Mamame goes global 🌍, ABC Impact backs green capital ♻️, SEA fintech shifts to sustainable growth 💰

Dear subscriber,

This week highlights how Indonesia’s innovation story continues to evolve across sectors. Snack brand Mamame Whole Foods is taking Indonesian tempeh to global markets with backing from Granite Asia, while ABC Impact, DBS, and UOB are reimagining sustainable finance through an impact-linked fund model. In logistics, J&T Express’s regional growth reinforces Southeast Asia’s e-commerce momentum. The rollout of the Indonesia Game Rating System (IGRS) also marks a step forward in digital policy. The latest Tracxn report signals a maturing fintech landscape in Southeast Asia, where funding growth is slowing but shifting toward more sustainable.

This week’s newsletter is sponsored by Biznet Gio CloudBiznet Gio Cloud: Reliable Cloud Designed for Optimal Performance

Bring your preferred web apps online with virtual machines or ready-to-use platforms. Start with cost-effective web hosting, VPS, or elastic cloud servers.

Learn MoreBest regards,

The DailySocial Team

What’s New

The Indonesian snack startup Mamame Whole Foods has secured a US$2 million investment led by Granite Asia to accelerate its plant-based tempeh chip business, targeting expansion into the US and UK markets. By re-imagining Indonesia’s staple tempeh using black-eyed peas instead of soy and focusing on health-conscious consumers, Mamame taps into both local culinary heritage and global plant-based snack trends. With Granite Asia’s backing, the brand is well-positioned to raise Indonesia’s snack exports profile and spotlight the country’s potential in the healthy-snacks segment.

The impact investment firm ABC Impact (backed by Temasek) has partnered with banks DBS and UOB to launch a US$110 million sustainability-linked subscription loan facility for its Fund II, tying capital deployment to measurable social and environmental KPIs across Asia. The structure flips the conventional subscription loan model by embedding sustainability performance triggers, signalling growing sophistication in impact-finance in Southeast Asia. For Indonesia, this offers a precedent for channeling growth-capital into businesses that deliver both financial and social returns, aligning with domestic agendas around green growth and inclusive development.

What’s Exciting

Bank Indonesia’s Global Cooperation Push

At the IMF–World Bank Annual Meetings 2025, Bank Indonesia emphasized that strengthening multilateral cooperation is key to sustaining global growth amid tight monetary conditions and shifting geopolitics. The central bank reiterated its commitment to macroeconomic stability, policy credibility, and inclusive growth, while supporting investment and trade across developing economies. Indonesia highlighted its role in driving regional financial resilience through collaboration and innovation in sustainable finance.J&T Express rides e-commerce boom, strengthens Indonesia’s logistics edge

J&T Express recorded an impressive 23.1% year-on-year growth in parcel volume for Q3 2025, propelled by a 78.7% surge in Southeast Asia and 47.9% growth in new international markets. The strong performance reflects the sustained momentum of e-commerce and cross-border trade across the region. As demand for faster, more efficient parcel delivery continues to rise, the market presents expanding opportunities for ecosystem players, from warehousing and fulfillment to last-mile technology. In this regional growth cycle, Indonesia remains a key node, both as a major consumer hub and a logistics innovation base shaping the next wave of digital commerce efficiency.

Indonesia’s Gaming Industry on the Global Stage

Indonesia’s gaming ecosystem continues to gain global recognition, driven by initiatives from the Ministry of Communication and Digital (Komdigi). Locally developed games are entering international markets, supported by a stronger regulatory foundation through the launch of the Indonesia Game Rating System (IGRS) at IGDX 2025 in Bali. The event recorded a business potential of around $75 million, underscoring Indonesia’s rising status in the creative digital economy. By aligning ethical standards, data protection, and innovation, the government aims to make Indonesia not just a market for games, but a creator and leader in the global gaming industry.

AI Adoption in Banking Faces Security Hurdles

A recent HSBC survey revealed that while banks across Indonesia are increasingly aware of AI’s potential to streamline operations and improve services, adoption remains slow due to cybersecurity concerns. Many financial institutions see AI as transformative for customer experience and fraud detection but remain cautious about data protection and hacker risks. The findings highlight the industry’s need for stronger governance, secure infrastructure, and clearer regulatory frameworks to fully unlock AI’s benefits. This cautious optimism mirrors Indonesia’s broader digital transformation—progressive, yet mindful of the balance between innovation and trust.

Whats Next

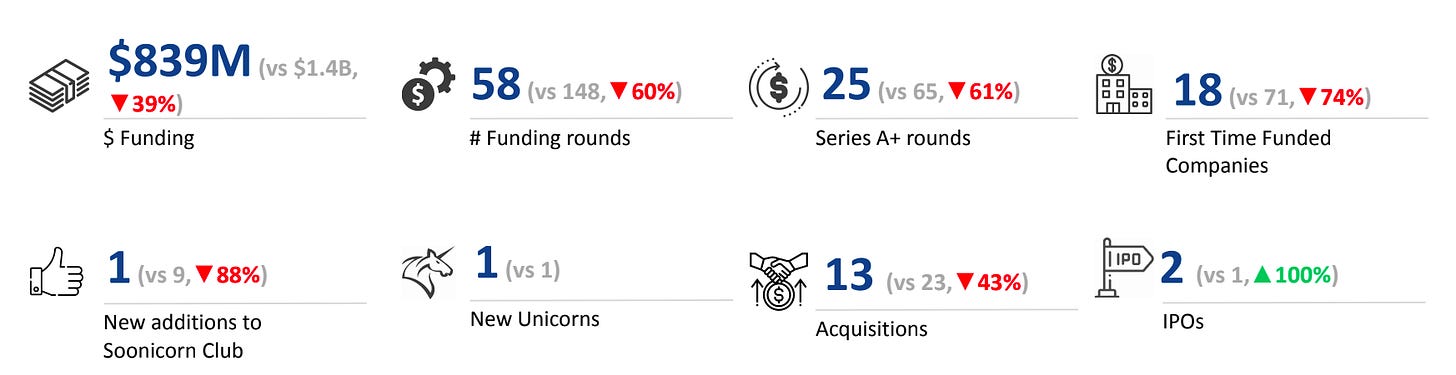

Despite a funding winter that has chilled the broader Southeast Asian fintech scene, Indonesia remains a market brimming with structural opportunity. According to Tracxn’s 9M 2025 report, fintech startups across the region collectively raised US$839 million, marking a 39% year-on-year decline. More tellingly, early-stage rounds contracted by about 63%, reflecting investor caution amid rising capital costs and tighter global liquidity. While Singapore commanded 84% of total funding, Indonesia captured only 4%, signaling both a slowdown and a gap between ecosystem maturity levels.

Despite the broader funding slowdown, Indonesia’s fintech base remains steady, with investors maintaining a clear focus on transaction infrastructure and inclusion-driven financial solutions that anchor long-term market growth. Funding in Jakarta reached around US $32.8 million (4% of SEA total), a sharp correction from 2024 levels but still anchored by strong early-stage activity from players like OY!, SkorLife, Ringkas, and Bang Jamin, backed by both domestic and regional investors including BRI Ventures and QED InvestorsSEA fintech funding TraxcnSEA fintech funding Traxcn. This shift hints at a more deliberate, fundamentals-driven capital deployment focused on credit scoring, digital lending, and financial access, areas central to Indonesia’s digital-finance expansion.

Looking ahead, the regional funding contraction may catalyze a healthier balance between growth and sustainability. The consolidation visible across Southeast Asia’s fintech scene, with fewer new entrants and more disciplined follow-on rounds—could ultimately favor markets like Indonesia that combine scale with policy support such as QRIS expansion and digital-lending regulations. As investors recalibrate toward resilient, infrastructure-led fintech models, Indonesia is likely to remain a critical node in Southeast Asia’s transition from high-velocity funding cycles to long-term financial inclusion and cross-border innovation.