Behind the Participation of Local Conglomerates in Grab's Pre-IPO

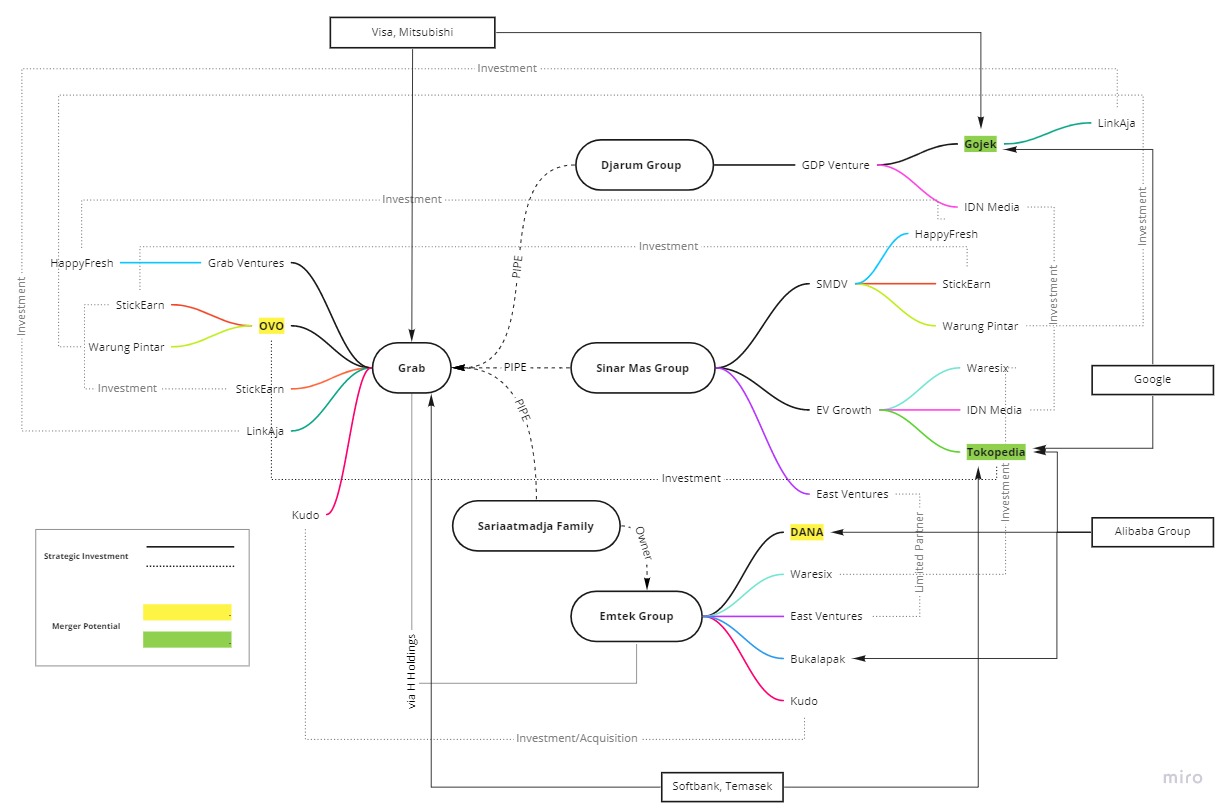

Strategically related in some ways, through portfolios or investment

Grab has officially announced to go public on the United States stock exchange using SPAC in collaboration with Altimeter Growth Corp ($AGC). Although it is not fixed on the finalization process, the market currently shows a positive response.

It is proven by the participation of several conglomerates in Indonesia to for the pre-IPO. There are three Indonesian representatives interested in participating through PIPE (Private Investment in Public Equity), Djarum Group, Sariaatmadja Family (EMTEK Group), and Sinar Mas Group. In total there are 14 investors involved in PIPE.

Grab is targeting $ 39.6 billion (around Rp.580 trillion) valuation and raising $500 million fresh fund from $AGC and $4 billion through PIPE. A total $750 million poured as Altimeter's commitment.

The arrival of the three local conglomerates deserves attention, as they are also affiliated with various digital businesses in the ecosystem. We tried to make the outline through the following mind map :

The figure above shows an interesting (indirect) relationship. Each of them can be said to be affiliated with digital business leaders in Indonesia today - even though they are also competing in the same market share.

Apart from its own service, Grab in Indonesia is affiliated with Ovo (supported by the Lippo Group) - the local unicorn Tokopedia also owned shares in the payment platform. Regarding payments, Grab also involved in LinkAja's funding, which Gojek is also part of. It implies that both superapps provide a payment option from the service formerly known as TCash.

Recently, Grab (via H Holdings) also reportedly entered into Emtek through PMTHMETD, along with Naver. It stirs up the rumors of the merger between Ovo and Dana - especially since the disclosure of Emtek that is no longer Dana's main shareholder. Since 2019, Grab has been one of the parties that encouraged the merger of the two payment platforms.

In the loop of three Indonesian conglomerates that have joined PIPE, Grab has several strategic attachments in supporting startups operating in Indonesia. On the other hand, with its competitors [including the Gojek-Tokopedia merger plan] some of the investors are crossing path.

The entrance of Djarum, Emtek and Sinar Mas in the Grab IPO comes with two perspectives. First, there is activity in corporations to take a deeper share in working on the digital economy in Southeast Asia. Second, it is not impossible if even greater consolidation between players will occur at a later date - previously Grab-Gojek had been rumored to merge before the IPO.

Market enthusiasm for the Grab IPO can also set a good precedent for similar exit initiatives for other unicorns and take the digital ecosystem - particularly in Indonesia - to the next level. The success of their exit [unicorn] can be interpreted as business maturity and open the door of opportunities for the next unicorn-to-be.

–Original article is in Indonesian, translated by Kristin SiagianGambar Header: Depositphotos.com

Sign up for our

newsletter

Premium

Premium