Southeast Asia Funding Slump, MSME Boosts, and Digital Economy Outlook 🇮🇩💡

Dear readers,

As the country enters holiday season, we bring you another roundup of important updates from Indonesia's tech ecosystem.

Have a blessed holiday season to you all.

Cheers,

The DailySocial Team

🚨 WHAT’S NEW

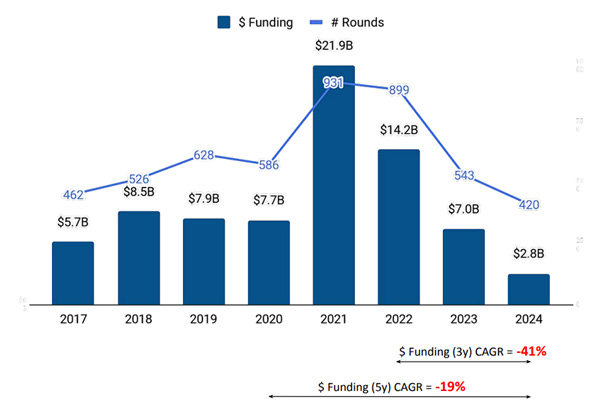

According to the latest report by Tracxn, tech startup funding in Southeast Asia plummeted by 59% in 2024 compared to the previous year, totaling only USD 2.84 billion. All funding stages—seed, early, and late—saw significant drops, with late-stage funding decreasing by 76.9%.

Despite the drop, sectors like Fintech, Cleantech, and Blockchain continue to draw investor interest, with Singapore leading regional fundraising efforts, contributing 67% of the total. [Read More]

Funding Societies, a digital financing platform for MSMEs in Southeast Asia, secured a USD 25 million investment from Japan’s Cool Japan Fund. This marks CJF’s first foray into Southeast Asia’s fintech sector. The funds will support MSME financing in five countries and expand digital payment solutions, fostering commercial links between local MSMEs and Japanese businesses while spurring regional economic growth. [Read More]

Interest in Generative AI (GenAI) courses among Indonesian learners on Coursera skyrocketed by 330% in 2024. Popular courses like "Google AI Essentials" and "Generative AI for Everyone" focus on practical workplace applications, reflecting AI’s growing relevance in today’s job market. Additionally, demand for foreign language courses and beginner-level professional certifications highlight Indonesian learners' commitment to staying competitive globally. [Read More]

PT Bahana Artha Ventura (part of Indonesia Investment Group) partners with embedded banking startup Fairbanc to enhance MSME financing through productive business loans for ERP users. Fairbanc serves as a registered OJK financial agent, while BAV provides loan products. Targeting $3,13 million in financing by Q1 2025, this initiative aims to support MSMEs in FMCG, pharmaceuticals, and medical equipment sectors, boosting national economic growth. [Read More]

Innoven Capital SEA announced an investment in Pintarnya, a platform bridging online and offline ecosystems for employment and financial services in Indonesia. This funding will help Pintarnya scale its reach and impact, reinforcing its mission to connect individuals with economic opportunities. As a leading venture debt provider, Innoven Capital supports high-growth innovative businesses across Southeast Asia. The previous month, Innoven also invested in McEasy, an Indonesian startup that focuses on providing SaaS for transportation. [Read More]

👏 WHAT’S EXCITING

1. Bank Indonesia Trials QRIS NFC Payments

Bank Indonesia (BI), alongside Payment Service Providers (PJP) and DAMRI, has begun testing QRIS Tap, an NFC-based payment method for transportation in Jakarta, targeting implementation by Q1 2025. This innovation aligns with the 2030 Indonesia Payment System Blueprint, enabling seamless, contactless transactions across sectors like transport, retail, MSMEs, and parking.

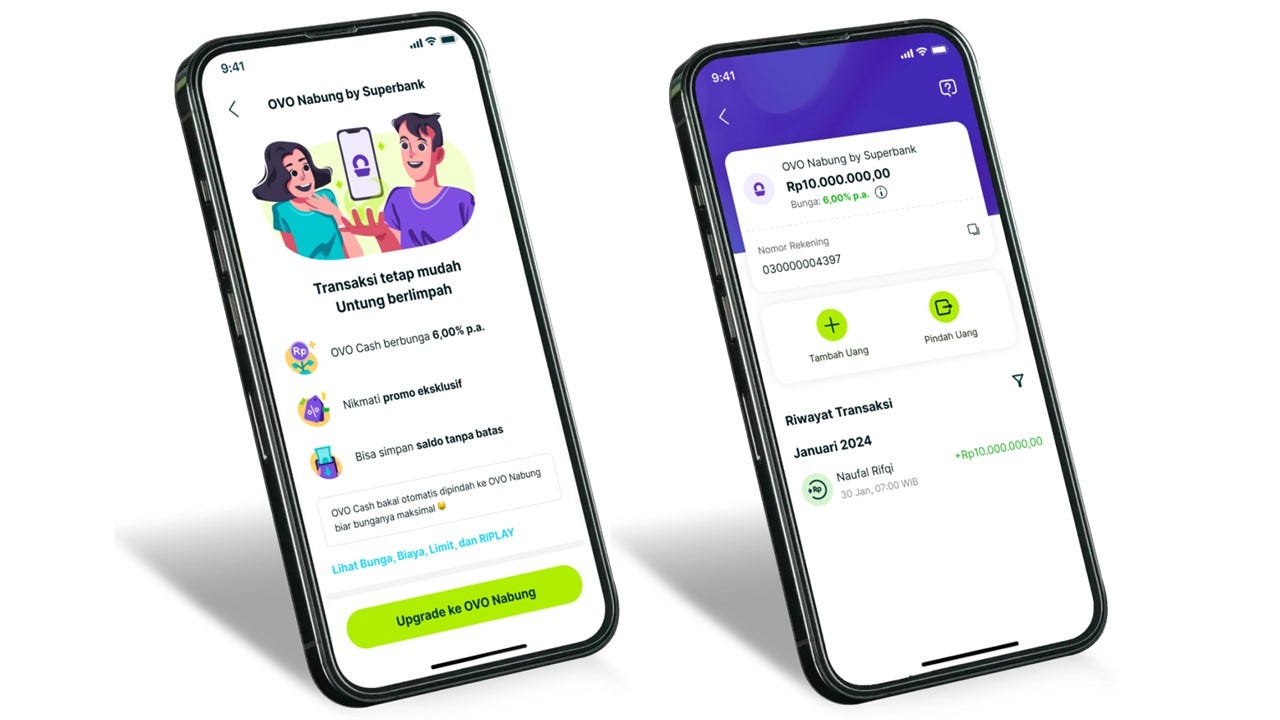

2. OVO and Superbank Launch Savings Feature

OVO has started rolling out "OVO Nabung by Superbank," a savings product offering 6% annual interest with no balance limit. This collaboration with digital bank Superbank provides more benefits compared to OVO Cash and mirrors similar initiatives, such as GoPay Tabungan by Jago.

3. Tyme Group Expands to Indonesia

Tyme Group launched GoTyme Indonesia to provide MSMEs with flexible funding access in partnership with embedded finance startup Finfra and p2p lending company Danabijak. After securing USD 250 million in Series D funding led by Nubank, Tyme Group solidifies its position as a leading digital banking player in emerging markets, backed by investors like Tencent and Gokongwei Group.

4. Indonesia’s Digital Economy Outlook

Indonesia's digital economy continues to grow, with projected e-commerce transactions reaching USD 30.6 billion and online transport GMV recovering to USD 820 million by 2025, based on the report compiled and projected by Celios. However, challenges like unequal internet access, data security, and a focus on consumer loans require collective action from government, businesses, and society.

🚀 WHAT’S NEXT

Strengthening Governance in Startups

Indonesia’s startup ecosystem is booming, but good corporate governance (GCG) remains a critical challenge. Incidents like eFishery’s CEO replacement, OJK’s revocation of Investree’s license, and delayed payments by KoinP2P highlight the need for better governance to maintain investor trust and ensure sustainable growth.

Good governance involves transparency, accountability, and efficient organizational structures, enabling startups to navigate complex business dynamics effectively. It also builds a solid reputation, attracting both partners and customers, and lays the foundation for long-term success in a competitive market.

“The recent fraud allegation is very concerning and raises a serious reality check on the startup ecosystem in Indonesia. To restore trust, we advocate for good governance practices and financial audits (especially for Series A startups and above). Startups should be managed and envisioned as sustainable businesses,” Amir Karimuddin, Founding Partner of DSX Ventures & DiscoveryShift.

By prioritizing governance, startups can secure investor confidence and thrive in Indonesia’s rapidly evolving tech landscape.