Amartha Appoints Rudiantara as a Commissioner, Introducing Amartha Plus App

Amartha has disbursed a total loan of Rp914 billion in the first six months of 2021

Amartha announced Rudiantara, the former Minister of Communication and Information for the period 2014-2019, as a President Commissioner effective per July 1, 2021. Rudiantara's mature experience in technology is expected to contribute to the company's ambition to accelerate MSME digitization.

In a virtual press conference the company held (19/7), Amartha's Founder and CEO, Andi Taufan Garuda Putra said that one of Rudiantara's important achievements was to develop policies regarding digital infrastructure in remote areas to support MSMEs.

“Amartha is honored to welcome Mr. Rudiantara to be part of Amartha's big exit. Amartha is optimistic that his presence will provide insight and wisdom in building leadership and partnerships with company stakeholders," he said.

Rudiantara added, he is also honored to be able to work together with Amartha in accelerating financial services for the unserved and underserved groups with no access to the banking sector. He said, not only focusing on microfinance, Amartha also focuses on the women's segment.

“This is the reason I joined Amartha. It is based on technology, but what makes it different is that they target MSMEs with a broad social impact, MSMEs, productive women, and sustainable business. This is what makes me honored to join Amartha," Rudiantara said.

Amarta Plus app

On the same occasion, Amartha's Chief Commercial Officer, Hadi Wenas said the company launched the Amartha Plus application specifically for Amartha borrowers to be more familiar with technology. This application complements the previous two platforms that are specifically designed for field agents and lenders.

The launching also in line with the realization of an investment of $28 million led by Women's World Banking (WWB) through WWB Capital Partners II and MDI Ventures in early May 2021.7.19

“Prior to this application, the field agent was tasked with inputting the online registration process. However, partners can now apply directly through the application, our field agent will be a sampling surveyer, therefore, the funds will be disbursed faster in about 15 minutes," Hadi said.

Amartha Plus currently has three features, Warung Loan Non Mitra, Warung Loan Mitra, and Amartha Pulsa/PPOB. In the first feature, the company becomes a financial partner for paylater products for stall partners who are included in the Sampoerna Retail Community (SRC) network. This collaboration allows SRC's warung partners to pay the due date for each stock purchase.

“This has only been running in June, the number of partners who have joined is about hundreds for the first batch. Soon, we are targeting tens of thousands as the SRC network already has millions of stalls, but there are hundreds of thousands already online.”

Next for the Warung Loan Mitra feature, it allows stall partners in the Amartha network to purchase FMCG product stocks wholesale through Tanihub, an agritech partner that is partnered with the company. As of now, it has operated at 11 points in East Java, there are more than 100 partners who shop regularly, and there are more than 4 thousand SKUs available.

“Last, is Amartha Pulsa, which service is more straight forward for topping up balance and PPOB payment. This service has been used in 93 points out of our 497 network points.”

Wenas said this new application could deepen the smartphone penetration in Indonesia, especially in rural areas. "Next we will develop other innovations related to intensifying smartphone penetratio, therefore, it can be used for business, and helping partners to have less cash for installment payments."

Currently, of the 719 thousand Amartha partners who have joined as borrowers, around 60% of them are engaged in trading businesses, such as food stalls, grocery, fashion, children's toy shops, and others. The composition of food stall and grocery business owners dominates around 20%-30% in this business group.

During the first half of this year, Amartha has disbursed loans of Rp914 billion, up 35% YOY to 203 thousand partners. Interestingly, about 60% of this distribution portfolio is channeled outside Java (Sumatra and Sulawesi). This number increased by 196.62% YOY.

Taufan said that this performance would continue to be improved considering the need for micro-financing outside Java is still very broad and has not been fully explored by fintech players at this time. "We are targeting to empower up to 1 million partners by the end of this year," he said.

Fintech lending business performance

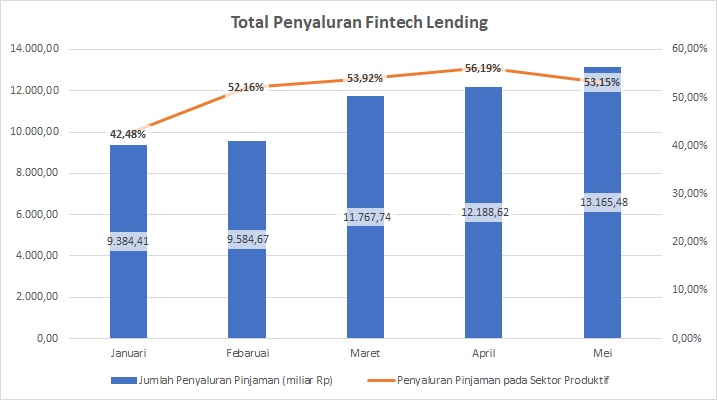

Based on OJK's statistical data as of May 2021, there are 118 conventional and 9 sharia fintech lending providers. In total, the total assets owned reach 4.1 trillion Rupiah. The platforms also managed to accommodate around 8.7 million lender accounts (p2p) channeling 13.8 trillion Rupiah of funds.

Indonesia's Fintech lending statistic per May 2021 / OJK

Indonesia's Fintech lending statistic per May 2021 / OJK

The number of loan disbursements also continues to increase from time to time. The productive sector also tends to get a slightly larger portion than the consumptive sector.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium