Indonesia eyes Sovereign AI Fund 🤖, GoTo records profit 💹, Indonesia 4th largest online population 🌐

Dear subscribers,

This week’s update captures a mix of funding momentum, regulatory moves, and ecosystem shifts shaping Indonesia’s digital economy. OY! secured fresh capital to scale its fintech infrastructure, while GoTo delivered record-breaking Q2 performance. Regulators are stepping up with new cybersecurity rules for crypto, and Grab Ventures announced its latest startup cohort. Meanwhile, Living Lab Ventures launched InnoLab, Indonesia unveiled plans for a Sovereign AI Fund, and IBM flagged the region’s AI readiness gap.

On the digital infrastructure front, Indonesia’s internet penetration reached 116% in 2025 with 229 million users—yet growth has slowed to just +1.8% YoY, signaling market maturity and shifting the focus to service quality, monetization, and bridging the digital divide beyond Java.

This week’s newsletter is sponsored by Keypaz, an advanced device-level fraud prevention system using fingerprinting, real-time monitoring, and AI risk scoring. Keypaz blocks high-risk devices across billions monitored globally, reducing operational costs, protecting brand reputation, and securing legitimate user experiences. [Try Now].

Keypaz, pioneer of proactive digital fraud defense!

Best regards,

The DailySocial Team

🚨 What’s New

OY! secures $15M funding – Indonesian fintech OY! raised US$15M led by MUFG Innovation Partners (MUIP) through their Indonesia’s focused Garuda Fund to strengthen payment infrastructure and expand its product suite. Processing billions in transactions monthly, OY! is positioning itself as a core enabler in Indonesia’s digital payments race. The round signals sustained investor appetite in fintech despite tighter funding. Read more

OJK issues cybersecurity guidelines – The Financial Services Authority (OJK) rolled out new cybersecurity rules for digital asset exchanges and custodians. The policy mandates stronger governance, incident response, and data security to curb systemic risks. It reflects regulators’ push to balance innovation with investor protection as crypto adoption rises. Read more

Grab Ventures picks five startups – Casion, Jejakin, Liberty Society, Rekosistem, and Sirsak join the Grab Ventures Velocity accelerator. The cohort will gain mentorship, market access, and scaling opportunities through Grab’s ecosystem. Themes include sustainability, social impact, and smart urban solutions. Read more

GoTo posts record Q2 2025 performance – GoTo booked 23% YoY revenue growth, its best quarter since IPO, fueled by ride-hailing recovery and fintech expansion. Efficiency gains also narrowed losses, boosting investor confidence in its turnaround. The milestone marks renewed momentum for Indonesia’s biggest tech group. Read more

👏 What’s Exciting

WeRide secures investment from Grab to launch robotaxis in SEA – Chinese autonomous driving company WeRide has secured a strategic equity investment from Grab’s partners to accelerate the rollout of robotaxis and autonomous shuttles in Southeast Asia. While Singapore has piloted autonomous taxis in controlled environments since 2016, WeRide’s Grab-backed expansion could mark the first large-scale commercial push for driverless mobility in the region. Read more

Living Lab Ventures launches InnoLab – A new program connecting startups with global IP strategy in 5 sectors (health, new gen semiconductor, renewable energy, logistics and climate. InnoLab aims to help founders bridge local research with global opportunities, supporting cross-border scaling. Read more

Indonesia plans “Sovereign AI Fund” – Indonesian government is preparing a state-backed AI fund to drive local R&D, support startups, and attract global partnerships. The move underscores Indonesia’s ambition to assert digital sovereignty and compete in the regional AI race. Read more

IBM: Only 11% of APAC organizations AI-ready – Despite 85% claiming readiness, only 11% of firms in Asia-Pacific have the infrastructure to scale AI, per IBM. The gap highlights execution risks but also a massive market for enterprise AI solutions. Read more

🚀 What’s Next

From users to services: The next phase of Indonesia’s internet economy

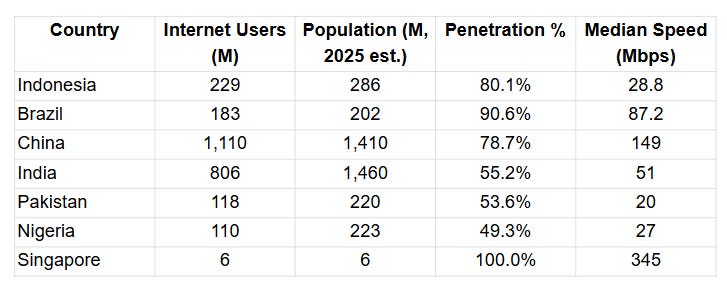

Indonesia now ranks 4th globally with 212–229 million internet users, behind only China, India, and the US. Its scale is remarkable: Indonesia’s digital population is 29 million larger than Brazil (183M), and nearly twice the size of Russia, Pakistan, Mexico, Japan, or Nigeria (all around 107–133M). This positions Indonesia as the largest digital market in Southeast Asia, accounting for nearly 94% of the combined internet users of the Philippines (97.5M), Vietnam (79.8M), and Thailand (65.4M)

Despite this massive base, Indonesia’s monetization potential remains under-optimized compared to peers. Average revenue per user (ARPU) in digital services lags behind the US and even Brazil, meaning that small improvements in monetization could unlock over US$1 billion annually. For investors, this suggests Indonesia is not only a scale story but also a margin expansion play as infrastructure and digital services mature.

Looking at India and China, Indonesia’s digital population is about 26–28% the size of India (806M) and 20% of China (1.11B). Yet, unlike these markets, Indonesia has fewer entrenched incumbents and a more fragmented ecosystem, giving startups room to scale. As growth in internet penetration slows, the spotlight shifts from adding users to building services that capture spending power—fintech, e-commerce, AI-driven productivity, and digital entertainment.

From a penetration standpoint, Indonesia is at ~74% of its 286M population, ahead of India (~55%) and Pakistan (~54%), but still below Brazil (~84%) and China (~78%). This shows there is still room for inclusion, particularly for the 47M Indonesians still offline, mostly in rural and eastern regions. On infrastructure, Indonesia’s median internet speed is ~28.8 Mbps, far below regional leaders like Singapore (345 Mbps) or the US (280 Mbps), signaling that service quality and network upgrades remain crucial for unlocking the next wave of digital growth.