RUN System IPO on IDX, Optimizing Momentum for Business Expansion and Sustainability

Targeting 49.9 billion Rupiah funds from this corporate action

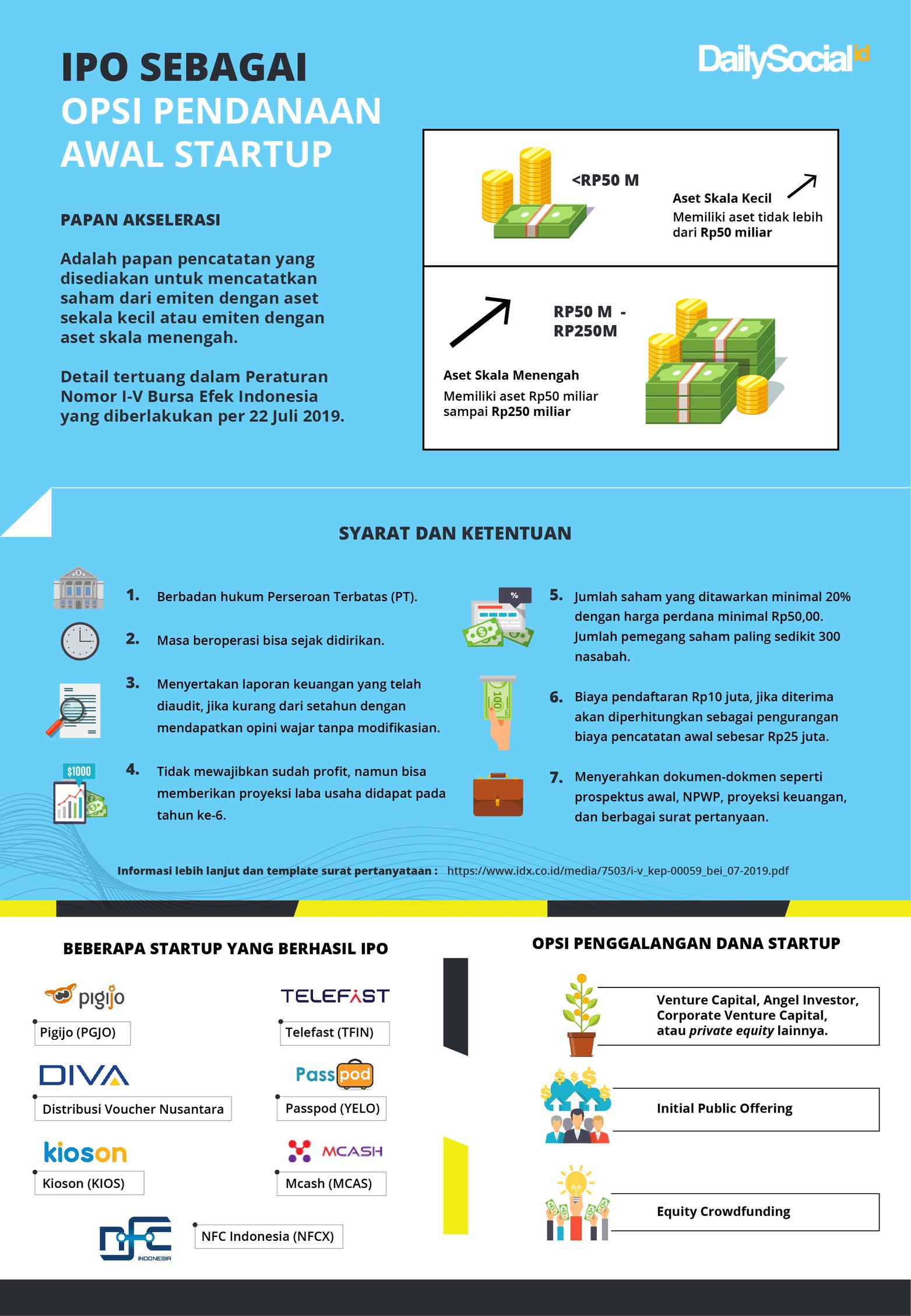

One of Telkom Group's investment portfolios, PT Global Sukses Solusi Tbk (RUN System) plans to expand its business and seek funds through an initial public offering (IPO) on the Acceleration Board. This SaaS platform providing ERP solutions targets to collect IDR 49.9 billion Rupiah from its corporate actions.

The development of the company's business in the past few years and the trust of various parties are believed to be one of the strong reasons for the IPO. With the current conditions, especially the impact of the pandemic that has changed many parts, including the urgency of digitizing business processes has urged companies to find ways to survive and thrive. On the other hand, the IPO is said to help improve the company's performance.

RUN System's Founder & CEO, Sony Rachmadi Purnomo said, "We've set an IPO as a target since the beginning in order to support business expansion and company's sustainability. As a startup, agility really helps to grow and develop, however, it can also backfire if we don't focus on stakeholders and corporate governance. We chose the IPO method in order to maintain the momentum for business expansion and sustainability (GCG) at the same time."

DailySocial received an official statement that the company is to sell a maximum of 196,800,000 ordinary shares on behalf of which all are new shares and are issued from the company at a value of IDR 4 per share. The number of shares represents a maximum of 20.01% of the total issued and paid-up capital of Run System post-IPO. The share price offered to the public is between IDR 230-254 per share.

In addition, the company also held an ESA (Employment Stock Allotment) Program by allocating shares of a maximum of 1% of the total number of shares offered or a maximum of 1,968,000 shares.

Run System has scheduled the initial offering period between August 20-26, 2021, with an estimated effective date of August 31st,2021. The IPO date for Run System is targeted between September 2-6, 2021, with an allotment date of September 6th. Meanwhile, the targeted date for distribution of electronic shares is September 7th and listing on September 8th, 2021.

Acting as the implementing guarantor of PT Global Sukses Solusi TBK’s share issuance are PT BRI Danarekse and PT Mirae Sekuritas Indonesia.

The proceeds from the Initial Public Offering after deducting share issuance costs are to be used for working capital (74%) including financing new projects, overhead and operational costs. Around 11% will be used for market acquisition and expansion and 10% for research and development. While 5% is to be allocated for the company’s capital expenditure which includes work equipment and infrastructure.

ERP Market in Indonesia

According to a report published by Allied Market Research, the global ERP market was pegged at $39.34 billion in 2019 and is expected to reach $86.30 billion by 2027, recording a CAGR of 9.8% from 2020 to 2027.

In a recent interview with DailySocial, Sony revealed that the ERP industry market in Indonesia is quite large, with around 10-20% of new companies taking advantage of the service for their business. This makes his team more optimistic about the development of this industry in the future.

The company, which has been focused on developing ERP solutions since 2013 from upstream to downstream, offer four types of products, an ERP software Run System, an enterprise internediary platform Run Market, Run iProbe (HR enterprise solution system), and a point of sales platform iKas.

In 8 years, RUN System has served around 50 companies in various business scales from MSMEs, medium to large, which are engaged in the manufacturing, distribution, trade, and service sectors. Sony said that his team is working on the integration of ERP and the banking sector.

Runway with Telkom Group

In 2014, RUN System participated in the first batch of Indigo Incubator program held by Telkom. Seeing the big potential in this startup, Telkom promotes RUN System as one of the Distribution Partners of ERP solutions for all its customers in Indonesia.

In addition, this Yogyakarta-based startup also received support from MDI Ventures and its managed fund MDI-KB Centauri with a strong partnership with Telkom Indonesia as their go-to-market prior to the IPO.

In 2020, a subsidiary of PT. Telekomunikasi Indonesia, Tbk (Telkom), PT Metra-Net signed a Shareholder Agreement with RUNSystem. At that time, this agreement had a vision, one of which was to monetize opportunities in the online industry.

As one of its first portfolios, MDI Ventures believes that Run System is a validation of their modernized IPO thesis in comparison to other conventional VC which are much more tailored to the local stock exchange. Run System managed to grow positively on both top-line and bottom-line with profitability since day one while treating IPO as an additional funding milestone. It’s the opposite with how the usual startup dogma, where they are letting go of profit to push growth and treat IPO as one of the exit strategies.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium