HappyFresh Secures 940 Billion Rupiah Series D Funding, Valuation Exceeds 2.8 Trillion Rupiah

This round was led by Naver Financial Corporation and Gafina B.V. with the participation of Mirae Asset-Naver Asia Growth Fund and Z Venture Capital

The online grocery marketplace, HappyFresh secures a series D funding worth of $65 million or equivalent to 940 billion Rupiah. The round was led by Naver Financial Corporation and Gafina B.V. Participated also some investors, including Mirae Asset-Naver Asia Growth Fund and Z Venture Capital.

Previously, HappyFresh announced a series C funding in April 2019 worth of $20 million. Based on DailySocial's calculations, all the closed rounds has brought the company's valuation to $200 million.

Regarding the focus of this funding, HappyFresh's CEO, Guillem Segarra said that his team is working hard to improve the company's operations in various markets and maintain the company's quality and safety standards. "We are still at the beginning of the journey and with all the support received, are very excited for the adventures ahead," he said.

In a previous discussion with DailySocial, HappyFresh Managing Director, Filippo Candrini has revealed that the company's current focus is to improve the user experience in online grocery shopping using a personal shopper approach. In addition, his team will also continue to carry out local expansion to tier 2 and 3 cities in Indonesia.

“We did not intend to be a super app, but we want to be a super in grocery app for our customers and partners,” Candrini added.

Debuting in Indonesia since 2015, HappyFresh has expanded its business to Malaysia and Thailand. The company claims to have experienced 10 to 20 times traffic growth. In the local market, this service is also available in 11 cities throughout Indonesia, including Greater Jakarta, Bandung, Surabaya, Malang, Semarang, Makassar, and Bali.

The e-grocery industry is said to be growing rapidly throughout Asia, especially Southeast Asia. The retail market for this industry is reported to have reached $350 billion supported by rapid adoption and fundamental changes in consumer behavior.

“We are seeing major changes in customer behavior; Retention rates and frequency have increased significantly while overall basket size has grown consistently. We attribute this to a major shift in wallet share from offline to online, which will remain,” Guillem said.

Indonesian market still dominated by offline

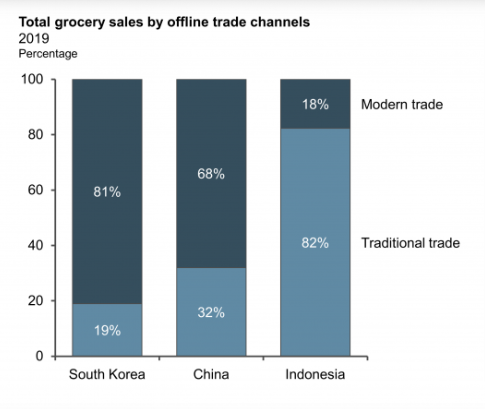

Despite the increasing penetration of online shopping, the offline market still dominates the online grocery industry in Indonesia. A research from L.E.K Consulting on the online grocery industry revealed that 82% of total food sales are still dominated by traditional markets.

This is in contrast to what happened in China and South Korea where the offline market only accounted for 30% and 19% of total grocery sales in 2019.

Sumber: L.E.K Consulting

Sumber: L.E.K Consulting

However, along with the increasing availability of services in various regions and people who are well educated from popular consumer applications, it is not impossible that the statistics of e-grocery will increase exponentially in the future.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium