Qiscus expands via acquisition 🤝. Superbank IPO frenzy 📈. AI adoption accelerates 🤖🇮🇩

Dear subscriber,

As we close out the year, Indonesia’s digital landscape continues to show strong momentum, with new funding and acquisitions in healthtech and AI alongside strong investor confidence reflected in Superbank’s IPO and growing interest in tokenization and applied AI. At the same time, rising consumer adoption of AI is reshaping how technology is used, even as many organizations work to improve governance and readiness.

Thank you for being part of our journey this year. We wish you a joyful holiday season and a restful end of year break, and hope you enjoy quality time with your family and loved ones. See you in the new year with more stories and insights ahead.

This week’s newsletter is sponsored by Biznet Gio CloudBiznet Gio Cloud: Reliable Cloud Designed for Optimal PerformanceBring your preferred web apps online with virtual machines or ready-to-use platforms. Start with cost-effective web hosting, VPS, or elastic cloud servers. Learn MoreWarm regards,

DailySocial Team

🚨 What’s New

Save the Children Global Ventures has invested in PrimaKu, an Indonesian digital health platform for early childhood development, to help address under-immunisation and stunting. The partnership will expand PrimaKu’s services, which are used by over two million parents for child health guidance, vaccinations, and nutrition monitoring, with a focus on underserved communities. Endorsed by national health authorities, PrimaKu has shown strong impact and is expected to scale further across Indonesia and beyond. [Read More]

Local omnichannel provider, Qiscus, has acquired AI voice platform Kokatto to expand beyond chat and strengthen its voice-based AI capabilities, responding to growing enterprise demand for handling higher volumes and more complex customer inquiries. Kokatto’s technology will be integrated into Qiscus’ offerings, enhancing its conversational AI stack as businesses increasingly seek advanced voice solutions. [Read More]

Satu Dental, an Indonesian dental clinic chain offering a wide range of general and cosmetic services, has raised US$3 million in a Series A1 funding round. The round included new and existing investors such as Stockhausen International, Alpha JWC Ventures, and Supernova Capital Investment, bringing the company’s total equity funding to over USD 14 million. As part of the transaction, Sai Global Singapore fully exited by selling its 12.5 percent stake through a secondary sale. [Read More]

Indonesia’s government is finalising two key AI regulations covering a national AI roadmap and AI ethics, which are now awaiting President Prabowo Subianto’s signature. The rules are expected to be issued as presidential regulations in early 2026 and will serve as a broad policy framework rather than sector-specific rules, allowing ministries and agencies to develop their own AI regulations as needed. [Read More]

Superbank’s IPO drew exceptionally strong investor demand, with the offering oversubscribed by 318.69 times and attracting more than one million orders ahead of its listing on the Indonesia Stock Exchange. Priced at Rp 635 per share, the IPO marks one of the largest debuts in Indonesia’s digital banking sector and reflects strong market confidence in Superbank’s fundamentals, growth strategy, and the broader outlook for digital banking in the country. [Read More]

👏 What’s Exciting

EDENA Capital Partners has secured up to US$100 million in investment from GEM Token Fund to accelerate the rollout of government-approved digital securities infrastructure in emerging markets. The funding will support the launch of regulated Security Token Offering (STO) exchanges in Indonesia and Egypt, enabling the tokenization of real-world assets such as real estate, carbon credits, equities, bonds, and commodities. EDENA aims to generate first revenues in 2026, scale across ASEAN, MENA, and Africa, and reach more than 30 countries with over US$10 billion in tokenized assets by 2030, positioning itself to capitalize on the rapid growth of real-world asset tokenization.

Antler has invested US$5.6 million in 14 AI startups as part of its 2025 Disrupt AI portfolio, backing early-stage companies building applied AI solutions for enterprise and industrial use. Launched through two cohorts in May and October 2025, the startups operate across sectors such as manufacturing, robotics, enterprise software, energy, and travel automation, with several already serving customers in Asia, Europe, and North America. Each company received US$400,000 after completing a four-week Disrupt sprint, marking their first institutional funding and highlighting Antler’s focus on AI startups with early commercial traction rather than experimental projects.

Crypto.com has partnered with Singapore’s DBS Bank to strengthen its fiat payment services, allowing users to deposit and withdraw Singapore dollars and US dollars directly via DBS. The partnership expands Crypto.com’s banking rails, complements its existing arrangement with Standard Chartered, and enables the setup of client money accounts to facilitate faster and simpler transfers within the app. The move supports Crypto.com’s strategy to enhance fiat access as Singapore remains a key hub for its growth, following the company’s receipt of a full licence from the Monetary Authority of Singapore to provide end-to-end crypto payment services.

🚀 What’s Next: AI Consumer Penetration in Indonesia

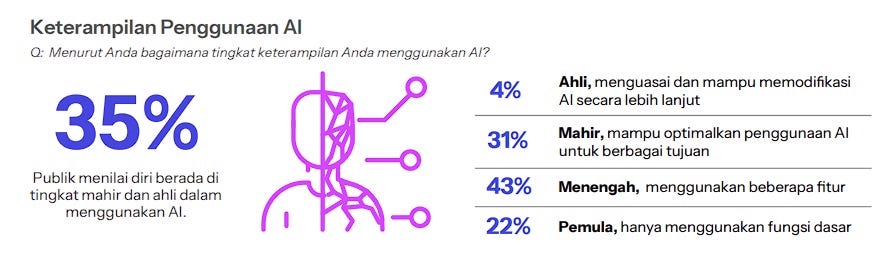

According to Kumparan’s Report, AI has achieved significant penetration in Indonesia, with 97 percent of the public aware that their daily digital services are powered by AI. Generative AI chatbots lead adoption, with ChatGPT commanding 85 percent of users, followed by Meta AI at 72 percent and Google Gemini at 65 percent. Within six months, 80 percent utilized AI for information retrieval, demonstrating that AI has become the default tool for accessing knowledge.

Adoption patterns differ markedly between generations. Gen Z prioritizes productive applications like coding and data analysis, while Millennials favor practical efficiency tools such as navigation and customer service chatbots. Both use AI equally for creative purposes at 61 percent for visual content creation. Usage intensity also varies, with Gen Z showing more stable integration at 35 percent using chatbots 6 to 10 times weekly, while Millennials display more variable adoption ranging from light experimentation to heavy usage.

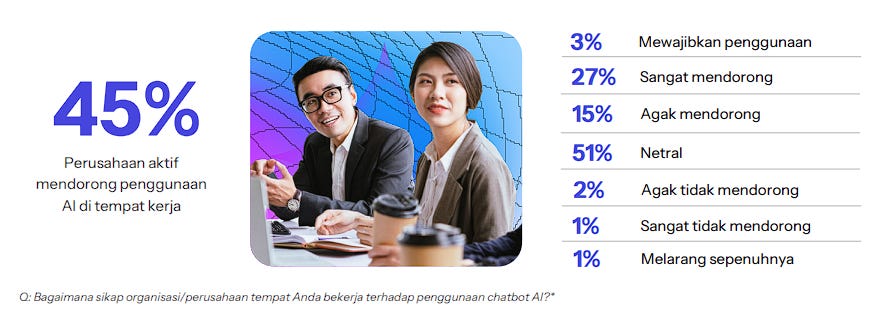

Organizational adoption lags individual use, with only 45 percent of companies actively promoting AI despite 57 percent of workers already using generative chatbots. The Digital Media sector leads adoption support at 55 percent, while Commerce Consumer Services remain largely neutral at 60 percent. This gap reflects limited AI expertise, high investment costs, and regulatory uncertainty. Compounding this, 68 percent believe AI will completely replace their jobs within five years, yet 79 percent express confidence their current skills remain adequate.

Data security emerges as the primary concern for 55 percent of users, followed by accuracy at 53 percent and cost barriers at 50 percent. Notably, 75 percent worry about deepfakes and identity fraud, while 62 percent fear personal data misuse. Learning remains predominantly informal, with 84 percent relying on social media and YouTube rather than formal courses at 21 percent, perpetuating pseudo-literacy where users feel competent but lack foundational understanding. Indonesia’s adoption trajectory will depend on whether institutional governance and education can match user-driven enthusiasm.