Indonesia's golden share in GoTo 🇮🇩. US$300B digital economy by 2025 🚀. Fintech's new era of discipline 💸

Dear subscribers,

We’re back with your essential roundup of the latest from Indonesia and Southeast Asia’s digital landscape. This week, we’re covering key developments like the GOTO-Grab merger news, the digital economy growth, and shifts in the latest fintech investment.

We are also excited to invite you to an exclusive event: Indonesia Food Resilience Forum 2025. This forum will bring together key stakeholders to discuss innovative steps towards a sustainable food future for Indonesia.

Secure your spot at this strategic discussion by registering here: https://luma.com/75o04yki.

Best regards,

The DailySocial Team

🚨 What’s New

Indonesia is reportedly considering a “golden share” scheme as a condition for approving the merger between Grab and GoTo. This plan would grant the sovereign wealth fund Danantara a minority stake with special rights in the merged entity’s Indonesian operations. This golden share would provide the government a direct voice in strategic decisions, including driver welfare and pricing, reflecting a desire to oversee a business that would dominate ~90% of the local ride-hailing and delivery market. While internal pressures, such as SoftBank’s push for a CEO change at GoTo, highlight the urgent need for consolidation, both companies officially state that no final agreement has been reached. For the government, this model represents a new approach to regulating a dominant digital platform critical to Indonesia’s gig economy. [Read more]

Superbank, the digital bank backed by Grab, Singtel, and Emtek, is preparing for a potential IPO that could be the largest for a digital bank in Indonesia, targeting up to IDR5.36 trillion. This move is bolstered by its strong Q3 2025 results, where it booked a pre-tax profit of IDR80.9 billion, grew its customer base to 5 million, and saw credit disbursement surge 84% to IDR9.04 trillion. This robust financial performance, alongside its deep integration with ecosystems like Grab and OVO, strengthens its market position ahead of the listing. However, Superbank’s management has officially declined to comment on the IPO rumors. [Read more]

NTT Group is launching a dedicated Southeast Asian investment vehicle, Synexia Ventures Pte. Ltd., based in Singapore and scheduled to commence on December 15, 2025. Managed by NTT DOCOMO Ventures and NTT Finance, the fund will target startups in key markets like Indonesia, Singapore, Malaysia, and the Philippines, focusing on strategic sectors including AI, IoT, and smart city solutions. This initiative aims to accelerate open innovation and create new business ventures by combining funding with opportunities for co-creation across NTT’s vast network of telecom, data, and IT services. [Read more]

👏 What’s Exciting

Grab has announced a strategic investment of US$60 million in Vay, a German company pioneering remote driving technology for driverless car rentals. This initial investment, expected to close in Q4 2025, grants Grab a minority stake and is the first part of a potential US$410 million commitment that could see Grab acquire a majority interest in Vay. The partnership aims to explore how Vay’s cost-efficient, “teledriven” service model—where remote operators deliver and retrieve vehicles for self-driving customers—can complement Grab’s long-term mobility strategy in Southeast Asia. Grab will also leverage its operational expertise to support Vay’s expansion in the U.S., while the driving data collected from Vay’s fleet could accelerate the development of AI for autonomous vehicles.

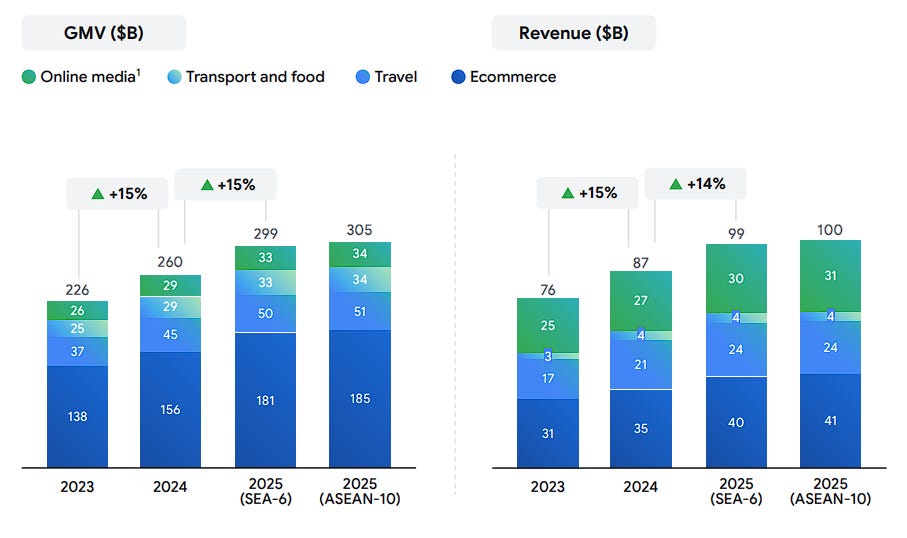

Southeast Asia’s digital economy is on a strong trajectory, projected to surpass US$300 billion in GMV in 2025, sustaining a robust 15% year-on-year growth. This momentum is fueled by a decisive shift towards monetization, with revenue growth keeping pace with GMV. Key drivers include a resurgent e-commerce sector, where video commerce now accounts for 25% of GMV, and food delivery, which is on the cusp of profitability. Furthermore, AI is rapidly becoming a core competitive frontier, reshaping consumer journeys from discovery to purchase and driving operational efficiencies. The region’s massive, digitally-engaged population, which shows enthusiasm for AI that exceeds the global average, provides a fertile ground for this continued expansion.

Standard Chartered has partnered with DCS Card Centre to power DeCard, a new credit card that enables users to make payments at physical merchants using stablecoins. As the principal banking partner, Standard Chartered will provide the backend infrastructure—including transaction processing, fiat and stablecoin settlements, and treasury services—to support seamless, real-world digital asset spending. The service launches first in Singapore, with plans to expand to other markets, marking a significant step in bridging traditional banking with everyday cryptocurrency payments.

Visa has launched its “Visa Scan to Pay” solution across Asia Pacific, significantly expanding QR payment acceptance for millions of merchants. Through partnerships with leading digital wallets and payment apps—such as Samsung Wallet, LINE Pay, and VNPT Money—the initiative enables consumers to make seamless and secure payments both locally and abroad by simply scanning a QR code. This rollout is part of Visa’s broader strategy to offer flexible, mobile-first payment options while helping merchants lower costs and tap into cross-border customer bases.

Fazpass is positioning its Intelligent Authentication (FIA) as the future of OTP verification by addressing core business challenges with a shift to a Monthly Active User (MAU) pricing model. This approach offers companies predictable costs with unlimited OTPs, moving away from the variable, per-message charges of traditional vendors. Coupled with AI-driven authentication designed to improve success rates and reduce user friction, Fazpass aims to provide a more scalable, secure, and cost-effective verification solution for businesses in 2026 and beyond.For more capability information: https://fazpass.com.🚀 What’s Next: The New Appetite in Fintech

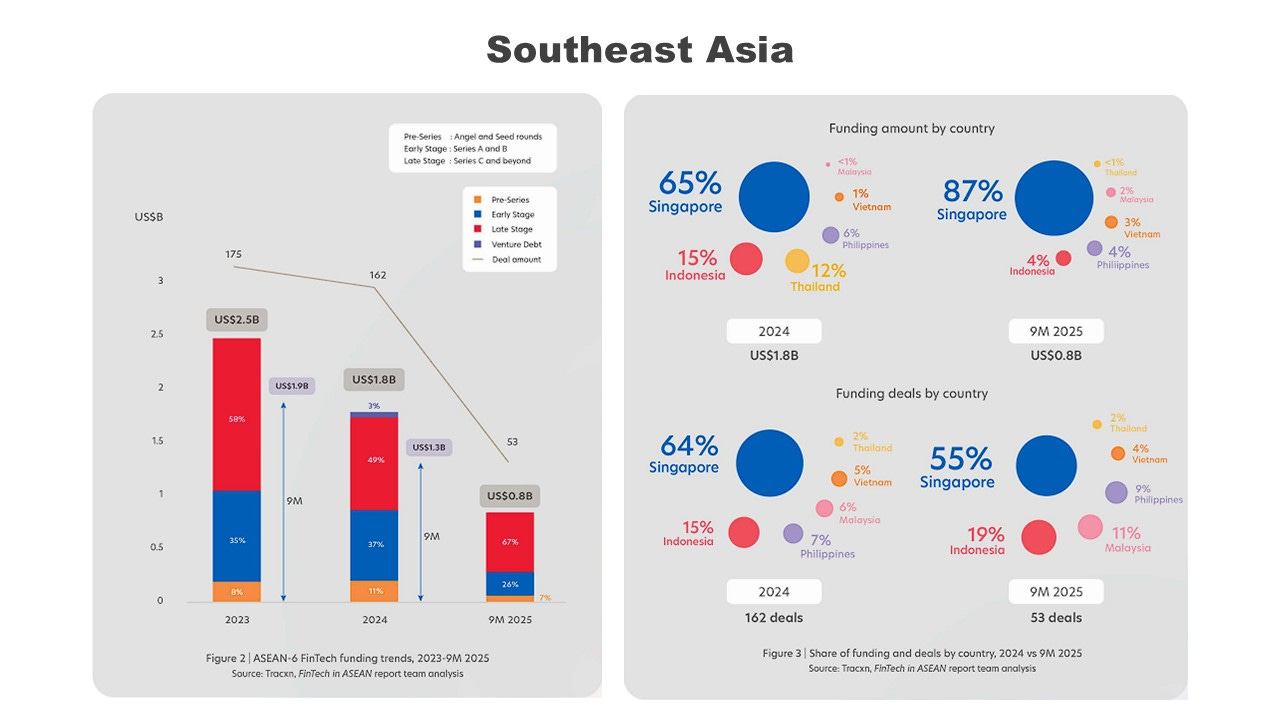

Fintech funding in Southeast Asia is undergoing a major shift. While overall investment is down significantly, the money is concentrating in fewer, larger deals for mature companies, signaling a new, more cautious phase for the industry.

The Big Picture: Quality Over Quantity

Funding Down: Total fintech funding across the six largest ASEAN economies fell 36% year-on-year to US$835 million in the first nine months of 2025.

Deals Plummet: The number of deals dropped 60% to just 53, the lowest in a decade.

Deal Size Up: Despite the downturn, the average deal size grew 42% to US$21.4 million. This shows investors are becoming more selective, moving away from early-stage startups and towards proven, mature fintechs.

Investors are Backing Proven Winners

The trend is clear: capital is flowing to companies that demonstrate a clear path to profitability and sustainability.

Focus on Late-Stage: Late-stage fintechs captured 67% of all funding, a significant annual increase.

Mega-Deals Drive Growth: The average late-stage deal value jumped to US$112 million, driven by a handful of mega-deals worth nearly US$450 million combined.

Singapore Solidifies Its Dominance

Singapore has firmly established itself as the region’s fintech hub.

It attracted a massive 87% of all ASEAN fintech funding (over US$D725 million).

It was also the location for over half of all deals, with a strong focus on blockchain for financial services and investment tech.

Eight of the ten best-funded fintechs in ASEAN are based in Singapore.

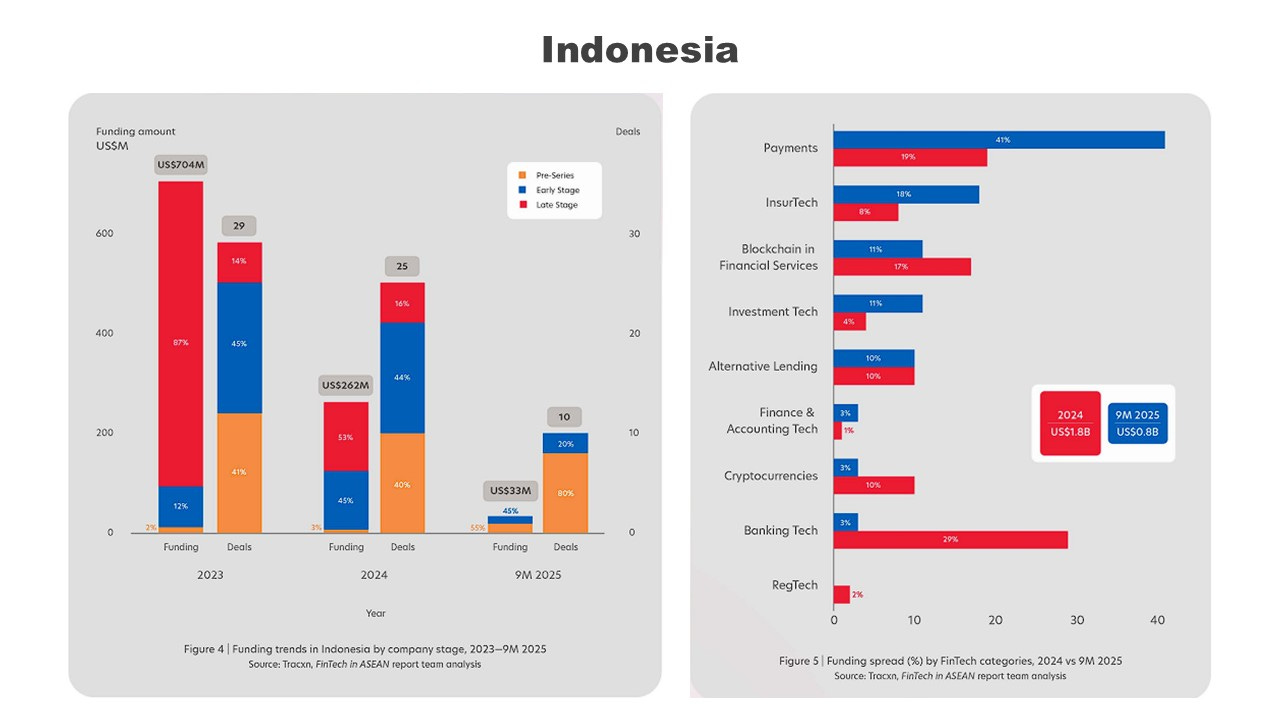

Indonesia’s Share Shrinks Dramatically

Indonesia’s position has weakened considerably.

Its share of regional funding fell drastically from ~20% in 9M 2024 to just 4% in 9M 2025.

The number of deals in the country also dropped from 23 to just 10.

The Philippines now ties Indonesia for second place in funding share.

Outlook: A More Disciplined Era

The message for fintechs, especially in Indonesia, is clear: growth alone is no longer enough to secure funding. To attract capital, companies must now highlight strong profitability, robust governance, and an ability to collaborate with established financial players. This more disciplined investment approach is seen as the foundation for a more mature and resilient fintech ecosystem.