Mandiri Capital Indonesia Channels Follow on Funding to Crowde's Series B

The source also reports that Monk's Hill Ventures and its subsidiary Great Giant Foods participated in the round

The CVC backed by Bank Mandiri, Mandiri Capital Indonesia (MCI) channels follow on funding to Crowde's Series B. Based on the sources, the latest round of this agriculture fintech lending startup also involves Monk's Hill Ventures.

Another thing, this funding also involves the business unit of Gunung Sewu Group conglomerate, PT Great Giant Pineapple (GGP), which is a subsidiary of Great Giant Foods (GGF). In general note, GGP is the largest pineapple canner producer in the world which has exported more than 15,000 containers to 60 countries.

This funding news has been confirmed by MCI's CEO, Eddi Danusaputro. "It is true, we are doing follow on series B funding to Crowde," he said through a short message to DailySocial.id.

According to the data submitted to regulators, the company has raised fresh funds of $9 million or around 127.2 billion Rupiah in the ongoing round.

Previously, MCI had participated by leading Crowde's pre-series A funding of $1 million or around 14 billion Rupiah in 2019. At the same time, Bank Mandiri also participated as an institutional lenderThrough Crowde amounting to 100 billion Rupiah.

Currently, Crowde has disbursed loans ranging from IDR 8 million to IDR 2 billion with an interest rate of 6%-18%. Crowde also recorded 97.89% TKB90. In addition to Bank Mandiri, Crowde has also collaborated with other institutional lenders, such as Bank BJB, BPR Supra, and Saison Indonesia to strengthen its credit distribution structure.

High potential yet hazardous

In the DSResearch report with Crowde entitled "Driving the Growth of Agriculture-Technology Ecosystem in Indonesia", the aquaculture sector is included in the business sector with a fairly high risk. This is due to business development in this sector is hindered by a number of obstacles, such as access to capital, financial literacy, and the ability and knowledge of farmers to cultivate.

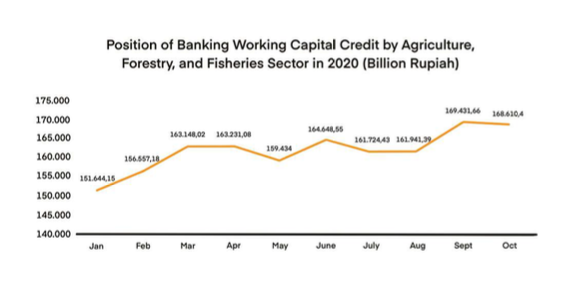

Capital distribution in agriculture, forestry, and fishery / DSResearch and Crowde

Capital distribution in agriculture, forestry, and fishery / DSResearch and Crowde

According to reports, the educational background and low financial literacy of the farmers are one of the inhibiting factors for cultivation. Crowde stated that 78% of active household farmers in Indonesia do not meet bank capital requirements.

In addition, internet penetration among farmers is quite low. Based on BPS data in 2018, only 4.5 million farmers were connected to the internet out of a total of 27 million business players in agriculture.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium