📉 Indonesia Startup Funding Slumps 43% in H1. ⚖️ Taxman Targets Online Sellers. And More.

Dear subscribers,

Indonesia’s startup ecosystem is entering the second half of 2025 with a sobering reality: investor appetite remains weak. Funding in H1 2025 plunged by over 43% year-on-year, with total capital raised dropping to just US$161.3 million—its lowest in recent years. While early-stage deals still show signs of life, the broader landscape reflects growing investor caution, stricter demands for profitability, and structural gaps in governance.

This week, we dive deep into what’s holding back recovery—and what it will take to bring capital back into the market.

Let’s get into it.

Best regards,

The DailySocial Team

🚨 What’s New

Indonesia’s new e-commerce tax rule stirs debate

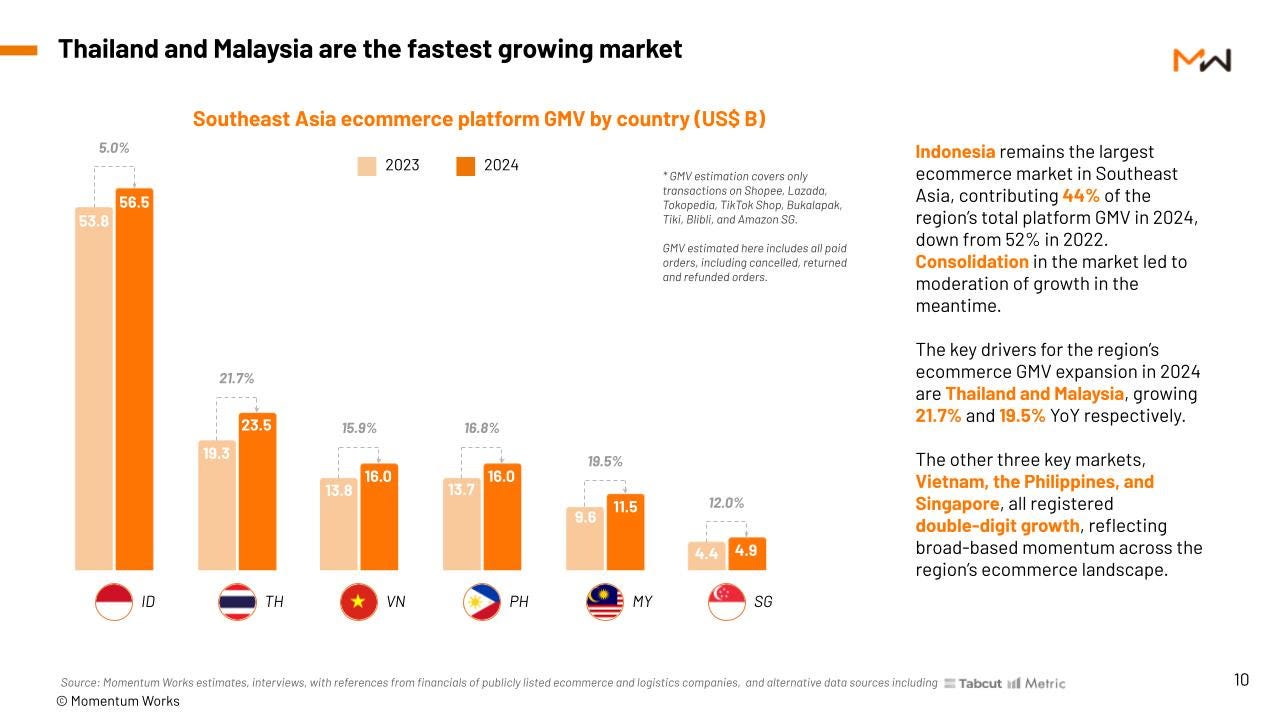

The government is finalizing a regulation that will require major e-commerce platforms to withhold 0.5% income tax from sellers in the MSME bracket (annual revenue of Rp500 million–Rp4.8 billion). The move, intended to boost state revenue (down 11.4% YoY in Jan–May 2025), has drawn industry backlash over its rushed timeline and system readiness concerns. Platforms could face penalties for slow compliance. A similar policy failed in 2018 after just three months. [Read More]SEA e-commerce hits US$145B GMV, Indonesia still leads

Momentum Works reports Southeast Asia’s e-commerce GMV reached US$145.2B in 2024 (+12% YoY), with Indonesia contributing 44% despite slowing growth (+5%). Shopee, TikTok Shop, and Lazada now control 84% of the market. Off-platform channels (e.g., WhatsApp, brand sites) generated US$16.8B GMV, while live commerce contributed US$17.6B. AI adoption could add up to $131B in GMV by 2030. [Read More]CATL’s US$6B battery hub in Indonesia kicks off

Chinese EV battery giant CATL has started construction on a US$6B battery materials ecosystem in West Java and North Maluku, in partnership with Indonesia Battery Corp and Antam. The complex includes a 15GW battery plant, solar storage, nickel operations, and precursor facilities—positioning Indonesia as a global energy transition hub. [Read More]

👏 What’s Exciting

Malaysia rolls out tax perks and $237M VC fund

To bolster its VC landscape, Malaysia offers a 5% tax rate for funds investing at least 20% in local startups, and 10% for VC/PE managers. The RM1B Jelawang Capital fund will be managed by firms like AppWorks, Granite Asia, and Kairous. It aims to position Malaysia as a regional VC hub by 2030.Seedflex lands in Indonesia, targets 50K MSMEs

Malaysia-based fintech Seedflex, founded by ex-Grab execs, is now registered with OJK as a financial aggregator. Backed by US$3.2M from Iterative, ZVC, and 500 Global, it plans to launch officially in Indonesia by end-2025. The startup offers sales-based credit (PAYS Advance) and has already financed 5,000 merchants in Malaysia.JD.com strengthens SEA logistics play

JD.com is doubling down on Southeast Asia with three new warehouses in Malaysia and Vietnam, two shipping routes from China, and its “semi-managed overseas warehouse” model for cross-border sellers. The company also invested US$120M in Vietnam and acquired US$350M in logistics assets in Singapore, pushing its ambition to elevate 1,000 Chinese brands in the region.

🚀 What’s Next: Indonesia’s Startup Funding Slows, Can Stimulus Revive Investor Confidence?

Indonesia's startup investment landscape remains sluggish in the first half of 2025. According to DailySocial.id, total funding dropped 43.5% YoY to US$161.3 million across 34 disclosed deals, down from US$285.4 million from 36 deals in H1 2024. This reflects broader challenges: a cautious global macroeconomic climate, stricter investor due diligence, and pressure on startups to demonstrate clearer profitability and governance.

Despite the downturn, early-stage funding (seed to Series A) continues to dominate—indicating a resilient appetite for high-potential early bets.

Sector-wise, New Retail (e.g., D2C food chains and fashion aggregators) led the pack with US$44.4 million, while Agritech remained active with seven deals totaling US$22.6 million. These verticals suggest where investors still see credible growth and defensibility.

Zooming out, Southeast Asia saw US$2 billion in startup funding in H1 2025 (Traxcn), a 24% drop from H2 2024 but a 7% gain YoY. Late-stage deals accounted for 70% of the capital—surging 140% compared to the previous half—driven by mega-deals in Singapore (92% of regional total).

🔁 Rebuilding Investor Appetite: What Needs to Change?

Founders must now refocus on strong fundamentals—cutting burn rates, improving unit economics, and building credible paths to profitability. Many startups are pivoting or consolidating, targeting recession-proof sectors like SaaS, logistics, and agri-supply chains.

Investors are shifting from “growth-at-all-costs” to “risk-adjusted scalability,” demanding transparency, stronger governance, and more collaborative engagement—offering not just capital, but active strategic support.

🏛️ The Role of Policy and Regulation

To accelerate recovery, policy intervention is critical. Several instruments are on the table:

Tax incentives such as tax holidays and super tax deductions for R&D can ease early-stage burdens.

IPO regulation upgrades like allowing Multiple Voting Shares (MVS) can provide better exit certainty for founders and early investors.

Public-private co-investment funds (e.g., Merah Putih Fund) can derisk early bets and attract crowd-in capital.

Simplified licensing and digital infrastructure improvements can lower operational friction and encourage regional scaling.

The government doesn’t need to pick winners—but it must act as a neutral facilitator that ensures a level playing field, regulatory clarity, and support for sustainable growth.

With coordinated action across founders, investors, and regulators, Indonesia can unlock its next wave of digital innovation and regain investor trust.