Carsome Announces Equity and Debt Funding of 2.8 Trillion Rupiah, to Sharpen M&A Strategy

New investors participated in this round, including Catcha Group, MediaTek, and Penjana Kapital; the company's valuation has reached $1.3 billion

Carsome announced the new series D2 funding round of $170 million or equivalent to 2.4 trillion Rupiah. In addition, the company obtained a credit facility (debt funding) worth $30 million to strengthen the car financing business; complete the total $200 million or 2.8 trillion Rupiah fundraising.

This funding brings the company's valuation to $1.3 billion, cementing its position as a unicorn in Malaysia.

This investment was participated by a number of companies, including Catcha Group, MediaTek, and Penjana Kapital. The company also backed by previous shareholders, namely Asia Partners, Gobi Partners, 500 Southeast Asia, Ondine Capital, MUFG Innovation Partners, Daiwa PI Partners, and several others.

Previously, Carsome had also planned to go public via SPAC on the US stock exchange.

Building the centralized car e-commerce ecosystem

In his remarks, Carsome's Co-founder & Group CEO, Eric Cheng said, the fresh funds raised allowed the company to accelerate traction growth while increasing its car financing business. He also revealed that he is ready to bring Carsome to become an integrated car e-commerce platform by strengthening a connected ecosystem.

Previously, Carsome has launched a new strategy to embrace the B2C segment. It is shown by opening several Experience Centers in several locations, including in Indonesia, enabling consumers to view and buy used car products that have been inspected by the Carsome team.

Initially, Carsome's business model was more like C2B. Inspecting and buying used cars from consumers, then offering them to the business (in this case the dealership owner) for resale.

Sharpen the M&A strategy

Moreover, this investment allows the company to sharpen its business consolidation strategy. It is by making strategic investments to partner companies or other corporate actions in the form of mergers & acquisitions (M&A).

In July 2021, Carsome has acquired PT Universal Collection, an offline car and motorcycle auction service company from Indonesia. It allows the company to expand its network coverage, access to finance and leasing providers, and potentially enter the motorcycle market. This initiative will also support their omnichannel strategy.

In addition, the company has established a partnership with iCar Asia, as an automotive listing and content platform. It is expected to increase the penetration rate of products in Carsome services.

Service competition

Based on the data, on an annual basis, Carsome has bought and sold cars more than 100 thousand times. It goes along the company's revenue at $1 billion. This shows that the market is very large, therefore, it is not surprising that the competition is also quite fierce.

Apart from Carsome, there are other regional players who also provide similar services, it's Carro. They both serve consumers in Indonesia – also taking strategic actions with startups from Indonesia (Carro acquires Jualo).

Carro and Carsome also promote an online-to-offline strategy by presenting outlets to assist in the transaction process. Carro just launched "Carro Automall Point" in late April 2021, currently the used car showrooms are in three locations around Jabodetabek. Meanwhile the Carsome Experience Center has reached 15 cities in Indonesia.

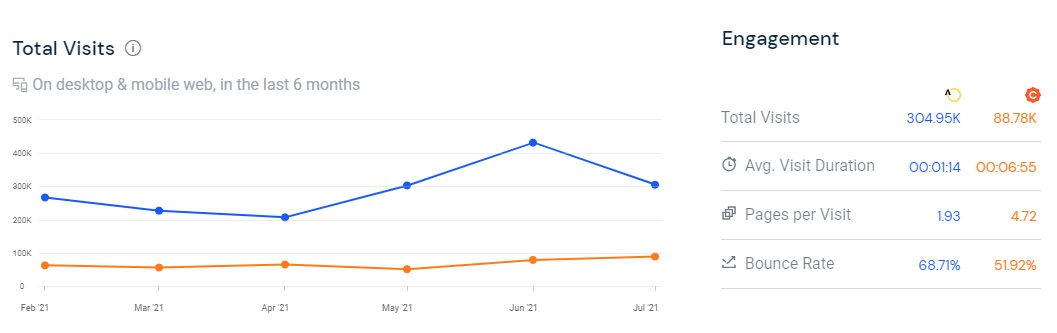

Comparison of visitor traffic of Carsome and Carro in Indonesia / SimilarWeb

Comparison of visitor traffic of Carsome and Carro in Indonesia / SimilarWeb

In Indonesia, there is also another player, OLX Autos (formerly BeliMobilGue) which has now been integrated with OLX's services. The main focus is more on buying cars from consumers — although some of the products that have been inspected are also starting to be sold through OLX and other online marketplace channels.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium