Sociolla lands General Atlantic 🤝. Fiber infrastructure bets grow 🌐. Regulators tighten digital rules 🇮🇩⚖️

Dear subscriber,

This week’s highlights include General Atlantic’s strategic investment in Sociolla, a major fiber-optic infrastructure collaboration between Indosat, Arsari, and Northstar, and new OJK regulations tightening rules for pay-later services. We also cover OJK’s response to the BI-Fast cybersecurity incident, Indonesia’s expanding digital tax framework with OpenAI appointed as a VAT collector, and a forward look at Indonesia’s green entrepreneurship ecosystem as sustainability and climate-aligned innovation gain momentum across the market. Stay tuned for more insights on Indonesia’s tech, digital, and startup landscape in the weeks ahead.

Warm regards,

DailySocial Team

🚨What’s New

• General Atlantic invests in Indonesia’s beauty-commerce platform Sociolla

Global growth investor General Atlantic has acquired a 54% controlling stake in Sociolla, completing a majority acquisition of the Indonesian beauty and lifestyle e-commerce platform in a deal largely structured through secondary share purchases. As part of the transaction, Pavilion Capital and L Catterton fully exited, while East Ventures and EDBI partially divested, alongside a US$10 million primary issuance by Sociolla. The company has previously raised over US$170 million from investors including Temasek, Jungle Ventures, Venturra, and UOB Venture Management, and the new ownership is expected to support Sociolla’s regional expansion.

• Indosat, Arsari and Northstar form $925M fiber-optic platform to expand Indonesia’s broadband infrastructure

Telecom major Indosat Ooredoo Hutchison has teamed up with strategic partners Arsari Group and Northstar Group to create one of Indonesia’s largest fiber-optic infrastructure platforms with a $925 million investment, aiming to accelerate high-speed connectivity across the archipelago and support digital adoption nationwide. This move reflects growing investor confidence in digital infrastructure as a long-term backbone for Indonesia’s digital economy.

• New OJK regulation caps pay-later interest and tightens debt collection practices

Indonesia’s financial regulator, the OJK, has introduced new rules for pay-later services that set explicit limits on interest charges and establish stricter guidelines for debt collection. The measures are intended to protect consumers and promote responsible lending practices in the rapidly expanding fintech credit market. Fintech players are expected to adjust their business models to balance growth with stronger compliance and consumer protection standards.

👏What’s Exciting

• Indonesian financial regulator steps up cybersecurity action after BI-Fast hack

Following a fraud incident affecting BI-Fast payments worth around Rp200 billion, Indonesia’s financial watchdog OJK has instructed banks to strengthen cyber defenses, improve fraud detection systems, and enhance incident response teams. The case highlights heightened regulatory focus on digital payment security as adoption rises. It also signals increasing scrutiny on banks’ operational resilience amid rapid digital transaction growth.

• Digital economy tax receipts hit Rp44.55 trillion; OpenAI designated as PMSE VAT collector

Indonesia’s government reported that digital economy tax revenues reached an estimated Rp44.55 trillion through November 2025, with contributions from e-commerce VAT and taxes on crypto and fintech activities. Notably, OpenAI was officially appointed as a VAT collector for online services, reflecting the growing fiscal role of AI-powered digital platforms. The milestone reinforces Indonesia’s commitment to ensuring fair taxation across global digital and AI-driven businesses.

🚀 What’s Next: Mapping Indonesia’s Green Entrepreneurship Ecosystem

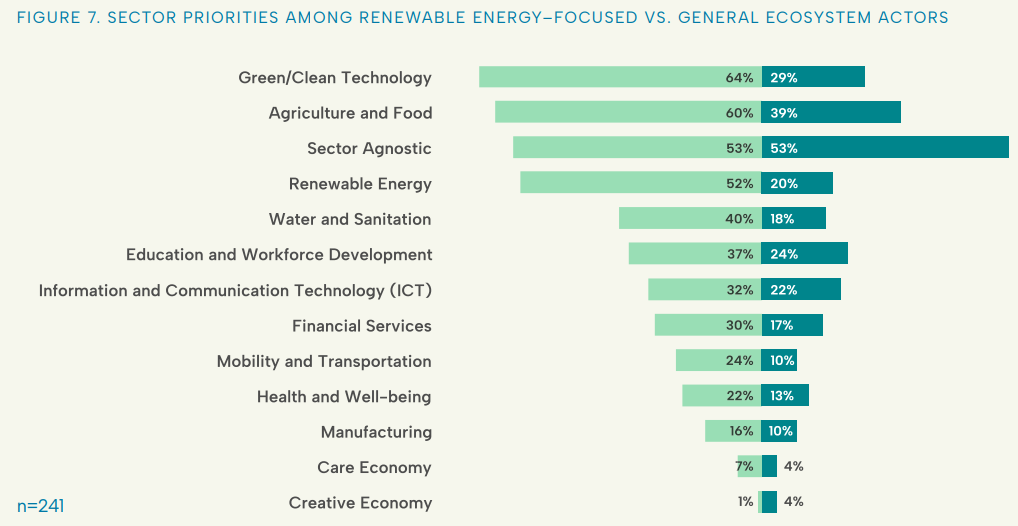

The report The State of Indonesia’s Entrepreneurial Ecosystem: Focus on the Green Economy provides a comprehensive mapping of Indonesia’s entrepreneurship ecosystem with a specific lens on green and climate-aligned businesses. It analyzes 304 ecosystem organizations, including investors, incubators, accelerators, and support providers, to understand how entrepreneurs are funded, supported, and scaled across regions and sectors, with a focus on sustainability, inclusion, and climate impact.

Key findings reveal a fast-growing but uneven ecosystem. While 87 organizations identify as green economy focused and 107 provide funding, support remains heavily centralized, with nearly 50% of actors headquartered in Jakarta. The data also shows strong early-stage support, with 88% of organizations serving early-stage ventures, but persistent gaps in climate-ready financing, access to technical expertise, and recognition of non-obvious green businesses such as agriculture or waste-reduction MSMEs.

For Indonesia’s broader startup and investment ecosystem, the report underscores the need to rethink how green innovation is defined, funded, and scaled. The findings highlight clear lessons for investors, policymakers, and ecosystem builders, including the importance of aligning capital with local contexts through blended and sharia-compliant finance, investing beyond Java, and ensuring inclusion, especially for women and rural founders, translates into measurable outcomes.