Paper.id to Complete Series B Funding Round, Launching a B2B Paylater Service

In collaboration with Modalku, Bank Jago, Pinjam Modal, and several other financial institutions for financing

The B2B invoicing and payment platform "Paper.id" is currently fundraising for series B round and to be announced in early 2022. Paper.id's Co-Founder & CEO, Jeremy Limman said to DailySocial that the company is currently in the process of finalizing and plan to use the fresh funds to support product developments that have proven to be growing rapidly during this pandemic.

Paper.id's latest funding was in 2019 for the series A round from Modalku fintech and Golden Gate Ventures. In early 2018, they also received seed funding from Golden Gate Ventures.

Pandemic elevating business

The number of Paper.id users has grown almost 3 times since the beginning of the pandemic last year. The invoices that have been processed has reached the highest level over Rp9 trillion, this number is claimed to have increased by 2 times from the same period last year. Currently, Paper.id has 300 thousand users and is spread across more than 300 cities and regencies in Indonesia.

"In general, the pandemic has negatively impacted the MSMEs, especially the tourism and retail sectors. However, Paper.id users belong to the sector-agnostic segment, therefore, several industries can still survive and continue to grow, such as logistics, FMCG and online sellers," Jeremy said.

In order to increase financing options for users, Paper.id collaborates with a strategic investor, Buana Sejahtera Group, a group of companies engaged in finance, logistics, and hospitality to expand Paper.id's capabilities in business funding and penetration into the conventional supply chain.

"Later on, we will ask our strategic investors about what business sector they want. Then Paper.id will recommend businesses that are eligible to get financing from the multifinance," Jeremy said.

Launching a B2B Paylater

Aiming to help SMEs make their business easier, Paper.id launched its latest product, the B2B Paylater or Buy Now, Pay Later (BNPL). For buyers, they can get benefits in the form of an extension of time. Suppliers can also experience other benefits from this product through a new feature called “Get Paid Faster”.

Prioritizing the aggregator concept, Paper.id will later recommend business owners who want to use BNPL for fintech lending services to banks that have become strategic partners. Currently, there are 10 fintech service and banking partners, including Modalku, Bank Jago, and Pinjam Modal.

"In terms of financing, we cannot provide services for all. Thus, we have good partnerships with P2P, multi-finance and banking services. Everything will be tailored to the needs of the business," Jeremy added.

In ensuring the business to run good track record, Paper.id conducts a curation process for businesses with intention to use BNPL through data invoicing on Paper.id. Therefore, banking partners and fintech services are guaranteed to get business recommendations with the best quality. Since the launching, Paper.id has validated more than 3000 invoices for BNPL products.

"With our experience that has channeled productive funding of more than Rp. 175 billion for MSMEs, BNPL is a feature that is much requested by our users and is expected to drive the MSME business development and help them manage cash flow better," Jeremy said.

B2B Paylater in Indonesia

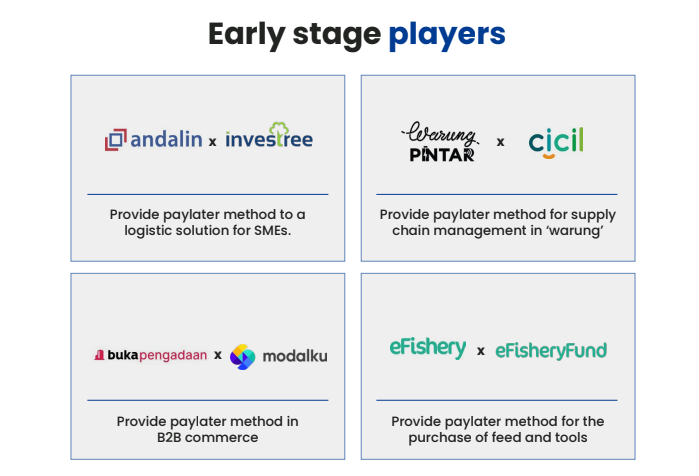

In a report titled "Indonesia Paylater Ecosystem Report 2021" published by DSInnovate, the paylater services that focus on business consumers is said to start mushrooming. The scheme is in the form of collaboration, between fintech lending and business service providers.

Indonesia's B2B Paylater players

Indonesia's B2B Paylater players

In contrast to productive loan products in the style of P2P Lending, B2B paylaters do not provide cash to improve business operations. They finance the expenditure of goods or services that are channeled directly to the provider.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium