Donald Wihardja: From Business Intelligence to Engineer the Tech Investment Ecosystem in Indonesia

He believes in order to engineer the tech investment ecosystem, one must have enough knowledge and experience in doing the business

This article is a part of DailySocial’s Mastermind Series, featuring innovators and leaders in Indonesia’s tech industry sharing their stories and point of view.

Donald Wihardja has more than 20 years of experience in applying technology for various industries, from telco to banking to web startup, as a manager, advisor, consultant, investment manager, and entrepreneur in Indonesia. He believes in order to engineer the tech investment ecosystem, one must have enough knowledge and experience in doing tech business.

He started the journey with a misstep. He left Silicon Valley in 1995 believing Indonesia was ready to experience a tech boom, which eventually he realized that it was still a long way to go from that moment to this stage we are now. However, he managed to pull the trigger and made his way into the tech industry in Indonesia.

Donald has expertise in data warehouses or what we now call big data. He is capable of using data to keep track of business performance and make intelligent strategic decisions. He learned how to use technology to transform business. That's the beginning of his shifting career path from electrical engineering computer scientist to a business consultant more than a tech consultant in terms of programming.

He entered the investment industry through a Private Equity (PE) company and learned enough to finally quit and started his own Venture Capital (VC), Convergence, with Adrian Li. Over five years of being a VC's partner, he discovered an opportunity to channel his investment style. It is through MDI Venture, where his concern will not only lie in multiplying the company's money but also creating opportunities for business synergy under the Telkom Group.

DailySocial had an opportunity to interview Donald who was at that time actually on sabbatical and currently staying in the States to discuss Indonesia's tech investment ecosystem. He shared a lot of his thoughts on how to create a better environment in our country's tech industry through the paragraphs below.

You have more than 20 years of experience in applying technology for various industries. How was it started?

I started the journey with a misstep. I left the State in 1995 believing Indonesia was ready to experience a tech boom, which happened in the US around that time. I never thought I had to wait for 20 years and had to be a part of its development. However, I always believe Indonesia will be the next technology hub and already on its way although with merely slow realization.

In fact, it takes literally a hundred years for Silicon Valley to get where it is now. The original Silicon Valley entrepreneur or Venture Capital investing in short Model-T. Cars without custom build or mass produce can make a successful venture a hundred years later. Banker started investing in tech ventures and created a success story. More and more technologists are getting rich and eventually took part in the investment industry.

The biggest issue with technology is the tech risk. Is this a real one? Is this just an illusion? Are you ready or not? Investing is all about the disparity between knowing personal private information and public information. The more you know, the less risky the investment. It is actually quite simple. If you know the ingredients to build a successful startup, you will know where to pour your money on.

There is this concept that Indonesia will be a significant tech ecosystem, at least in Southeast Asia. I already miss the tech boom in the US, my job is to build the current boat so I didn't miss this one.

How was your first attempt to engineer the startup/tech industry in Indonesia?

I saw my journey going on here. I look back at my job in the States, at that time we just freshly came out of recession. Raises are slow and I was impatient. I know and I was told if I come back I will make a good manager in no time. That is true somehow.

My first job in Indonesia was as a programmer for Hewlett Packard (HP) customer support system. At that time, I'm extending my knowledge to business consulting and rejoining the company as a project manager. My job is basically to solve business problems and my product expertise is business intelligence and data warehouse or big data. This gives me exposure to tech business and problems.

I learn how to use data to keep track of business performance and make intelligent strategic decisions. That is the product I'm selling back then. From that experience, I get the technical side of how to use technology to transform business.

That is how Donald the electrical engineering computer scientist ended up being a business consultant more than a tech consultant in terms of programming.

In 1998, a recession happened. All of my fellow consultants got shipped up around the world. I refuse to leave, I rather build my own tech software development company with my current partner. Another thing, we also tried to build something that looked like Tokopedia back in '98. We all know it didn't work out because there is not enough market and users are not ready.

From that crisis, I learned that when the other side of the world has upgraded and we are one generation behind in terms of data and connectivity. Consumers at that time were too far behind, they could barely browse the web. People who can use it are very small compared to the population. Everything is too slow. This is a problem we cannot just let slide.

You have an educational background in electrical engineering and computer science, then ended up being a business consultant. What drives you to enter the investment industry?

In 2005, I got invited to join a PE (by the time I have my own programming company and stuff), named Quvat. I learned how to fundraise for a company with all the paperwork regarding investment agreements. I am grateful to work at a company with a very educational culture. I had to learn subjects outside of my work field in order to improve my quality. This is how I know what I want to do.

I have my first project to build fiber optic cable, allowing Indonesia to catch up with two generations of tech. During that time, Indonesia finally experienced the first rush of the real full bandwidth. We actually make bandwidth in Indonesia cheaper by 90%. Then, people are getting interested and willing to pay more. After all this time, Indonesia is finally ready.

In time, I realize that Quvat will never invest in a startup. That is the difference between PE and VC. If my future is to be tied with the tech revolution, I should not be in a PE. I should either be in a startup or a VC. After a long time with Quvat, I was asked "Where do you want to go from here? What do you want us to do for your career?" and I said I want to quit and join the startup. I quit Quvat to join Indomog.

I was a CTO back then with Indomog. What I do is help the company build its business model. One of the biggest issues at that time is that everything in tech is free. Startups cannot make money in Indonesia because there is no way to get paid. It's easy in the US, they have credit cards, but here it didn't go that way. Therefore, we build a cash payment infrastructure, specifically around games.

That is what the Indomog thesis is. However, from day one, we know the thesis is to build more than a payment solution for games, but for commerce. One thing I realize, if there is going to be a tech boom in Indonesia, I need to help solve the thesis of the problem. And with the startup, I choose to solve the payment issue.

Another problem arises, Indonesian startups did not have VC funding because we don't know how to raise money from investors. Also, there's not enough investor awareness in Indonesia either. While doing my job in Indomog, I also helped few other startups as I have extensive knowledge on writing convertible notes and so on. This is when I know the next problem to solve is in the VC. And when Adrian Li came to me with the idea of Convergence, I decided to join.

I joined Convergence to capitalize on the opportunity that we need for venture capital in Indonesia. There are a lot fewer VCs than people making startups back then. I'm getting too old to be a programmer. Also, Quvat has prepared me to be a partner. By that time, my experience in Quvat and my years' building startups got me enough knowledge to be a partner in a VC.

During my time in a VC, I also realized how immature the Indonesian VC ecosystem is. That is why, with fellow VCs in the field, we created Amvesindo. It is actually a lobbying group of PMVs and VCs and a bridge to the government.

How can you describe the transition from Convergence as a Venture Capital to MDI Ventures as a Corporate Venture Capital?

In Convergence, we learn how to invest as a minority shareholder. We see and we believe the founder knows better than the VC in terms of running the company. Furthermore, we don’t take over the company. We provide them with growth capital. This is a high-risk business, therefore, we need to find the right asset and only invest in a company we can really grow.

As I started as a business consultant, my style has always been more like a mentor. That is why, when the opportunity arises from MDI, I think that fits me better. As a CVC, MDI does not only have a money-multiple mandate. Does it also push on how the startup can create revenue for Telkom? That forces the team to have a synergy division whose job is actually to vouch for these startups to work together with Telkom. It also allows me to have an active role in growing the startup.

Telkom, on the other hand, has generated more revenue from its corporate business than the amount poured for investment. Therefore, how much capital gain I generate in investment wouldn't make that much difference to the group. What they actually need is what kind of innovation and digitalization can we bring to the table. This is where I realize I have come to a company where they are actually telling me to stop just worrying about money-multiple and start by creating business opportunities for startups. Indeed, not exactly how the company translates it, but I choose to interpret it that way.

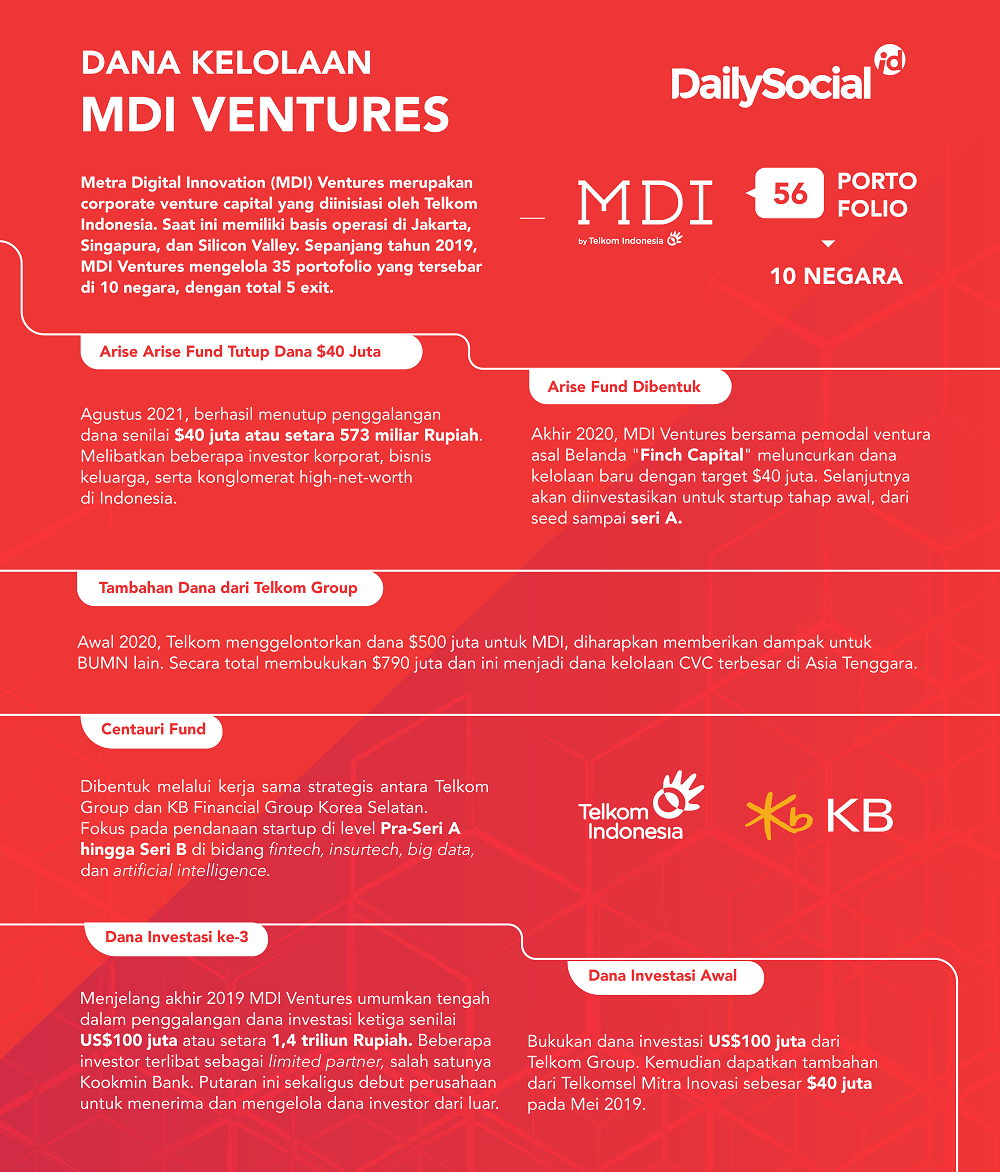

I want to take the digitalization requirement in Telkom and deliver that using the solution proven by startups. That is the work I want to do. Therefore, we focused on the startup in the later stage. As the stage gets later, the startup becomes more stable and able to deliver revenue and synergy with Telkom. MDI alone has multiple funds, we also have a fund for earlier stages. However, in each company we invest, we tried to build the relationship and synergy with Telkom. How can we comfortably make the continuous investment, in a way to engineer the growth of the company?

Recently, your portfolio in MDI, RunSystem, has announced its IPO. I'm interested to know your perspective about IPO, is it really an ideal exit?

In MDI, we have two KPIs, money multiple and synergy value. In terms of CVC, we are focused more on synergy as the impact is greater. However, one day we'll be facing this question, "How much money you've brought back to the company?". In order to answer, we need a way to prove that we have delivered two times more than the money we're given. More importantly, we can engineer exit in investment profitably. For what success a synergy can bring if the company you invest in is dead. I will no longer be trusted with money.

In order to balance these two, we create a system to prove our estimated value in each portfolio. Furthermore, we have successfully generated exit, bringing real cash to the company. One of Telkom Group's subsidiaries with the highest performing net income. That is about the exit.

The ideal exit is what multiples more money, but IPO is an important exit. It will be a way to prove the maturity of the Indonesian tech ecosystem as the information will go public. The more mature the Indonesian investing ecosystem worldwide, the more investors will come, and the faster we will grow. IPO is the barometer for the Indonesian healthy investment ecosystem. Although IPO might only have been done by 10%-20% of startups with a good track record.

In terms of paper, Indonesia has many startups with overly high valuations and still rising. However, what is value means if there's no way to exit. It is why Indonesia needs to create a more successful IPO story, in order to prove that we have an investable tech ecosystem. MDI has exited through IPO two times, in Australia and Japan. With RunSystem finally announcing, MDI is already on the right track. Also, we'll have several announcements related to this matter in the near future.

During those years of experience, what kind of challenges have you had along the way?

The biggest challenge during 20 years of experience is in public confidence. It's hard to make people believe in the Indonesian tech ecosystem when we barely can browse the internet. Imagine this country will be an investment destination or even a tech destination, and our tech will make a significant impact. When we can build confidence, it will have a good multiplier effect.

Thus, ensuring the digital transformation to have a big impact is very important in order to get enough support from all the stakeholders in the country. For the digital startup ecosystem in Indonesia to grow steadily, we need to understand and fight this together. This is not the work for a single person. Collaborate to fabricate the vision of the Indonesian future, it has to be developed and marketed to enrich the Indonesian ecosystem with competition and variety.

Anything you want to say to those tech enthusiasts trying to make their way to be a part of the Indonesian tech ecosystem?

This is the right time, especially with the pandemic and stuff. There's a saying "Don't let a good crisis go to waste". The crisis is indeed the time to showcase your ability. This is the right moment to join the tech revolution in your own way as a VC, corporate, founder, or else. Because never before has Indonesia been more ready for digital transformation. We're nowhere near the end. Make us more startups and more mature VC with more mature investors. In whatever field you are interested, join the game. It's a call to action.

You said you've come back to Indonesia at the wrong time. Did you ever regret it? Do you still have something you want to do but have no chance to do so?

Actually, my current project is how we can create digital transformation in the ecosystem backed by many state-owned enterprises. How can we use the existing customers to be digitized by startup players? We can identify which digital ecosystem is ready to develop based on the business opportunity captive market in the state-owned enterprise but also powered by the startup's proven solutions. Thus, I can level up as a CVC which not only introduces startups to the Telkom group but also creates opportunities outside what the startup or Telkom's thought to create more impactful innovation.

Sign up for our

newsletter

Premium

Premium