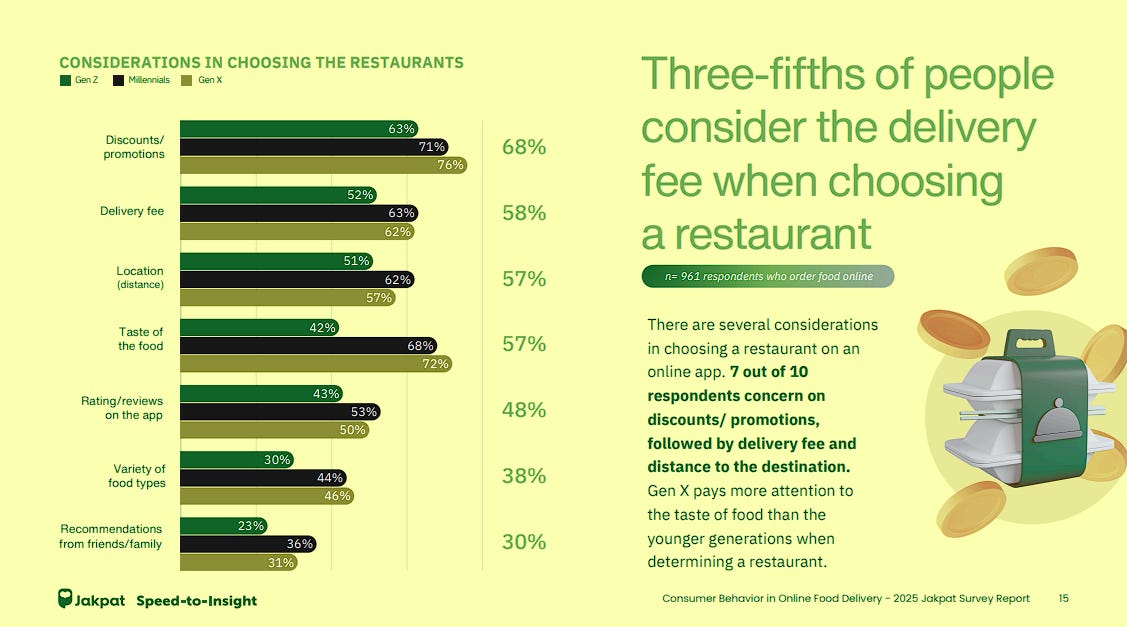

A new report by Jakpat Consumer Behavior in Online Food Delivery 2025 (n=1,343) shows discounts remain the key driver for ordering decisions. GoFood led usage in early 2025, surpassing ShopeeFood, whose popularity declined compared to two years ago. Gen Z users favored ShopeeFood, while GoFood was the top choice among Millennials and Gen X. [Read More]

South Korea's PFC Technologies Inc. acquired AIForesee, a credit scoring platform formerly developed by Investree. The sale follows Investree’s liquidation mandated by Indonesia’s Financial Services Authority (OJK) after financial troubles. AIForesee was originally launched in 2022 to support SME lending with enhanced credit assessments. [Read More]

The Global Data Centres Report 2025 by Knight Frank highlights Indonesia’s challenges in electricity stability and inconsistent regulations, hindering its growth compared to Malaysia, Singapore, Vietnam, and Thailand. However, Indonesia still holds significant market potential if infrastructure and regulatory improvements are made. [Read More]

Recent funding rounds

Se'Indonesia raised over US$9.5 million from investors including Insignia Ventures Partners, Argor (GoTo Group's CVC), and Trihill Capital. The beef-based food chain operates across Jabodetabek, Java, and Bali.

Funding Societies, the parent company of Modalku, secured an additional US$5 million from VNG Singapore, bringing their latest equity round to US$37.4 million. Previous backers include Gobi Partners and Cool Japan Fund.

👏 What’s Exciting

Notable developments from across the Southeast Asian region:

ZUS Coffee targets 200 new stores across Southeast Asia in 2025

After overtaking Starbucks as Malaysia’s largest coffee chain, ZUS Coffee plans aggressive regional expansion with over 100 new outlets in Malaysia, 80 in the Philippines, and six in Singapore, while entering Thailand and Indonesia. ZUS’ focus on affordability and strong online sales (70% of revenue) has been key to its success.FancyTech secures Series B+ funding and eyes Indonesia expansion

China-based FancyTech raised Series B+ funding led by GSR Ventures and Zhilin Capital, doubling its annual recurring revenue (ARR) to US$15 million in 2024. Indonesia is a priority market for its AI-driven visual content production platform, already adopted by local agencies like Brainchild Communication, Sideroom Studio, and Space and Shapes.

🚀 What’s Next: D2C, the Next Promising Sector After a 207% Funding Rebound in 2024

Southeast Asia’s D2C (Direct-to-Consumer) startup funding rebounded by 207% in 2024, reaching US$32.5 million. Although still below the US$128 million peak in 2022, this marks a strong recovery, driven mainly by late-stage rounds (US$19.5 million) that returned after a complete absence in 2023. Early-stage funding remained steady at $10 million, while seed-stage funding surged over 300% to US$3 million.

Indonesia’s rising middle-class consumers are increasingly seeking high-quality products, presenting significant opportunities for local D2C brands. Notable players include Sociolla (beauty), BASE (data-driven skincare), Compawnion (healthy pet food), UpBanx (financial services for D2C brands), and Hypefast (D2C brand aggregator).

D2C brands leverage customer data for product personalization and community building. Despite challenges such as uneven digital infrastructure and regulatory complexities, many are successfully localizing products and strengthening digital customer engagement.

Investors like East Ventures and Creative Gorilla Capital (CGC) are actively backing this sector. CGC, for instance, launched a US$15 million fund dedicated to D2C startups. Fashion brand Claude secured US$1.4 million in seed funding from CyberAgent Capital and Prima Fund I to support global expansion. Endeavor Indonesia is also supporting D2C founders through accelerator programs and global investor networks.

With strong consumer demand and growing investor interest, Indonesia’s D2C sector is poised for further growth and innovation.

Media Partner

Join global tech leaders and Southeast Asia’s boldest innovators at AI SEA 2025 in Bali (9–10 June) to shape the future of AI, blockchain, and emerging tech—get your ticket before prices rise on 10 April: Event Link.