Hypefast eyes IPO 📈, fintech and travel funding returns 💸, crypto market matures 🇮🇩

Dear subscriber,

Indonesia’s innovation and investment landscape is becoming more selective and strategic, with companies focusing on scale, integration, and long term value creation amid tighter funding conditions. Moves such as Hypefast’s IPO ambition, renewed early stage investment in travel and fintech, and continued growth in plant based foods reflect investor preference for differentiated and sustainable business models. At the same time, state led initiatives including large scale capital deployment, cross border QRIS expansion, and emerging AI governance frameworks signal a stronger public sector role in shaping market direction. In parallel, Indonesia’s crypto asset market in 2025 shows signs of maturation, with an increasing number of licensed trading providers and transaction values.

AI adoption shouldn’t start with tools.

It should start with clarity.

We’ve opened a complimentary AI strategy review for organizations exploring AI thoughtfully.

Share your business context, and we’ll return a short note outlining:

- Relevant AI opportunities

- Practical, low-risk starting points

- Strategic considerations before implementation

A quiet, useful first step.Stay ahead,

DailySocial Team

🚨 What’s New

Hypefast Sets the Stage for a 2027 IPO

Hypefast has publicly set its sights on an IPO by 2027, signaling a maturation phase for Indonesia’s consumer brand roll-up model. The company is doubling down on an integrated retail infrastructure, spanning supply chain, omnichannel distribution, and data-driven brand operations. This move reflects growing investor confidence in scalable, asset-light consumer platforms amid volatile funding conditions. As domestic consumption remains a core growth driver, the strategy positions Hypefast to capture long-term value beyond short-term brand arbitrage.

Early-Stage Capital Returns to Travel Innovation

Early-stage travel startup SPUN has secured initial funding as it looks to reimagine travel planning through a more personalized and community-driven approach. The funding comes as the travel sector continues its post-pandemic recovery, with shifting consumer preferences toward flexible and experience-based travel. Investors appear to be betting on differentiated tech-enabled services rather than traditional OTA models. This signals renewed appetite for niche travel innovation within Southeast Asia’s fragmented tourism ecosystem.

UangCermat Deepens Its Fintech Lending Play

Personal finance platform UangCermat has expanded its fintech lending footprint through new strategic funding, reinforcing its role as a financial marketplace rather than a pure content play. With rising demand for transparent lending options, UangCermat’s positioning bridges consumer education and financial access. This reflects a broader trend where fintech players are consolidating services to improve unit economics. In Indonesia’s underpenetrated credit market, such hybrid models are increasingly relevant.

Green Rebel Doubles Down on Plant-Based Growth

Plant-based food startup Green Rebel Foods has raised fresh capital to accelerate product development and regional expansion. The funding underscores sustained investor interest in alternative proteins despite global funding slowdowns in climate tech. Green Rebel’s focus on taste localization and affordability addresses a critical barrier to mass adoption. This approach aligns with shifting consumer awareness around sustainability and health without relying solely on premium positioning.

Danantara Signals Jumbo Capital Deployment

State-linked investment platform Danantara has revealed plans to deploy up to IDR 235 trillion in investments by 2026, signaling an aggressive push into strategic sectors. The scale of the capital allocation suggests a strong mandate to catalyze long-term national growth rather than short-term returns. Priority areas are expected to include infrastructure, digital economy, and industrial downstreaming. Such large-scale capital mobilization could reshape competitive dynamics across multiple industries. For the private sector, this presents both partnership opportunities and heightened competition for strategic assets.

👏 What’s Exciting

Grab–GoTo Talks Highlight Consolidation Complexity

Talks surrounding a potential deal between Grab and GoTo have reportedly hit obstacles due to the presence of a state-backed shareholder. The development highlights the complexity of consolidation efforts in markets where strategic assets intersect with public interests. While synergies remain compelling on paper, governance and regulatory considerations continue to shape outcomes. This illustrates how market structure, not just economics, defines deal viability in Southeast Asia. Any future consolidation will likely require more nuanced alignment among stakeholders.

QRIS Eyes Cross-Border Expansion

Bank Indonesia is pushing to enable QRIS usage in China and South Korea by Q1 2026, marking a significant step in cross-border payment integration. The initiative aims to simplify transactions for travelers and SMEs while strengthening regional payment interoperability. It also reflects Indonesia’s ambition to export its domestic payment infrastructure abroad. Such moves could reduce reliance on global card networks and lower transaction costs.

Indonesia Moves Toward Structured AI Governance

The Ministry of Communication and Digital Affairs, Komdigi, is preparing to issue two new AI regulations covering security frameworks and a national AI roadmap. These regulations aim to balance innovation with risk mitigation as AI adoption accelerates across sectors. Clear regulatory guidance is expected to provide certainty for startups and enterprises alike. This step indicates a shift from reactive to proactive digital governance.

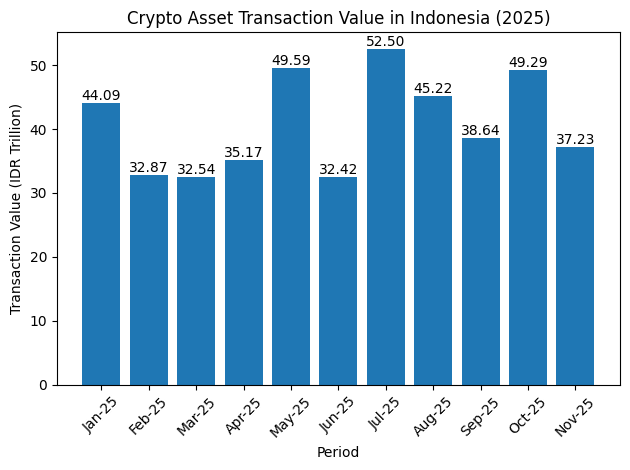

🚀 What’s Next: Overview of Indonesia’s Crypto Asset Market in 2025

Indonesia’s crypto market throughout 2025 demonstrates a strengthening market structure and expanding scale of activity. The number of Digital Financial Asset (DFA) trading providers increased gradually, reaching 29 licensed entities by November 2025, reflecting broader industry participation under a clearer regulatory framework. This growth is primarily driven by the increase in registered crypto asset traders, indicating rising industry confidence and intensifying market competition. In terms of activity, crypto asset transaction values remained volatile but substantial, with a year-to-date total of approximately IDR 449.55 trillion, confirming that crypto assets continue to play a meaningful role in Indonesia’s digital financial market despite global market fluctuations

On the demand side, the crypto consumer base continued to expand steadily, growing from approximately 13.3 million users in February 2025 to 19.56 million users in November 2025. This growth is largely supported by domestic retail participation, particularly Indonesian individual investors, highlighting strong local adoption of crypto assets. Although participation from business entities and foreign consumers remains relatively limited, their gradual increase suggests further potential for market deepening. Overall, the data indicate that Indonesia’s crypto market is entering a more mature expansion phase, characterized by broader institutional participation, sustained transaction activity, and a growing user base, reinforcing the importance of ongoing regulatory oversight and consumer protection.