Lincah acquires Orderfaz. 🤝 BPJS eyes global AI infra investments 🌍. Indonesia EV momentum soars ⚡

Dear subscribers,

As we enter the final month of 2026, Indonesia’s startup and digital ecosystem continues to move at full speed. Strategic milestones — from IPOs and M&A activity to regional expansion — have shaped the headlines over the past week. To help kickstart your week, we’ve curated the key highlights for you in this issue.

We are also pleased to invite investors — including VC, PE, and angel investors — to Garuda Sparks’ Lunch and Launch, featuring pitching sessions from 10 selected high-potential startups. The event will take place on Thursday, December 4, 2025 at 10:00 AM at GSIH fX Sudirman, Jakarta.More information and registration for investors: https://luma.com/gt784e9eStay ahead,

DailySocial Team

🚨 What’s New

Here are several key updates from Indonesia’s startup ecosystem over the past week:

Lincah has acquired Orderfaz to strengthen its social commerce infrastructure across Southeast Asia, integrating Orderfaz’s technology and seller base to build a more unified regional ecosystem and accelerate growth for creators and social entrepreneurs. Lincah currently powers more than 23,000 sellers and 8.3 million buyers across major social platforms with over 500,000 monthly transactions, while Orderfaz is a platform providing tools for order management and social selling enablement for online merchants. The acquisition supports expansion from Indonesia toward Malaysia, supported by an experienced leadership team and long-term regional strategy. [Read more]

Superbank — the digital bank formed through a collaboration between Grab and Emtek — has officially entered its IPO phase, targeting to raise over Rp3 trillion by offering up to 4.40 billion new shares priced between Rp525–695 during the 25 November–1 December 2025 book-building period. The funds will be used mainly to support lending expansion (70%) and operational investment (30%). Superbank is expanding digital financial products such as Saku, Celengan, and competitive deposit services, aiming to strengthen its position in Indonesia’s digital banking landscape through its upcoming BEI listing scheduled for 17 December 2025. [Read more]

INDODAX, Indonesia’s largest crypto exchange, has announced a major strategic partnership with Hong Kong–licensed digital asset exchange HashKey to strengthen the national crypto ecosystem. The collaboration focuses on improving liquidity, upgrading trading infrastructure, and enabling technical integration, paving the way for innovations such as Real-World Assets (RWA). Both companies emphasized aligned commitments to regulation and user security, with HashKey viewing Indonesia as a key regional market due to its fast-growing crypto user base. The phased execution is expected to deliver faster, safer, and more reliable trading experiences while reinforcing Indonesia’s role in the Southeast Asian digital asset landscape. [Read more]

TOCO, a community-based e-commerce platform founded in 2024 by Arnold Sebastian Egg (Founder Tokobagus, acquired by OLX), is rapidly attracting sellers by rejecting the subsidy-driven “burn money” model and eliminating admin fees for merchants. Instead of taking 8–38% platform cuts like major marketplaces, TOCO charges a flat Rp2,000 per transaction to buyers—referred to as a “parking fee”—covering logistics and payment processing. This pricing approach, combined with frustration over rising admin fees at platforms such as Shopee and Tokopedia, has triggered a wave of organic seller migration, helping TOCO reach over 1 million monthly active users and 3.4 million product listings without any marketing spend. [Read more]

BPJS Ketenagakerjaan is exploring investment opportunities in global AI infrastructure companies, including those in the U.S., Taiwan, Japan, and South Korea, as part of a strategy to diversify its portfolio and tap into the rapidly growing AI supply chain sector. Managing Rp879 trillion in assets, the institution has requested approval to invest up to 5% overseas, focusing on data centers, energy providers, and cable network companies rather than core chipmakers—though options like Nvidia remain under consideration. The initiative awaits government regulatory clarity and hinges on rupiah stability, while BPJS also targets doubling domestic equity allocation to 20% over the next three years. [Read more]

👏 What’s Exciting

Here are several noteworthy industry developments from the regional landscape:

Malaysia is preparing to ban social media access for users under 16 beginning in 2026, citing rising concerns around child safety online—including cyberbullying, scams, and sexual exploitation. Communications Minister Fahmi Fadzil said the government is evaluating models from countries such as Australia, where platforms are set to deactivate under-16 accounts, while other European nations test age-verification systems. The move comes amid increased global scrutiny of TikTok, Snapchat, Google, and Meta over alleged links to youth mental-health risks, and follows Indonesia’s earlier plans for tighter content filtering and age controls. Malaysia has already tightened regulation requiring major platforms to obtain licenses, reflecting broader efforts to curb harmful online content.

Seviora Group will integrate Pavilion Capital — boosting its total assets under management to about US$72 billion — creating a larger Asia-focused asset-management platform. Pavilion Capital, a wholly-owned subsidiary of Temasek Holdings, is known for investing across technology, consumer, business-services and growth-stage private equity in Asia. In Indonesia, Pavilion has backed companies such as GudangAda (a leading FMCG B2B marketplace), SiCepat Ekspres (a major logistics/delivery startup), and Social Bella (beauty-tech startup) — reflecting its interest in e-commerce, logistics and consumer-tech opportunities in Southeast Asia. The integration with Seviora is expected to deepen its investment reach and leverage its existing portfolio across public markets, private equity, and tailored financing.

🚀 What’s Next: Indonesia EV Market Surges Despite Automotive Slowdown

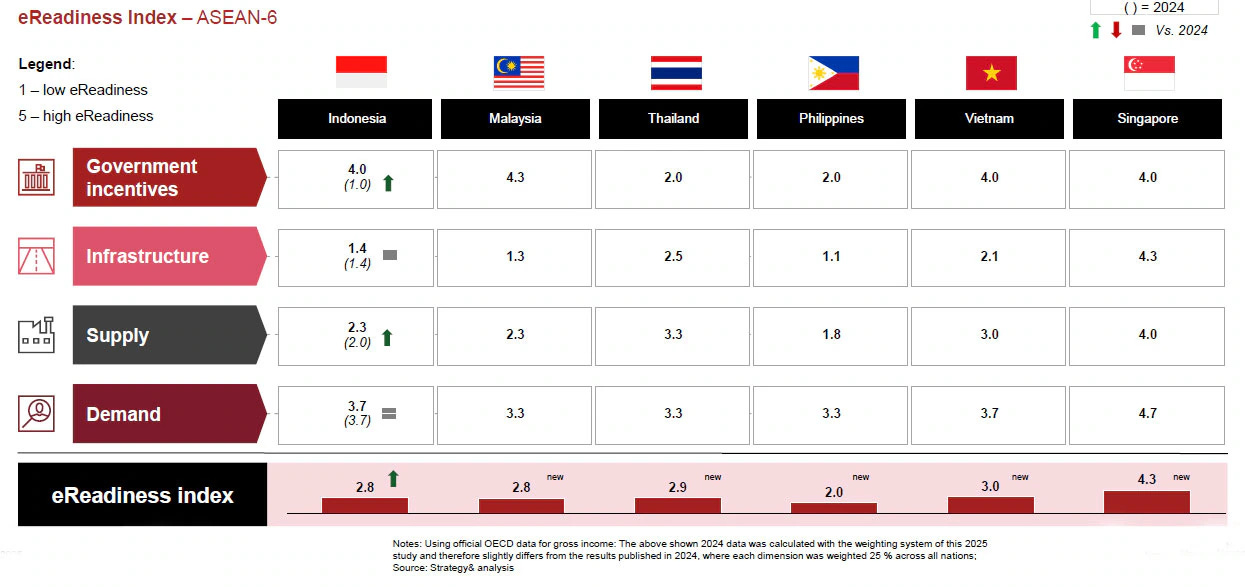

Indonesia’s electric vehicle (EV) market recorded significant growth of +49% year-to-date (YTD) Q3 2025, despite the national light-vehicle market declining -11% due to economic slowdown and increased luxury tax. EV adoption has now reached 18% of total vehicle sales, slightly above the ASEAN average of 17%. Across the region, xEV sales in ASEAN-6 surged 63% in the first half of 2025, signaling a continued shift toward electrification.

Survey results show 99% of EV owners in Indonesia are satisfied, the highest in ASEAN. However, 33% are considering returning to internal combustion engine (ICE) vehicles, driven by higher-than-expected maintenance costs and less-than-expected driving experience. Meanwhile, 70% of respondents are EV prospects, although this is the lowest share among ASEAN-6 markets.

Indonesia’s overall EV readiness score reached 2.8/5, up from 2.0 last year. Government incentives achieved a score of 4.0—the highest in ASEAN-6, while charging infrastructure remains a key weakness at 1.4, well below Singapore’s 4.3. Closing infrastructure and supply-chain gaps will be essential to sustaining growth momentum.

PwC highlights ambitious national objectives, including plans to build a full EV battery ecosystem by 2027–2028 and reach 600,000 EV units by 2030, supported by expanded fast-charging networks to meet accelerating demand.

Invitation to Join IFRF 2025!

We are also excited to invite you to an exclusive event: Indonesia Food Resilience Forum 2025. This forum will bring together key stakeholders to discuss innovative steps towards a sustainable food future for Indonesia.

Secure your spot at this strategic discussion by registering here: https://luma.com/75o04yki.