Grab-GoTo merger talks resumes 🛵 eFishery takes in new management🎣 commoditization of LLMs 🤖

Dear Readers,

The AI race is heating up with new challengers like ByteDance’s Omnihuman and Deepseek entering the scene. Meanwhile, Indonesia’s startup ecosystem sees key developments—from eFishery’s internal review to deeptech investments and a potential Grab-GoTo merger that could reshape Southeast Asia’s digital landscape.

In this edition, we’ve compiled the latest updates and insights to keep you informed and ahead in the fast-evolving digital ecosystem.

Best regards,

The DailySocial Team

🚨 What’s New

eFishery has appointed FTI Consulting as interim management following a review of an internal fraud report. This move, approved by shareholders, ensures an independent evaluation of the company’s business and financial conditions. The Board of Directors stated that proactive steps have been taken to address the findings in the preliminary 52-page report by FTI Consulting, which alleged financial misreporting by the management. [Read More]

LIQUID8, a recommerce startup specializing in managing overstock and failed delivery products, recently raised seed funding from SPIL Ventures. This funding will help expand its services, enabling SMEs to access high-quality goods at affordable prices while promoting a circular economy in Indonesia. LIQUID8 is also launching a platform called Bulky to simplify transactions for SMEs and resellers. [Read More]

Grouu, a startup producing baby food and children’s snacks, recorded a revenue increase of more than 3x in 2024 with a positive EBITDA trend since Q2. It sold over 1.5 million units across various categories, including fresh meals, seasonings, and snacks. Grouu expanded its reach by partnering with 1,200 retail outlets in 50+ cities, including supermarkets and baby stores. [Read More]

Malaysian-based LiveIn has officially entered the Indonesian market with its innovative Offline-to-Online (O2O) model. The platform provides affordable and modern housing for young people while helping property owners increase rental income. LiveIn operates in Jakarta, Bogor, Depok, Tangerang, Bekasi, and Bandung, with around 1,000 rooms currently in its portfolio. [Read More]

Alpha JWC Ventures marks a decade of supporting startups in Indonesia and announces plans for broader expansion across the Asia-Pacific region. Since its inception in 2015, the firm has invested in nearly 100 startups with $645 million in assets under management (AUM). Looking forward, Alpha JWC aims to explore opportunities beyond Indonesia, focusing on APAC. [Read More]

👏 What’s Exciting

#1 OpenAI’s dominance in gen AI will soon be gone

The rise of new gen AI players such as Deepseek, Alibaba’s Qwen, Tencent’s Hunyuan and ByteDance’s Omnihuman has introduced fresh batch of serious competition in a landscape previously dominated by OpenAI. This shift is fueling rapid innovation and diversifying AI solutions, moving beyond large language models (LLMs) to more advanced visual and audio-based AI technologies. For developers, this competition offers a golden opportunity to tap into specialized models that were previously unavailable or underexplored.

AI agent developers, in particular, benefit from the increasing availability of diverse models, allowing for more flexible and context-specific problem-solving. Instead of relying solely on a single provider’s ecosystem, developers can now build solutions by combining different AI capabilities, enhancing the precision and personalization of end-user experiences. This competitive environment encourages a more resilient AI ecosystem, with richer applications in sectors such as customer service automation, personalized healthcare, and creative content generation.

#2 Deeptech: The Next Investment Frontier for Southeast Asia

Deeptech startups are gaining traction in Southeast Asia, capturing the attention of regional venture capital (VC) firms. These startups focus on advanced technology solutions across fields such as medtech, agrifood tech, advanced manufacturing, and sustainable energy. With significant growth potential, deeptech offers a unique value proposition for both investors and ecosystem players.

Cocoon Capital, a Singapore-based VC, recently launched its third fund dedicated to B2B deeptech startups, aiming to invest in five startups annually across Southeast Asia. SEEDS Capital, the investment arm of Enterprise Singapore, allocated US$221.6 million to co-invest with 20 newly appointed partners in deeptech startups. Notable players like East Ventures and Monk’s Hill Ventures have successfully expanded deeptech startups such as Mesh Bio and AMILI into the Indonesian market, showcasing the region’s growing capacity to nurture and scale high-impact technologies.

#3 Healthtech Funding at Its Lowest, but Long-Term Prospects Remain Positive

Southeast Asia’s healthtech sector saw a sharp decline in funding in 2024, falling to US$123 million—a seven-year low. This 79% drop from 2023 reflects investor caution driven by macroeconomic uncertainties and geopolitical tensions. Despite the downturn, Singapore contributed US$92 million or 75% of the total funding in the region.

While late-stage funding suffered the most, some early-stage companies managed to secure significant rounds. For instance, HealthifyMe raised US$20 million in a Series C round, while Biobot Surgical attracted US$17.9 million in Series B funding. Neurology-focused startups and employee health IT solutions gained the most investor interest, signaling that targeted segments within healthtech still hold strong potential. As the region continues to prioritize digital healthcare innovation, the sector’s long-term outlook remains optimistic.

#4 Tech Giants Double Down on AI Investments

Major tech companies are significantly increasing their AI-related capital expenditures, reflecting an ongoing race for dominance in this transformative field. Amazon plans to invest US$100 billion in 2025, with a large portion allocated to enhancing AI capabilities in its AWS cloud services. Meta, Microsoft, and Alphabet are also scaling up their AI infrastructure, focusing on data centers, advanced networking, and server upgrades.

Alphabet CEO Sundar Pichai emphasized the strategic importance of AI in unlocking new opportunities, while Meta is set to invest US$60 billion in AI infrastructure in 2025. The decreasing cost of AI technology is expected to drive higher adoption across industries, opening up new possibilities in sectors like finance, retail, and logistics.

#5 Indonesia’s Social Media Age Restriction Policy: What to Expect

The Indonesian Ministry of Communication and Digital Economy (Komdigi) is drafting regulations to restrict social media access for children. This initiative aims to protect minors from exposure to harmful digital content by imposing stricter age requirements and parental consent for account creation. Platforms like Facebook, Instagram, TikTok, and X are expected to collaborate with regulators in enforcing these measures.

The policy also addresses concerns such as child digital profiling, content moderation, and the prevention of fake adult accounts. As part of its broader strategy, the government has implemented the Content Moderation Compliance System (SAMAN) to oversee and mitigate risks related to child exploitation, terrorism, and illegal financial activities.

🚀 What’s Next: The Implications of a Grab-GoTo Merger

A potential merger between Grab and GoTo could reshape the Southeast Asian digital ecosystem, offering significant synergies across ride-hailing, e-commerce, food delivery, and financial services. Both companies dominate key markets, particularly in Indonesia, where they collectively control over 80% of the ride-hailing market.

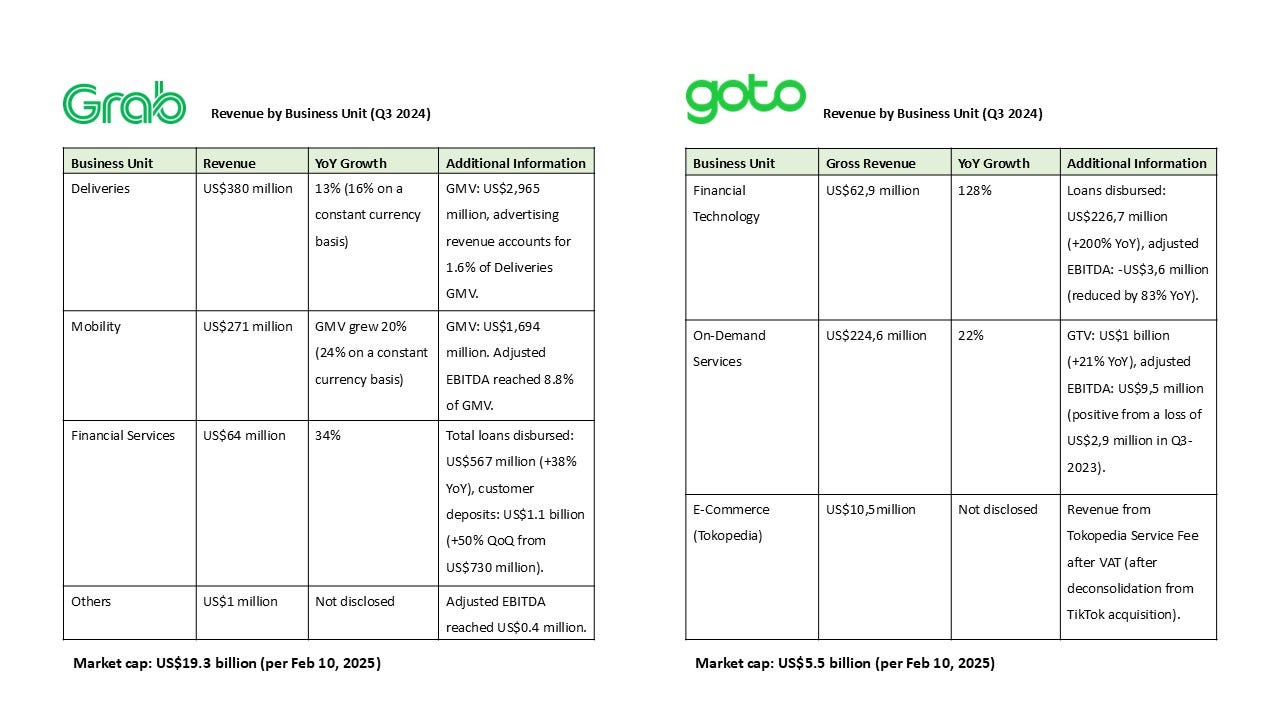

From a financial perspective, both companies have shown solid performance in 2024. GoTo reported net revenue of US$239,6 for the January–September period, while Grab’s Q3 revenue reached US$716 million. Combining their market positions could result in operational efficiencies and stronger profitability, especially in competitive markets where other players like Sea Group are also expanding aggressively.

However, such a merger comes with inherent challenges. Operational risks, cultural integration, and regulatory scrutiny are key areas to address. Differences in business models and strategic approaches need to be carefully aligned to prevent inefficiencies and conflicts. Regulatory requirements in countries like Indonesia and Singapore could also slow down the merger process, potentially affecting the short-term valuation of both companies.

For investors, this merger presents both risks and opportunities. If managed well, the combined entity could achieve long-term growth, create a more stable cash flow, and strengthen its market leadership in Southeast Asia. Transparent communication from both companies regarding their integration strategy and financial impact will be crucial to maintaining investor confidence.