TikTok surges 🛍️, Grab turns profitable 💰, Ant & Microsoft expand bets 🌏

Dear subscribers,

This week’s edition reflects a digital economy entering a more decisive phase. Social commerce is scaling into infrastructure as TikTok Shop cements regional dominance, while Grab’s profitability signals a broader shift from hypergrowth to disciplined execution. Telecom resilience, EV expansion into Jakarta, and large-scale healthcare investment in BSD City highlight strengthening sectoral foundations. At the same time, capital market reforms, AI commitments from global tech giants, renewable-powered data centers, and Ant International’s regional payments push underscore rising institutional confidence. With Indonesia’s eTrade readiness under review, the focus now turns from rapid expansion to building a more integrated, inclusive, and execution-driven digital ecosystem.

Most companies don’t need “AI transformation.”

They need starting points. That’s where we come in.

No tools pushed. No automation hype. Just clarity.

If AI is on your agenda this year, start here!

Stay ahead,

DailySocial Team

🚨 What’s New

TikTok Shop’s SEA Surge Signals Indonesia’s Commerce Dominance

TikTok Shop is projected to reach US$64.3 billion in GMV by 2025, with Southeast Asia emerging as the primary growth engine and Indonesia standing as its largest market. The region continues to outpace other geographies in social commerce adoption. The combination of short-form video, creator-driven discovery, and seamless checkout has accelerated transaction velocity at scale. For Indonesia’s digital ecosystem, this reinforces the structural shift from traditional marketplace traffic to content-driven commerce. The implication is clear: live commerce is no longer experimental, it’s infrastructure.Grab Turns Profitable, Proving Platform Discipline Pays Off

Grab reported its first full-year net profit in 2025, marking a pivotal moment after years of aggressive expansion and heavy investments. As detailed in its latest earnings release on Grab, improved cost discipline and ecosystem monetization across mobility and financial services drove the turnaround. The company’s performance underscores a broader regional trend: sustainable growth is now valued over hypergrowth. In markets like Indonesia, where Grab maintains a strong footprint, profitability signals maturity in the super app model. It also sets a new benchmark for tech companies navigating post-pandemic capital efficiency.Indonesia’s Telcos Strengthen the Digital Back

Indonesia’s telecom sector is reinforcing its role as the backbone of the digital economy, led by solid performances from Indosat (ISAT) and XLSmart. ISAT recorded 1.1% revenue growth to IDR 56.51 trillion in 2025, with EBITDA rising 0.8% to IDR 26.59 trillion and margins reaching 47.1%, underscoring operational resilience despite recent share price pressure. Meanwhile, XLSmart posted 23% revenue growth to IDR 42.5 trillion and a 63% jump in normalized net profit post-merger, serving 73 million subscribers with data contributing over 90% of revenue. As 5G rollout expands and integration synergies materialize, telcos are moving beyond basic connectivity to anchor AI, cloud, and enterprise digital transformation across Indonesia.VinFast Eyes Jakarta with Battery-Swap E-Scooters

Vietnamese EV manufacturer VinFast plans to launch battery-swap electric scooters in Jakarta by 2026. The model aims to address range anxiety and charging infrastructure gaps through rapid battery exchange stations. Indonesia’s urban mobility challenges and strong two-wheeler culture create fertile ground for this strategy. With regulatory support for EV adoption accelerating, Jakarta becomes a logical expansion hub. The move intensifies competition in the region’s growing electric mobility race.Sinar Mas Land’s LLV Bets Big on Healthcare, Develops 60-Hectare SEZ in BSD City

Living Lab Ventures (LLV), the corporate venture arm of Sinar Mas Land, is transforming BSD City into a leading healthcare hub through a 60-hectare International Education, Technology, and Health SEZ designed to reduce Indonesia’s reliance on overseas treatment. Backed by a US$150 to 180 million Healthcare Fund and a Biomedical Fund supporting research centers, biobanks, and health innovation, LLV is focusing on established providers while building a strong medical ecosystem. Global partnerships, including with Japan External Trade Organization and MEDRiNG Corporation, alongside collaborations in Australia, Singapore and Malaysia, have driven key milestones such as the 2025 investment in Euromedica Group, the launch of a Japanese-style clinic for BSD City’s 500,000 residents, and accelerated fundraising in 2026 to attract major international capital for further hospital development.

👏 What’s Exciting

Capital Market Reform Accelerates Institutional Confidence

OJK, BEI, and KSEI announced coordinated reforms to strengthen capital market integrity and respond to MSCI’s feedback, according to an official release from OJK. The initiative focuses on governance improvements, transparency, and trading infrastructure enhancements. For Indonesia’s financial ecosystem, this signals a push toward deeper global integration and stronger foreign investor trust. Structural reforms in capital markets often catalyze liquidity inflows and valuation rerating. In a competitive emerging market landscape, credibility is capital.IBM and Meta Double Down on AI Expansion

IBM and Meta are expanding artificial intelligence initiatives in Indonesia, signaling long-term confidence in the country’s digital transformation trajectory. The focus spans enterprise AI deployment, ecosystem partnerships, and talent development. Global tech giants are increasingly viewing Indonesia not just as a consumer market, but as an AI adoption frontier. This momentum reinforces the urgency for local enterprises to accelerate digital capability building. The AI race is becoming less about experimentation and more about execution.Microsoft Secures 200 MW Renewable Energy for Data Centers

Microsoft signed a 200 MW renewable energy contract with PLN to power its data center operations. The scale of the agreement reflects rising demand for cloud infrastructure while aligning with sustainability commitments. As hyperscale data infrastructure expands in Indonesia, energy partnerships become strategically critical. This move positions the country as both a digital and green infrastructure hub. The convergence of cloud growth and renewable energy signals where long-term investment is headed.Ant International Injects S$10 Million Into 2C2P, Strengthens Southeast Asia Strategy

Ant International, the global arm of Ant Group, strengthened its majority control of Singapore-based payments platform 2C2P with a S$10 million capital injection through new ordinary shares, reinforcing 2C2P’s role as the Southeast Asia arm of Antom. Serving more than 3,500 merchant groups across Malaysia, Singapore and Thailand and aggregating over 300 payment methods, 2C2P continues to anchor Ant International’s regional strategy. Recent moves include appointing Worachat Luxkanalode as CEO Designate, integrating EV charging payments in Hong Kong through a partnership with XPENG, and expanding the Alipay+ ecosystem, as Ant International reported 20 to 25 percent revenue growth in 2025 to an estimated $3.7 billion, fueling IPO speculation.

🚀 What’s Next: Indonesia eTrade Readiness Assessment 2026: Accelerating Inclusive Digital Trade

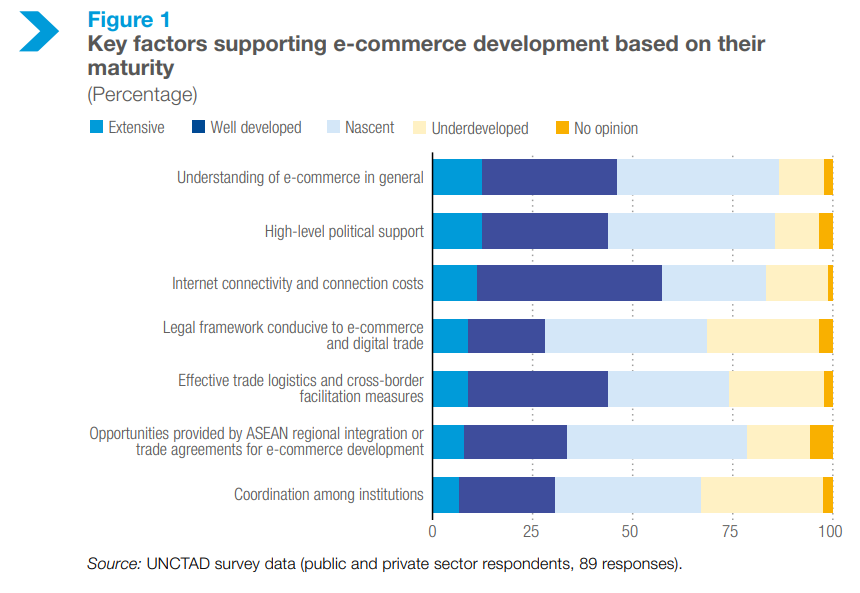

The Indonesia eTrade Readiness Assessment 2026 by UNCTAD reviews the country’s digital trade ecosystem across five critical pillars: policy coordination, technology adoption, MSME participation, legal and regulatory frameworks, and digital payments. Indonesia remains Southeast Asia’s largest digital economy, valued at approximately $90 billion in 2024, with projections reaching $300 billion by 2030. While the report underscores strong growth momentum and rising digital adoption, it also identifies structural gaps in governance, infrastructure, and institutional coordination that must be addressed to ensure inclusive and sustainable expansion.

Key data points reflect steady acceleration. E-commerce transactions reached $65 billion in 2024, up 10.17% year-on-year, supported by 65.65 million users. Internet penetration surpassed 75%, driven largely by mobile connectivity, although fixed broadband access remains limited at around 15%, highlighting infrastructure disparities. MSMEs account for over 60% of GDP, yet only about 40% actively sell online, and fewer than 10% leverage advanced digital tools for inventory management or cross-border trade. In digital finance, QRIS adoption has exceeded 30 million merchants, significantly expanding merchant acceptance of cashless payments. However, formal account ownership stands at 56%, indicating that a substantial portion of the population remains outside the formal financial system.

For Indonesia’s market, the report signals a decisive inflection point aligned with the Golden Indonesia Vision 2045. The next phase of growth will depend less on consumer demand and more on strengthening execution: improving inter-agency coordination, accelerating rural and outer-island connectivity, operationalizing the Personal Data Protection Law, and enabling deeper MSME formalization and digital integration. As regulatory frameworks mature and digital infrastructure scales more evenly across regions, Indonesia is well positioned to consolidate its leadership as ASEAN’s digital commerce powerhouse while building a more inclusive and resilient digital economy.