💸 Honest lands funding.⚖️ TikTok, Netflix face scrutiny. 📊 SEA’s investment reset.

Dear Subscriber,

This week brings a mix of momentum and growing scrutiny in Indonesia’s digital economy. Fintech player Honest secured a major funding boost to strengthen its lending and product expansion, while Sriwijaya Capital launched a new private equity fund. TikTok continues to face mounting regulatory challenges. Even Netflix has entered the spotlight as officials revisit the taxation framework. At the same time, the expansion of players like Tyme and Indies Capital Partners signals continued investor appetite for Southeast Asia’s tech ecosystem. Southeast Asia’s tech funding cools sharply, with digital finance emerging as the region’s key growth engine.

This week’s newsletter is sponsored by Biznet Gio CloudBiznet Gio Cloud: Reliable Cloud Designed for Optimal Performance

Bring your preferred web apps online with virtual machines or ready-to-use platforms. Start with cost-effective web hosting, VPS, or elastic cloud servers.

Learn MoreBest regards,

The DailySocial Team

🆕 What’s New

💸 Honest Secures Major Funding Boost - Honest, a fast-growing Indonesian fintech platform, has secured an impressive $100 million in equity funding alongside an additional $40 million in debt facilities. The new capital will fuel the company’s efforts to enhance its lending capabilities and expand its product suite, focusing on empowering small businesses and consumers with better financial access. With this funding milestone, Honest continues to strengthen its position in Indonesia’s competitive fintech landscape and signals investor confidence in the country’s digital finance potential. Read more

🤝 Sriwijaya Capital Makes PE Fund Debut - Sriwijaya Capital has made its debut in the private equity space with a $200 million growth fund, officially licensed by Singapore’s Monetary Authority (MAS). The fund is backed by anchor limited partners from Indonesia’s leading conglomerates — Barito Pacific, Indika Energy, and Sinar Mas — underscoring strong institutional confidence in the firm’s long-term strategy. With this launch, Sriwijaya Capital aims to invest across strategic sectors and scale high-potential Indonesian and regional companies, positioning itself as a key emerging player in Southeast Asia’s investment landscape. See the post

🛍️ E-Commerce Tax Rule Postponed - The Indonesian government has announced a delay in implementing the new income tax regulation (PPh 22) for e-commerce sellers, citing concerns over maintaining consumer purchasing power. The policy, originally aimed at strengthening tax compliance among online traders, will now undergo further review. This move reflects the government’s balancing act between fiscal objectives and supporting digital economy growth amid current market challenges. Full story here

⚖️ TikTok Faces Regulatory Heat - TikTok is under mounting regulatory pressure in Indonesia as authorities tighten oversight of major tech firms. The platform was fined IDR 15 billion by the Business Competition Supervisory Commission (KPPU) for late reporting of its Tokopedia acquisition, setting a key precedent for merger transparency. Adding to its challenges, the Ministry of Communication and Informatics has temporarily suspended TikTok’s license after it failed to provide requested data on live demos and gaming content, reflecting rising tensions over compliance and data-sharing standards. Read the coverage

🎬 Netflix Under Tax Spotlight - Indonesia’s Ministry of Finance has spotlighted Netflix’s substantial revenue growth in the local market, raising questions about its tax contributions. Officials noted that despite significant earnings from Indonesian subscribers, the streaming giant has yet to fully comply with domestic tax obligations. The statement hints at potential policy shifts aimed at ensuring equitable taxation across foreign digital service providers operating in Indonesia. Details here

✨ What’s Exciting

💡 Garuda Spark Hubs Drive Indonesia’s Digital Readiness - Komdigi has inaugurated the Garuda Spark Innovation Hub in Jakarta and Bandung, with plans to expand further into Medan, as part of its effort to create collaborative spaces for startups and digital talent—reinforcing Indonesia’s vision to become a leading digital nation. The initiative aligns with the country’s improving Indonesia Digital Society Index (IMDI), which reached 44.53 in 2025, signaling strong progress in digital readiness across four pillars: infrastructure, digital skills, industry, and literacy. These efforts aim to accelerate innovation, nurture millions of digital talents, and strengthen Indonesia’s digital sovereignty by fostering local startup ecosystems and empowering regional digital talent across diverse sectors. Read more

💡 Indonesia Launches Innovation Hub with Microsoft - Indonesia is set to launch an Innovation Hub in collaboration with Microsoft and support from the United Arab Emirates, aiming to strengthen digital transformation and startup growth. The initiative will focus on fostering AI research, cybersecurity development, and public-private partnerships to accelerate Indonesia’s tech-driven economy. This strategic move highlights the nation’s ambition to become a regional leader in digital innovation. Read more

📱 Government Plans IMEI Blocking Policy - The government is considering implementing an IMEI blocking policy for lost or stolen mobile phones to combat illegal trade and enhance device security. This rule would prevent the reactivation of blacklisted devices, aligning Indonesia with global best practices in digital regulation. The proposal reflects ongoing efforts to protect consumers and improve transparency within the country’s telecommunications ecosystem. Learn more

🏦 Tyme Expands into Indonesia and Vietnam - Digital bank Tyme, backed by Tencent, is preparing to expand into Indonesia and Vietnam as part of its Southeast Asia growth strategy. The company plans to acquire an existing bank in Indonesia, leveraging its successful model from South Africa and the Philippines. This expansion reflects increasing investor confidence in Southeast Asia’s digital banking landscape and the growing appetite for inclusive financial services. Full story

💼 Indies Capital Closes Fourth Fund - Indies Capital Partners has successfully closed its fourth fund at over $300 million, reinforcing its position as one of Southeast Asia’s leading private equity firms. The fund targets investments across high-growth sectors such as consumer, financial services, and digital infrastructure. This milestone underscores strong investor appetite for opportunities in the region’s rapidly maturing venture and private capital markets. More details

💰 OKX Rolls Out Stablecoin Payments in Singapore - In Singapore, crypto exchange OKX has introduced stablecoin payment services for local GrabPay merchants, marking a significant step toward mainstream crypto adoption. This launch enables seamless digital asset transactions across retail and service sectors, aligning with the city-state’s vision for a regulated yet innovation-friendly financial ecosystem. The initiative signals a growing intersection between traditional finance and decentralized technologies in Asia. See announcement

🔮 What’s Next

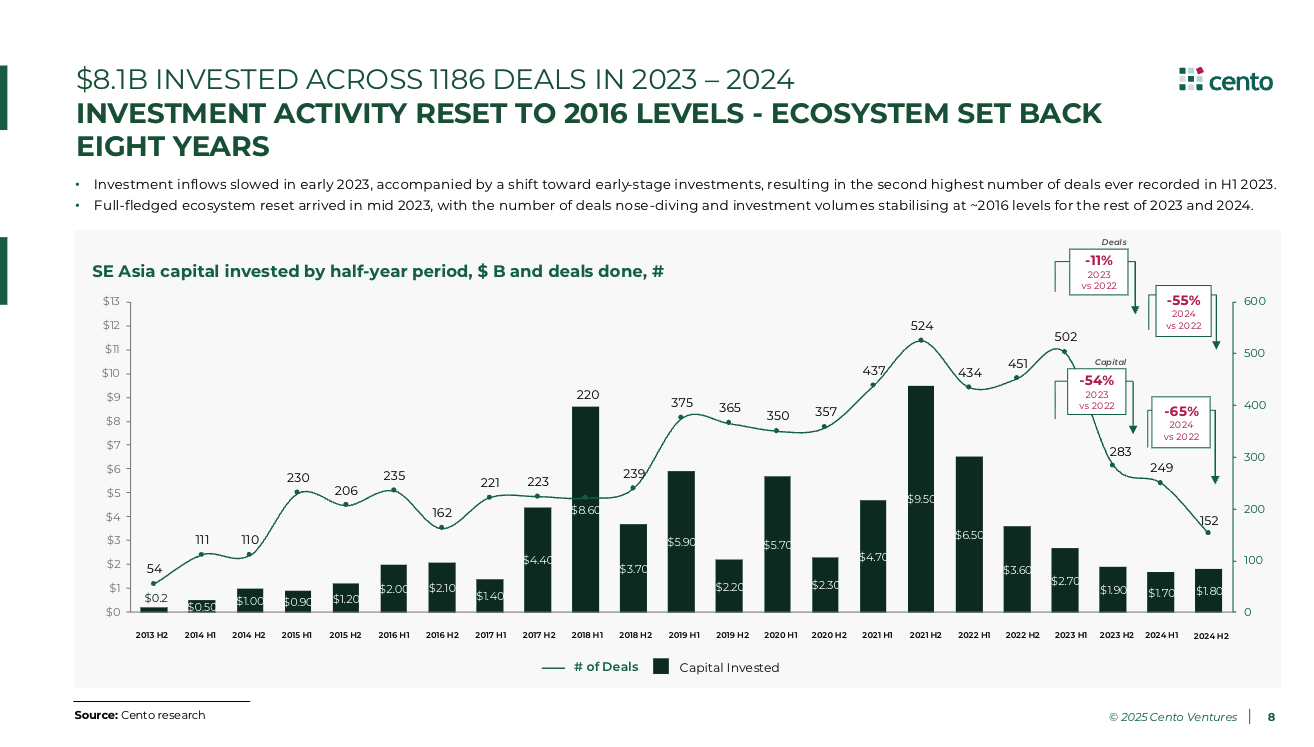

Southeast Asia’s Tech Investment Landscape: From Boom to Reset

Southeast Asia’s tech investment scene has entered a major correction phase after years of exuberance. Between 2023 and 2024, total venture capital inflows reached $8.1 billion across 1,186 deals, a sharp 55–65% decline compared to 2022. Investment activity has effectively reset to 2016 levels, setting the ecosystem back eight years. By contrast, India and Latin America were raising two to four times their 2017–2020 baselines by mid-2024, leaving Southeast Asia as the only emerging market still below its pre-pandemic average. The number of mega-deals ($100 million or more) also dropped to just $2.1 billion, less than half the peak of $5.3 billion seen in late 2021.

Amid this contraction, Digital Financial Services (DFS) have become the region’s undeniable growth driver. As of the second half of 2024, DFS absorbed 74% of all venture capital, up from roughly 35–40% historically. The sector’s resilience stems from the rapid modernization of payment infrastructure and the rise of profitable digital lenders in the Philippines and Indonesia. Within DFS, core payments accounted for 46% of total investment, followed by consumer and business lending at 27%, and wealth management at 12%. This trend signals a clear shift away from the “super-app” model toward fintech-driven profitability and embedded finance across industries.

In Indonesia, where valuations peaked in early 2022, investors have become more selective, pivoting from consumer apps to regulated digital lenders and embedded finance platforms. Although overall deal volume fell sharply, Indonesia continues to provide scale for experimentation — from licensed digital banks to hybrid lending models. The country’s startups benefit from a large unbanked population, improving digital literacy, and strong regulatory support for fintech innovation. As the region resets, Indonesia’s ability to turn financial inclusion into a sustainable, profitable ecosystem could determine Southeast Asia’s broader recovery trajectory in 2025 and beyond. Explore insights