🤖 Local AI innovations. ❄️ Indonesia’s startup winter deepens. 🔄 Secondary deals surge.

Dear subscribers,

This week brings a mix of funding moves, strategic exits, and product innovations shaping Indonesia’s startup landscape. Talixa AI secured fresh capital to expand its AI solutions, while Fishlog is restructuring its business units to improve efficiency. Vidio made headlines as the first OTT platform in Indonesia to launch in-screen shopping with Shopee. On the investment front, Peak XV may divest its stake in Kopi Kenangan, GudangAda executed a major secondary buyback, BukuWarung welcomed Goodwater Capital as a larger shareholder, and SIRCLO closed a down round at a steep valuation cut.

We also released our H1 2025 Indonesia Startup Funding Report, revealing a 54.3% YoY decline in total funding and sharper drops in late-stage deals, driven by the eFishery scandal, weak IPO pipeline, and heightened governance scrutiny.

Best regards,

DailySocial Team

🚨 What’s New

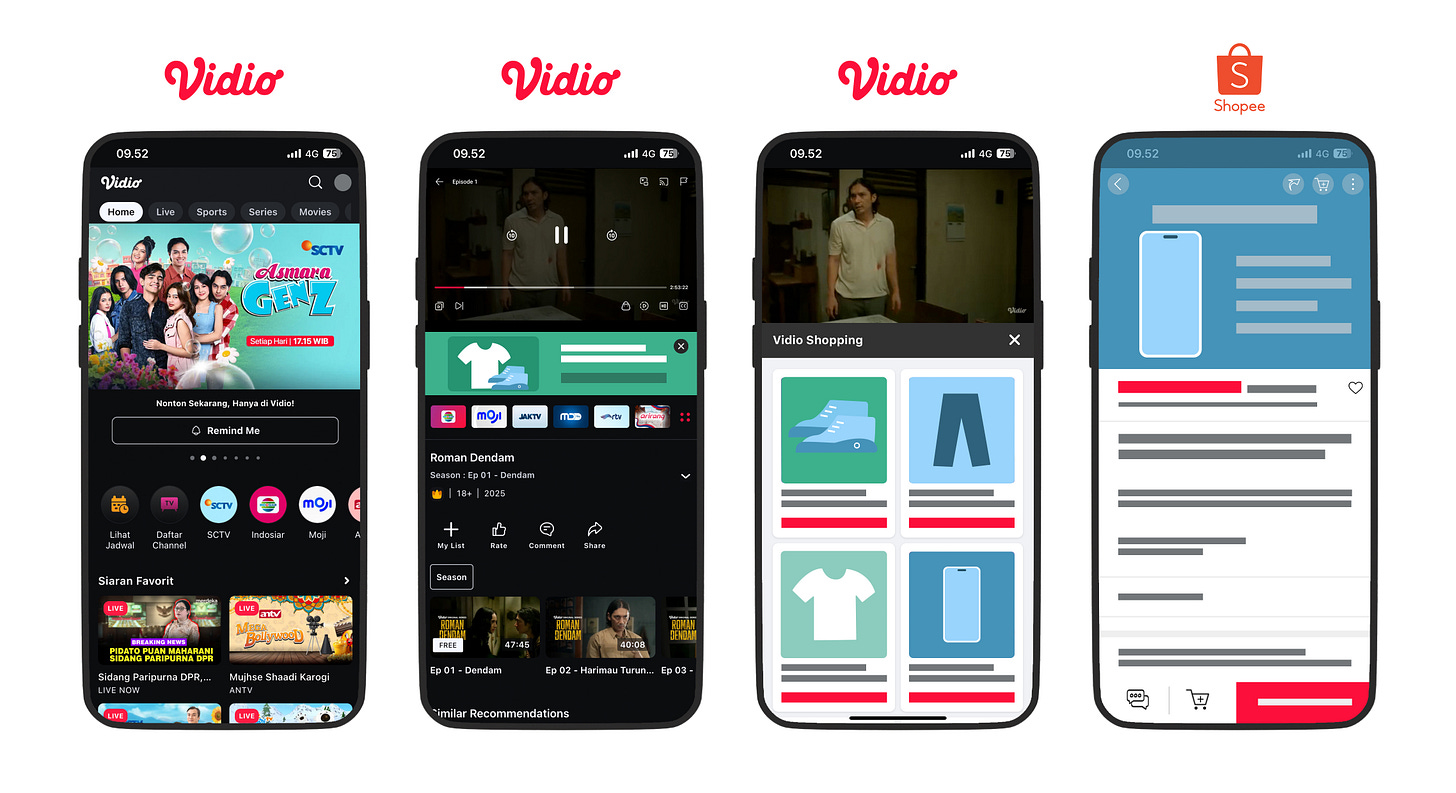

#1 Vidio Becomes Indonesia’s First OTT Platform with In-Screen Shopping

Vidio, Indonesia’s leading OTT platform, launched an in-screen shopping feature in partnership with Shopee, allowing viewers to purchase products directly while watching their favorite shows. This makes Vidio the first OTT platform in Indonesia to integrate content and commerce in a single experience. [Read More]

#2 Talixa AI Secures New Funding to Accelerate Regional Expansion

Talixa AI has secured fresh funding to accelerate the development and regional expansion of its AI-driven solutions. The new capital will be used to strengthen its product capabilities and expand its market reach across Southeast Asia, where demand for AI tools in various industries continues to grow. [Read More]

#3 Fishlog Restructures Business Units to Boost Efficiency

Fishlog is undergoing a restructuring of its business units to streamline operations and boost profitability. The move reflects the company’s efforts to adapt to shifting market dynamics in the seafood supply chain sector and to optimize its resources for long-term sustainability. [Read More]

#4 Binar Launches SINCRO, a No-Code AI Agent Platform

Binar introduced SINCRO, a no-code AI agent platform built using technology acquired from QUTKE. The platform enables businesses to create and deploy AI-powered agents without coding expertise, expanding Binar’s offerings in enterprise AI solutions. [Read More]

👏 What’s Exciting

#1 NTT Data Highlights GenAI Opportunities and Gaps in Healthcare

A study by NTT Data underscores the vast potential of generative AI in healthcare, citing opportunities to enhance patient care and operational efficiency. However, the research also highlights key challenges that must be addressed, including data quality, cybersecurity risks, and the need for clear strategic alignment in implementation. [Read More]

#2 Indonesia's Startup Winter Just Got Colder ❄️

Startup funding in Indonesia plunged 54.3% YoY in H1 2025, with an even steeper 97% collapse in Q1 alone. A mix of the eFishery scandal, a weak IPO pipeline, and tighter governance scrutiny has reshaped investor sentiment and deal flows.

Yet, there are bright spots—New Retail is gaining traction, early-stage deals remain active, and Fore Coffee’s IPO signals that the public market may be opening up for high-quality consumer brands.

💡 Dive into the key numbers shaping Indonesia’s tech landscape below. It’s time to fix governance, rebuild trust, and make Indonesia investable again.

🚀 What’s Next: Secondary Liquidity Surge in Indonesia’s Startup Ecosystem

Indonesia’s startup landscape is seeing a surge in secondary share transactions and investor exits, driven by venture funds approaching maturity and limited IPO/M&A pathways.

Recent examples include GudangAda’s buyback of shares from Sequoia Capital, Alpha Wave Global, and other institutional investors, Goodwater Capital increasing its stake in BukuWarung to over 12%, SIRCLO’s USD 38M down round at a steep valuation cut, and reports that Peak XV Partners is exploring a sale of its stake in Kopi Kenangan following earlier exits by other investors.

While total startup funding in Indonesia plunged 54.3% YoY in H1 2025, late-stage deals have been hit the hardest. These secondary transactions highlight growing pressure on early investors to secure liquidity, even at discounted valuations. Sectors like B2B commerce and fintech bookkeeping, once hotbeds for early-stage capital, are now facing profitability challenges—GudangAda, for instance, achieved 10x revenue growth but still recorded USD 33M EBIT losses.

“Exit opportunities for startups in Indonesia still face significant challenges, primarily due to the limited IPO channels and an underdeveloped domestic M&A market. On top of that, many investors are entering fund maturity, which increases the pressure to realize exits while market liquidity remains weak.

The biggest hurdle, however, lies within the startups themselves—many still lack strong governance structures. Improving the exit process must start internally, supported by ecosystem-wide collaboration. VCs need to play a more active role in preparing their portfolios for exit readiness, while regulators, corporates, and financial institutions should help create a healthier exit environment through stronger secondary markets and more strategic local acquisitions.”

— Eddi Danusaputro, CEO of BNI Ventures

This trend underscores the urgent need for better exit infrastructure, stronger governance, and more active participation from regulators and corporates to build a sustainable pathway for both investors and founders.