OJK leadership shifts 🏛️, Dash Electric secures seed funding ⚡, SEA venture resets 📉

Dear subscriber,

This edition opens with regulatory developments at OJK, where recent leadership changes have put market stability and execution in focus, even as no immediate policy shifts have been announced. Against this backdrop, the market remains active but increasingly selective. Recent updates include early-stage funding in electric mobility, continued scale in food delivery, and a rare profitability milestone from a homegrown consumer brand. Strategic capital is still flowing into insurance, payments, and data infrastructure, supported by clearer policy direction and regional partnerships.

Not all bets are paying off. Una Brands’ exit from Indonesia highlights mounting pressure on aggregator and roll-up models, while leadership changes at major platforms and stricter fintech enforcement point to a more disciplined operating environment. Looking ahead, the APAC private capital outlook suggests a slow reset rather than a rebound, with Southeast Asia nearing the bottom of its venture cycle and investors prioritizing resilience and execution over rapid expansion.

Thanks for reading RISE by DailySocial! Subscribe for free to receive new posts and support my work.

Thinking about AI?

Share your business context.

Receive a practical AI strategy in return.

Stay ahead,

DailySocial Team

🚨 What’s New

Top leadership turnover at OJK amid market volatility

Indonesia’s Financial Services Authority (OJK) has appointed new commissioners following the resignation of its chair and senior officials amid recent market turbulence. The leadership change comes after volatility in Indonesia’s financial markets, estimated at around USD 80 billion, which has raised questions around regulatory confidence and stability. While turnover at the top of the regulator can affect the pace of policy execution and market oversight, no immediate regulatory or policy shifts have been announced. Key industry counterparts, including associations such as Amvesindo, also remain structurally unchanged.For fintech and other market participants, the impact is not operational at this stage. Regulatory direction and supervisory frameworks remain intact, suggesting continuity rather than disruption. The near-term risk lies more in execution speed and coordination during the transition, rather than changes to rules or enforcement. For startups, this development is best read as a signal to stay attentive, not to revise strategy.

Sagana joins Dash Electric’s seed round

Dash Electric secured fresh seed funding with Sagana coming in as a new investor. The funding signals growing interest in Indonesia’s electric mobility supply chain, especially beyond consumer-facing EV brands. Early-stage capital in this segment suggests investors are betting on long-term infrastructure demand. While the round size was not disclosed, seed activity remains selective in the current market. This reflects a cautious but continued appetite for climate and hardware-linked startups in Indonesia.Indonesia’s food delivery GMV hits USD 64 billion in 2025

Indonesia’s food delivery market reached USD 64 billion in gross merchandise value in 2025. Growth was supported by high order frequency and deeper penetration outside tier-one cities. The scale confirms food delivery as one of the country’s most mature digital consumer services. However, competition and cost pressure remain key challenges. The number highlights why the sector continues to attract platform, logistics, and fintech innovation.Kopi Kenangan reaches profitability with USD 184 million revenue

Kopi Kenangan reported USD 184 million in revenue and achieved profitability in 2025. This marks a rare milestone for a consumer startup operating at national scale. The result reflects disciplined expansion and tighter cost control after years of aggressive growth. It also shows that offline-first consumer brands can reach sustainable margins in Indonesia. The performance strengthens confidence in consumer startups with strong unit economics.Insurtech Igloo raises USD 5 million from Tokio Marine

Igloo raised USD 5 million in funding from Tokio Marine, reinforcing strategic interest from established insurers. The investment highlights rising demand for digital insurance distribution across Southeast Asia. For Indonesia, embedded and micro-insurance remain underpenetrated but high potential. The deal suggests incumbents are increasingly partnering rather than competing with startups. It also signals steady capital flow into practical, revenue-linked insurtech models.Una Brands exits Indonesia as part of profitability reset

Una Brands, a Singapore-based brand aggregator, has exited the Indonesian market as of January 2026. The decision is part of a broader restructuring aimed at improving profitability and narrowing focus to fewer core markets. This marks a clear shift from its earlier expansion plans, after the company had announced a commitment of around IDR 500 billion in late 2021 to acquire local consumer brands. The exit reflects tougher conditions for roll-up and aggregator models in Indonesia’s competitive e-commerce landscape. It also highlights how scale alone is no longer enough without clear margins and operational efficiency.

👏 What’s Exciting

Leadership changes at Tokopedia and TikTok Shop Indonesia

Melissa Siska Juminto has stepped down as President Director of Tokopedia and TikTok Shop Indonesia, signalling a significant leadership shift at two major e-commerce platforms. These platforms play key roles in shaping online retail behavior across the country. Her departure may reflect changing strategic priorities amid evolving competition and market consolidation. Leadership transitions at this scale often influence operational focus and partnerships. For founders and partners, this could mean new direction in market tactics and execution.OJK concludes investigation into Crowde, raises legal stakes in fintech

Indonesia’s financial regulator has completed its investigation into fintech lender Crowde, with key executives now facing charges that could carry penalties of up to 15 years in prison. This development highlights stricter enforcement around consumer finance and lending practices. The case reinforces that regulatory scrutiny in Indonesia is intensifying, especially where consumer protection and lending standards are concerned. It also signals to investors and startups that compliance and governance are increasingly non-negotiable. As the broader fintech ecosystem matures, stronger oversight may build longer-term trust.Indonesia advances national digital and data infrastructure agenda

The government announced new steps to strengthen Indonesia’s digital and data ecosystem. The focus includes governance, infrastructure readiness, and cross-sector coordination. These moves aim to support long-term growth of data-driven industries. For startups and investors, clearer policy direction reduces regulatory uncertainty. It also underlines the state’s role in enabling digital scale rather than only regulating it.NeutraDC and Japan’s Ishikari plan data center expansion in Indonesia

NeutraDC and Japan-based Ishikari announced plans to expand data center capacity in Singapore and Indonesia. The move reflects sustained demand for regional cloud and data services. Indonesia’s growing digital economy continues to push local hosting and latency needs. Cross-border partnerships help accelerate capital-intensive infrastructure development. This expansion supports enterprise, fintech, and AI workloads across the ecosystem.Artajasa and Ant International launch global QR payments

Artajasa and Ant International introduced a global QR payment initiative linked to Indonesia’s QRIS network. This enables Indonesian users to transact more easily across borders. The launch shows how domestic payment infrastructure is gaining international relevance. It also supports tourism and cross-border commerce. The collaboration strengthens Indonesia’s position in regional digital payments.

🚀 What’s Next: APAC Private Capital in 2026: A Slow Reset, a Southeast Asia Bottom, and New Paths to Liquidity

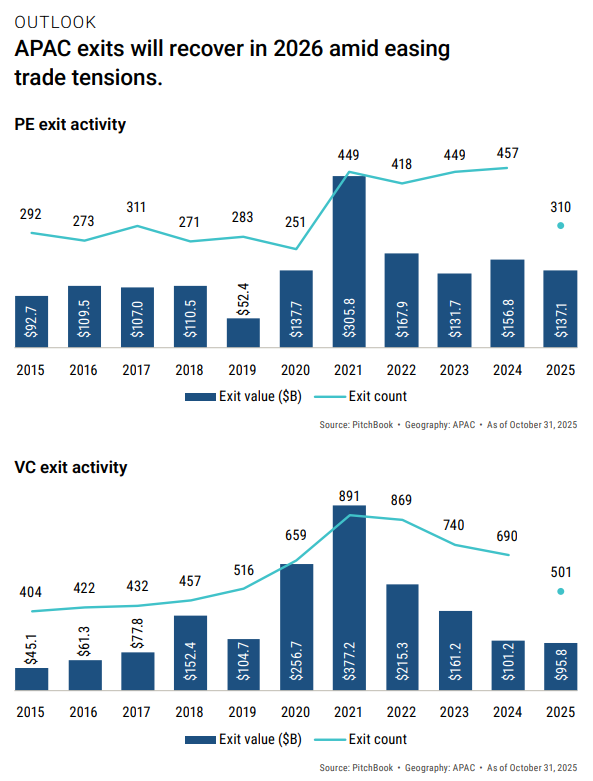

Private capital markets across Asia-Pacific are entering 2026 in a more stable position, helped by lower interest rates and easing financing pressure. Deal activity is expected to improve gradually, but the recovery remains uneven across countries. Exit markets are reopening slowly, with total exit value projected to grow around 10–20% year on year, still far below the 2021 peak. Liquidity remains the main constraint, as IPOs are selective and distributions to investors are limited. This sets the tone for cautious reinvestment rather than aggressive growth

Southeast Asia’s venture market is expected to reach its lowest point in 2026 after several years of decline. Venture deal value in the region fell to under USD 5 billion in 2025, down sharply from more than USD 17 billion in 2021. Investors are prioritizing capital efficiency and clearer paths to profitability, especially at later stages. Exits will rely mostly on M&A and secondary sales, with public listings remaining rare. This environment implicitly puts pressure on markets like Indonesia to focus on stronger fundamentals rather than rapid scaling.

A key structural shift highlighted in the report is the rise of alternative liquidity options, particularly GP-led secondaries. Globally, GP-led transactions reached about USD 48 billion in the first half of 2025, nearly matching traditional secondary deals. Asia is still early in adopting this model, but activity is expected to grow in 2026 as exits stay limited. For Southeast Asia, this creates a practical path to recycle capital from older funds. Over time, this could help stabilize the ecosystem and support more sustainable investment cycles in markets such as Indonesia.