Rough storm for aquatech, Djarum’s shopping spree, ITE law revised 🇮🇩🚀

Dear readers,

Welcome to RISE by DailySocial, your essential weekly update on Indonesia’s technology ecosystem. This English newsletter format is a culmination of months of research and trying to understand the market, its needs and pain points.

Here, we’ll be covering the latest tech highlights (investments, M&A, product launches); dive into key insights, trends, regulatory updates and featured reports (we love research reports ❤️). We have divided our newsletter into 3 main sections: WHAT’S NEW (news updates Indonesia), WHAT’S EXCITING (trends, insights, actionable knowledge) and WHAT’S NEXT (near future trends).

We hope you enjoyed our newsletter as much as we enjoyed crafting it. And do let us know your feedback (you know we love to hear back from you).

Cheers!

DailySocial Team

🚨 WHAT’S NEW

Here are some of last week’s highlights you might have missed:

Kumparan Secures Major Corporate Action. GDP Venture, Djarum Group's investment arm, has acquired a 99% stake in media powerhouse Kumparan for $60 million. This follows Djarum investment arm GDP Venture’s earlier 42% ownership. Other stakeholders, including Argor (GoTo’s investment arm) and Cakra Ventures, are fully bought out. [Read more]

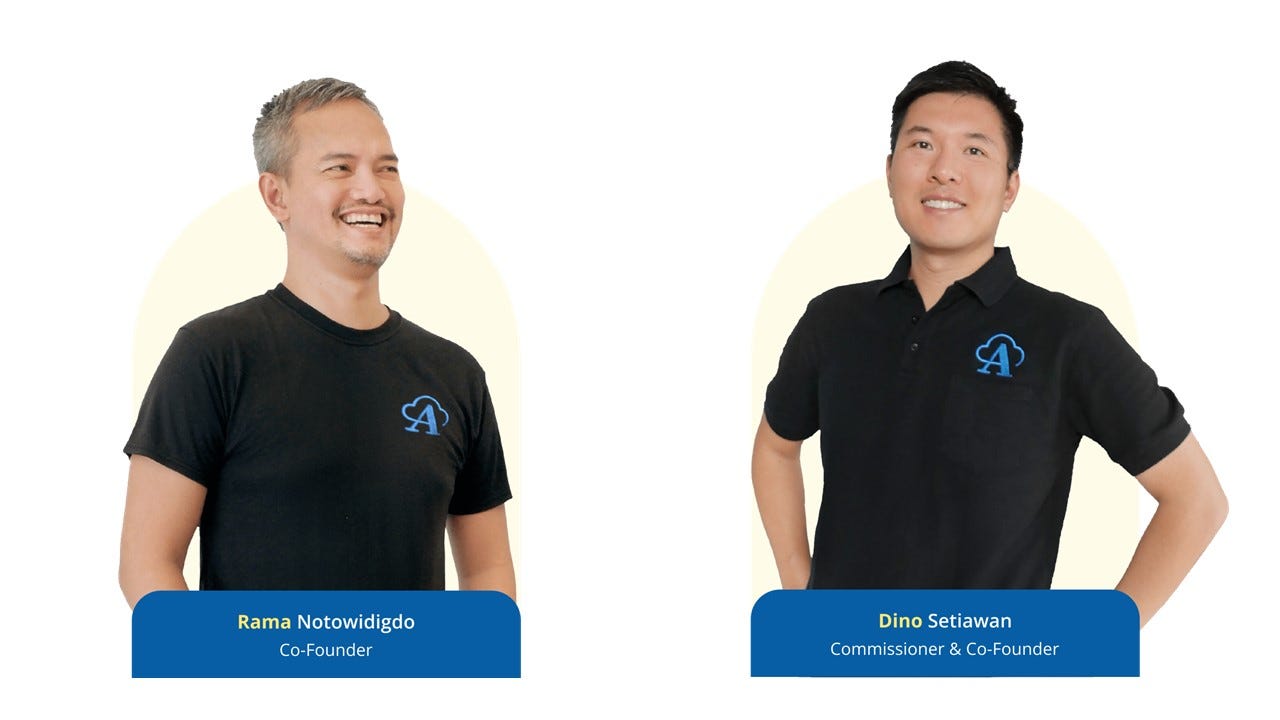

AwanTunai Secures $60M Debt Financing. SMEs digital supply-financing platform AwanTunai secured $60 million in debt financing from Accial Capital and other investors, expanding financial access for Indonesia’s MSMEs.

This follows a mid-2024 credit injection of USD18.5 million from HSBC and a USD27.5 million Series B funding round earlier this year. [Read more]

Carro Attracts Strategic Investment. Southeast Asia's car marketplace Carro welcomed strategic investment from Woori Venture Partners to bolster regional expansion, specifically Indonesia. The company also reported a remarkable 11x year-on-year EBITDA growth and a 49% increase in gross profits. [Read more]

Lamudi Acquires IDEAL. Rocket Internet’s property marketplace Lamudi has acquired IDEAL, a mortgage service provider, strengthening its presence in Indonesia’s digital property sector. This move boosts its collaboration network, now partnering with 500 developers, 30,000 agents, and 28 financial institutions. [Read more]

GORO Joins OJK’s Regulatory Sandbox. Property investment platform GORO has entered OJK’s Regulatory Sandbox, using blockchain technology to enable fractional real estate ownership. This move could redefine Indonesia’s proptech landscape. [Read more]

Exclusive Interview

Discover how MilikiRumah aims to bridge the home ownership gap for the underbanked. Their unique service combines a credit scoring system with a rent-to-own concept.

"Think of our service like a diet program. You can wear that cool outfit right away, but to make it truly fit for the long term, you need to stay disciplined with your eating habits, exercise, and so on."

Turbulence in Local Aquatech Startups

FishLog, a B2B platform promising to revolutionize Indonesia's fisheries cold chain, is making significant changes due to financial challenges, including cutting its workforce by over half and considering a strategic merger or acquisition (M&A). As recently as April 2024, FishLog raised a pre-series A funding of USD 3.5 million from Mandiri Capital Indonesia, BNI Ventures, Accel Partners, and other investors.

The board of directors of eFishery, Indonesia’s aquatech unicorn, has reportedly suspended two co-founders, CEO Gibran Huzaifah and COO Chrisna Aditya, following an investigation into alleged financial irregularities, according to DealStreetAsia. Last year, eFishery secured a USD 200 million Series D funding round, boosting its valuation past USD 1 billion. In addition to equity funding, the company frequently obtained debt funding, including a USD 30 million facility from HSBC earlier this year. eFishery supports the fisheries supply chain from upstream to downstream, offering services from sales to financing for its partners.

👏WHAT’S EXCITING

#1 Proposed Revisions to the ITE Law

Government Regulation No. 71 of 2019 (PP-PSTE) has significantly regulated electronic transactions. While its intentions are positive—giving the government authority to maintain digital sovereignty—specific clauses are viewed as flawed. The ITE (Information and Electronic Transaction) Law is set to undergo revision next year.

Article 27 Paragraph 3 of the original regulation that covers defamation, has led to frequent misuse to criminalize public and online criticism, against public officials or institutions.

The proposed revision addresses these issues by removing ambiguous clauses, solidifying the government’s absolute discretion in managing electronic transactions and digital content. The revision also hopes to further enhance digital identity protection, electronic system risk management, and legal equality.

#2 XL-Smartfren Merger

PT XL Axiata Tbk (XL) and PT Smartfren Telecom Tbk (Smartfren) have officially merged into XLSmart, with a pre-synergy valuation exceeding USD6.5 billion. This merger resulted in a combined customer base of 94.5 million, increasing their market share to 27%. They are closely trailing Indosat Ooredoo Hutchison (28%). Meanwhile, the market leader is still Telkomsel with a market share of around 45%.

This merger is said to be a strategic step to strengthen competitiveness in the telecom industry that has been rife with issues with revenue growth and lowering margins. Previously, Indosat Ooredoo and Hutchisons Tri’s merger resulted in a 43.4% year-over-year revenue surge to USD1.7 billion in H1 2024.

With only three telecommunications companies left, competition and innovation are expected to become more dynamic.

#3 Amar Bank Introduces "Embedded Banking"

Amar Bank, the digital bank owned by Tolaram Group, introduced the concept of embedded banking, enabling digital platform developers to integrate banking financial capabilities into their products. This innovation allows full integration with the bank's core system, seamlessly providing more comprehensive financial capabilities.

CEO Vishal Tulsian stated that the concept of “embedded banking” addresses fragmentation issues in digital financial services, often resulting in high costs and suboptimal user experiences. In a report launched by Amar Bank and our good buddies at Discovery/Shift, embedded financial models have become a preferred option for digital players. According to the report, 69% of digital players prefer third-party financial services, with only 28% choosing to develop them in-house. Complexity, scalability, and regulations remain significant challenges and embedded banking is expected to become an integral part of the digital industry, shaping the growing digital economy in the region.

#4 Jakarta Introduces First All-Electric, 5-Star Taxi Service

Vietnamese ride-hailing company Xanh SM has officially launched in Jakarta, introducing Indonesia's first fully electric taxi service. Partnering with VinFast, Xanh SM provides a premium, quiet, and eco-friendly travel experience to help reduce the city's air pollution. In addition to Indonesia, they have also recently expanded to Laos.

Xanh SM enters a highly competitive ride-hailing landscape dominated by Gojek, Grab, and Bluebird. While Gojek and Grab grapple with unit economics, Bluebird has long been a sustainability leader, operating over 200 electric taxis since 2019 and committing to a 50% carbon emission reduction by 2030. Their partnership with BYD and plans for fleet expansion add further pressure to the market.

Xanh SM’s focus on sustainability and premium service positions it as a compelling choice for eco-conscious riders. However, its ability to gain traction will depend on balancing competitive pricing with its green initiatives.

🚀 WHAT’S NEXT

As of the second week of December 2024, data from DailySocial reveals the following funding activity:

Total Funding Transactions (2024): 114, including 12 debt financings.

Total Funding Amount: Approximately USD2 billion, with USD533 million from debt financing.

Comparison to 2023: USD2.85 billion, reflecting a 29.82% decrease in total funding.

Responding to this year’s funding conditions, Eddi Danusaputro, CEO of BNI Ventures and Chairman of AMVESINDO, noted that the situation remains consistent with the tech winter era.

“2024 is still experiencing a tech winter regarding funding disbursement and the number of transactions. Many investors are shifting their focus to fundamentals, such as the path to profitability, rather than just valuations. I believe 2025 will remain challenging, as the macroeconomic conditions also appear tough.”

Nevertheless, despite the challenges, venture capital investments are still progressing positively with many industry sectors still attracting investments. Similarly, local VC DSX Ventures remains optimistic. According to Founding Partner, Rama Mamuaya, the venture capital market in Asia continues to show resilience amidst global challenges, opening new opportunities for investors.

Positive indicators include the recovery of VC fundraising. After declining from $383 billion in 2021 to $340 billion in 2022, fundraising rebounded with $202 billion raised by mid-2023. Investor confidence remains strong. While VC funding volume has declined, projections for 2024 show stability, with a focus on funds with solid track records for long-term growth.

He also highlighted several exciting investment ideas worth exploring in 2025, including:

AI-Powered Customer Insight

SaaS for SMEs in Agriculture

Healthcare SaaS

Energy Efficiency Solutions

Procurement Tech for Retail

Let’s RISE Together 🌟

The road ahead is full of challenges and opportunities, but one thing’s for sure—Indonesia’s tech ecosystem keeps moving forward. Stay curious and bold; we’ll return with even more updates next week!

-

Notes: At 16 Dec, 10.00 Jakarta time, we have updated information about Fishlog.