Corporate Venture Capital as an Answer to the Disruption Era

It is mostly focused on investing the growth-stage startups

In June 2010, UberCab has launched in San Fransisco for easier access to book a cab. Soon, the platform was getting popular in the area, although the fare was higher. Users are willing to pay more for efficiency.

Five months later, the company received seed funding worth $1.25 million from several investors. The brand changed into Uber following its decision to include other transportation besides taxi. In early February next year, Uber announced Series A funding of $11 million.

Settled with $60 million valuations, they finally had its grand launching in New York. The public expressed their enthusiasm with the new innovation, the big apple later become the early biggest market share in the US. Some taxi provider companies have issued an intervention, asking for the business legal.

In late 2011, Uber secured $32 million Series B funding, including Jeff Bezos. The international expansion begins, aimed at Paris. User's feedback, on the fare and availability, has encouraged the company to release some variant products, including UberX for more affordable service.

Halfway to 2014, Uber made expansions to India and Africa. Along with the Series C investment worth of $258 million. Valuation exceeds $3.76 billion and the company is officially a unicorn. Next, they secured another investment worth of $1.2 billion in July 2016 and took the company to a decacorn valuation at $17 billion.

In brief, with the current business dynamics, including expansion, downsizing business, and follow on funding, they finally had an IPO in May 2019 in NYSE with a market capitalization reached $75.5 billion.

Based on the business journey, there are some points to be highlighted: (1) a rapid growth business, (2) disrupted business, (3) business with fantastic valuation growth.

"Disruption" term as a barrier

Uber business model is getting replicated by others, including Gojek with the local wisdom - in this case, ojek (two-wheeler) transportation. After running a business in a semi-conventional way since 2011, they finally launched the first app on the Android and iOS platforms on January 7th, 2015. It used to provide only transportation, instant courier and groceries.

Welcome to the future of GO-JEK! Download aplikasi mobile GO-JEK di App Store or Google Play http://t.co/rQm1ISvVS9pic.twitter.com/LoTgVY091S

— Gojek Indonesia (@gojekindonesia) January 7, 2015

Similar to Uber, the offered services are in high demand. Traction rise up now and then, as well as financial support from investors. It applies to the rejection issue, both the motorcycle taxi drivers and transportation companies had a hard time. Sometimes, the "pressure" comes from regulation, due to no legal umbrella to accommodate the business model, at that time.

It's from the ride-hailing sector, the truth is new platforms (e-commerce, digital wallet, SaaS, online learning and so on) are created as a way to replace traditional businesses and it's getting the hype as the increasing number of smartphone users in Indonesia. Suddenly the term "disruption" became the main topic in various news, public discussions, to scientific publications.

Some companies have passed the term and feel encouraged to follow the existing trends, in order to not be eliminated. In the end, the jargon "digital transformation" turned into a campaign. Businessmen massively go-digital, trying to adopt the latest technology to accelerate the business model. From the simplest as creating a social media account for marketing and applying the concept of data science to business.

Technology holds an important role in the disruption era. Moreover, it has the right medium to connect a service to its user, the computing devices - including smartphones. If not through the mobile apps, maybe the growth of Uber, Gojek, Tokopedia, Moka, Bridestory and other startups won't be that fast.

Strategic partnership through investment

Some of the large companies with high demand in market share were made flustered by digital startups. As the few shopping centers said to be empty of visitors - and some reduce the number of outlets - after the booming e-commerce services in Indonesia. "Natural law" in business seems to start showing results: adapting or slowly dying.

Some retailers are trying to change their approach, for example, Matahari Department Store which finally released an e-commerce portal. Other shopping centers are starting to optimize application-based services, such as the GetPlus loyalty platform at Grand Indonesia. Its vision is to improve the customer experience. So far, the consumer sector is where the disruption impacted the most.

There are two options, to develop independently or collaborate with existing startups. Each option comes with implications. First, if you choose to build a digital foundation independently, you must invest in a variety of resources including infrastructure and experts. As for the second option, a strategic partnership can be one solution and most likely to be effective.

Digital transformation should be fast. Even technology is dynamically evolving. While corporate executives stay focused on improving the core business, they don't think there's enough time to create digital solution experiments. Digital products require some process in order to reach market-fit - research, market validation, and others.

Corporates can adjust the synergies with business vision of both. As for the companies in the financial sector, they can collaborate with fintech startups which appropriate to support business development. Companies in the insurance field can start cooperating with insurtech startups to increase the presence and easy access to public services.

After finding a suitable startup and they have proven product-market-fit, further cooperation is required for a more exclusive stage. One way is by giving investments - acquiring a few percent of ownership shares - to related startups. Furthermore, if this soon become a concern to the corporation, they can create a new venture capital sub-company.

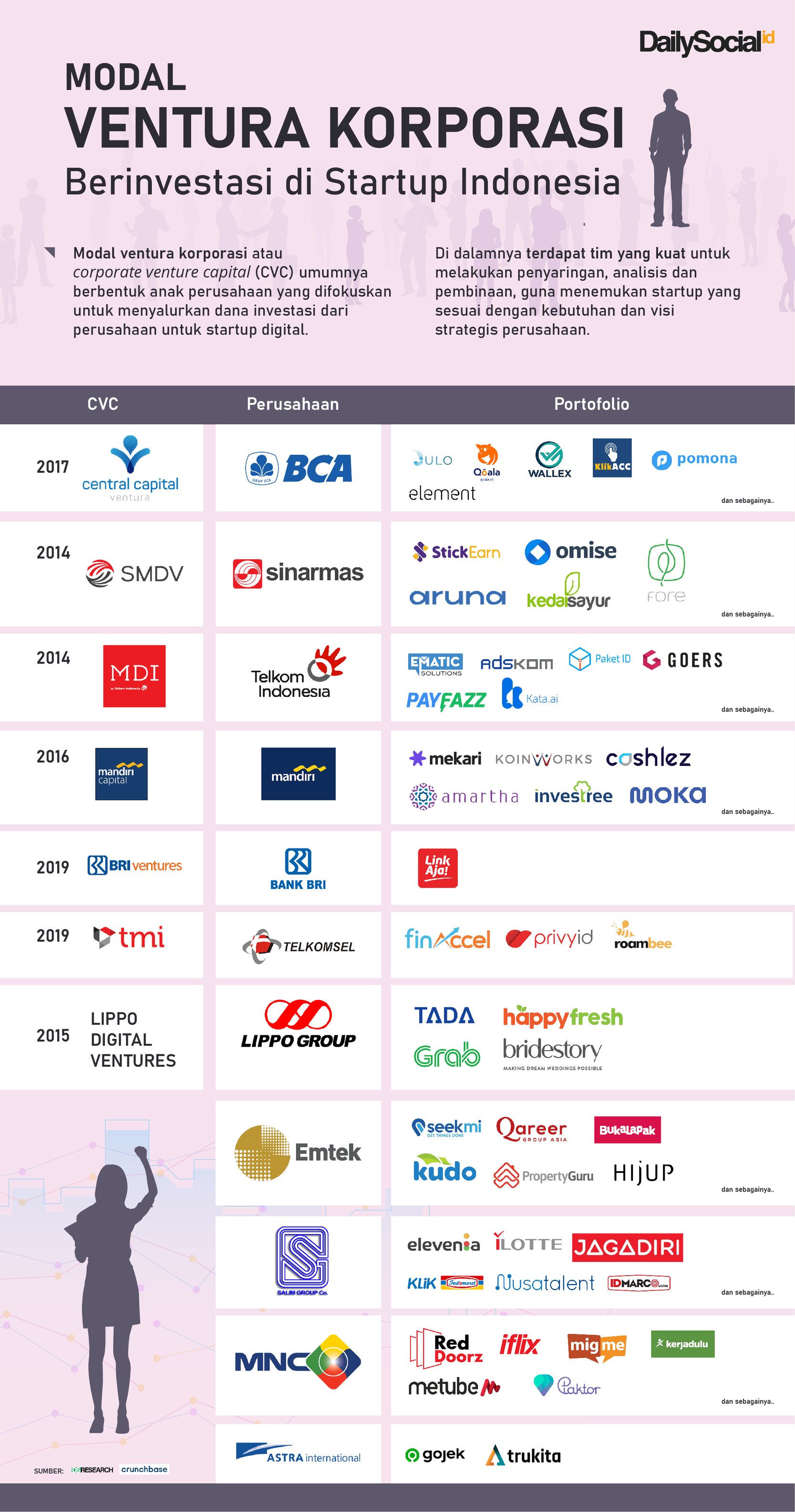

Indonesian corporate venture capital

Corporate venture capital (CVC) usually takes form as a separate business unit (subsidiary) that is focused on channeling company investment funds to startups. It involves a strong team to do analysis and screening, in order to find startups that fit the company's requirements.

CVC is getting popular in Indonesia, along with its achievements - both in terms of strategic partnerships to increase business or exit (IPO or acquired with a higher valuation value) as a mechanism for investors to get financial returns.

The investment focus is simple, each company explores the sectors with the highest potential to strengthen corporate lines. As an example, Central Capital Ventura from BCA, it's targeting startups which provides access to financial convenience for consumers and businesses. The derivatives are quite diverse, ranging from credit platforms, financial technology supporting businesses, to insurance. Apparently, Astra International follows the rule, the company focuses on startups that empower automotive products, around transportation and logistics.

A bigger chance for growth-stage startups

After previously debuting with up to 3.5 trillion Rupiah managed funds. Recently, BRI has re-injected additional capital worth 500 billion Rupiah for BRI Ventures. In addition to increasing the portion of share ownership to 99.97%, it is expected to accelerate the subsidiary. Quite a fantastic number for a business kick-off in the new venture capital business.

Another CVC, Mandiri Capital Indonesia (MCI) has invested in 13 startups by the end of 2019. The CEO, Eddi Danusaputro said to have 50 billion Rupiah ready to be invested in other fintech startups. Their latest lead is the investment to the Halofina financial planning platform in the pre-series A.

The large value poured by corporations into the CVC is not random. From the existing trends, they are usually investing in startups at the growth stage. In this phase, startups are usually have proven the traction of the targeted market. As with Telkomsel Mitra Innovation (TMI), which was recently formed halfway to the end of last year, they made a debut investment to Kredivo's series C.

A deeper approach was taken by the Telkom Group by establishing the Indigo Creative Nation's integrated incubation and acceleration program. MDI Ventures is involved to invest in the startups graduated from the program.

More CVC to come

Although it's not explicit, several companies reportedly participated as Limited Partners (LP) in venture capital. Acting as an LP means that they entrust the designated party to channel funds to the right startup, instead of forming their own team or subsidiary in processing investments from top to bottom.

Digital startups with the success story in demonstrating competitive value in the market and support for the current industry, are believed to attract more corporates involved in the ecosystem, specifically forming CVC. Aside from local case studies, overseas even world-class companies have also intervened in the ecosystem.

The latest news is that several other state-owned companies are also interested in forming a subsidiary in the field of venture capital. BNI and Pegadaian are said to be finalizing an investment strategy to strengthen the company's business line.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter