Indonesian Agritech's Top Three Bucket List for The First Quarter of 2020

Summarize the CompassList report titled "Indonesia Agritech Report 2020"

Agritech has become one of the essential segments in the industry for its representation of Indonesian culture. Agriculture held one-third of Indonesian land and workers. Technology has a crucial role to increase productivity in this industry due to the decreasing talent for the last decade.

Otherwise, the country should import more in order to feed its citizen. In 2025, Indonesian population is predicted to increase by 11 million from the current position at 270 million people.

Quoted from CompassList research project report titled "Indonesia Agritech Report 2020" released in March, the world is currently struggling with food supply crisis due to the Covid-19 pandemic. The global food supply chain is tightening for some countries are lockdown and stop exporting.

Most businesses are getting suspended as life continues, amid efforts to curb the spread of the virus. These conditions show the importance of maintaining food security - and national agriculture.

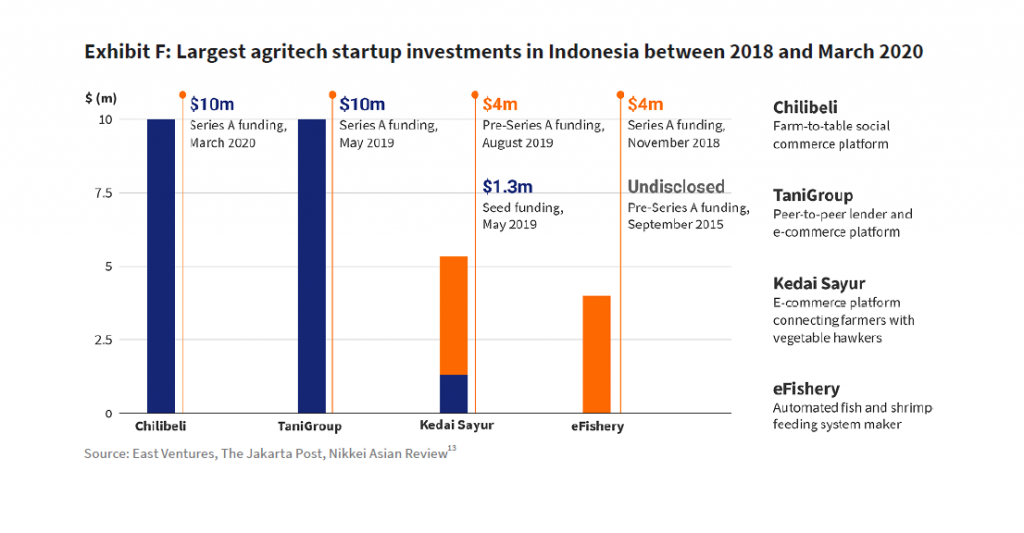

The report shows high optimism for agritech, given the sector is relatively new in Indonesia. As Chilibeli secured series A funding in March 2020, it shows a bright future in this sector. Chilibeli has just launched in less than a year.

"More efficient and equitable agricultural practices will pave the way for sustainable agriculture in Indonesia, benefiting farmers, resources and the community. This helps create a stronger agricultural sector, which in turn will support Indonesia's food security and economic growth," the report stated.

Require more deep-tech innovation

CompassList listed four categories for the current operational agritech. It's based on funding, e-commerce, education and assistance, also technology development. In structural, it shows the highest concentration of agritech startups.

UMG Idealab's Investment & Venture Partner, Jefry Pratama said, the act of selling agriculture commodities is the simplest and most certain way for agritech startup to gain profit. Of all the highlighted startups, they utilize the e-commerce sector or market the products offline.

To date, the deep-tech startup in this industry only works with AI, data analytics, and robotics. There is no further deep-tech (a new technology that offers significant improvement of the current issue), such as genetical manipulation.

Startups took part in this sector includes Habibi Garden, BIOPS, HARA, and JALA. Each startup has a certain tech specialization in data collecting, farmers can translate daily and take action instantly.

JALA, for example, has been using series of sensors to detect water quality in shrimp ponds, salinity, and pH rate to oxygen. The data is to be sent to the cloud-based media analytics for further diagnosed options to improve water quality.

Shrimp farmers can eventually distribute less feed for exceeding feed can impact on the final quality. It should reduce shrimp waste and loss, also increasing yields.

The lack of deep tech innovation might occurs due to various factors. Starting from the lack of available talent, campus support, research institutions, large corporations. These entities have an important role in carrying the development costs (R&D) for certain sectors. This is where most likely the first time innovation has been found.

However, these issues are not impossible to overcome, as UMG Idealab did, the incubator and CVC from the conglomerate from Myanmar UMG. They invested in PT Mitra Sejahtera Pembangunan Bangsa (MSMB), an agritech startup focused on creating sensors, drones, and mobile applications for farmers.

Uniquely, the MSMB was founded by lecturers and students from UGM. The staff consists of students, recent graduates, and lecturers from local campuses in Yogyakarta and surrounding areas.

Other factors are also reflected in supporting infrastructure such as logistics and supply chain. India is more or less the same as Indonesia, although it cannot be generalized. Both are countries with large areas with infrastructure development that are still late in the countryside.

R&D becomes essential

The existence of an R&D center for a business is important, not just for agritech. To encourage more local farmers to increase their crop yields and reduce potential losses, more high-quality seed production is needed, developing better disease diagnosis tools, and new hardware.

Startups are yet to have the resources to create their own R&D, therefore, they become obstacles to entering "deep biotech" in seed development. They will take advantage of collaboration with local universities, such as IPB and UGM. The campus is equipped with expertise and facilities to pursue cross-marriages, genetic engineering and other basic science projects.

Unfortunately, this country still lacks funds to build R&D center. In 2018, the overall R&D budget will be Rp. 25.8 trillion or 0.2% of total GDP.

This condition encourages each stakeholder to collaborate to create superior seed varieties. Many multinational companies are financially supported through collaboration with local players and the central government, as well as with their own budgets. Collaboration like this can accelerate the discovery of seed development that suits local needs and conditions, such as varieties that are more resistant to drought.

"The government can play a more active role in developing Indonesian agriculture to be more resilient. We need to fund R&D in Indonesia, "added Pamitra Wineka's Co-Founder & President TaniGroup.

Initiatives to accelerate logistics

The Food and Agriculture Organization of the United Nations (FAO) estimates as much as 120 kg to 170 kg of food per capita is lost or wasted every year in South and Southeast Asia. This is homework for Indonesia to improve logistics and supply chain infrastructure to prevent the loss of food.

ADB statistics link 25% -45% of the results of this decay due to poor packaging, inadequate cooling systems, and long delivery times.

Here the role of government and private sector is needed to reduce post-harvest losses. You do this by building a warehouse, a packing place, a cooling place close to agricultural land and fisheries. Food delivery vehicles must also be improved through better road conditions and vehicles that can adjust the temperature.

TaniGroup created a logistics subsidiary, TaniSupply, in September 2019 to address imbalances in the supply chain. Then, 8villages worked with agricultural intermediaries to create VLOGS, gathering data on logistics providers in a platform to help farmers find logistical partners.

If small farmers from neighboring villages can agree to the same logistics provider, for example, they can increase their bargaining power by collectively asking for lower shipping rates.

Tokopedia also made a similar initiation by making a branch store, a smart warehouse that can predict which items sell best in the nearest city. All traders, even micro, can place their stock in warehouses based on predicted purchasing trends.

This model can be adopted for agricultural products because farmers and fishermen have more or less the same challenges as online traders in Tokopedia.

Simplifying modes of transportation and supply chains undoubtedly results in reduced post-harvest losses. There is a need for intensive initiatives from startups and the government to strengthen local food, allowing fresh products to be easily accessible to consumers without any middlemen who bother.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter