In-depth: On the Potential Integration of Gojek and Tokopedia Merger into "Goto"

Analyzing the service ecosystem of both applications

The latest news arrived from the potential merger of Gojek and Tokopedia worth $18 billion. Based on a source quoted by The Information, the merger of the two brands will be named "Goto". He also said that the agreement would be completed at the earliest this month.

The source also said that Kevin Aluwi, Andre Soelistyo, William Tanuwijaya, and Patrick Cao would occupy the top ranks of the joint company's management.

In early April 2021, Bloomberg reported the company's executives and commissioners had decided the merger agreement details and were seeking approval from other shareholders. In a general note, the two startups have some related investors, including Google, Temasek, Seqoia Capital India, and Alibaba Group.

The next plan,rumor has it, that the joint company will continue to NASDAQ - using SPAC and seeking a valuation of up to $40 billion.

Gojek's ecosystem

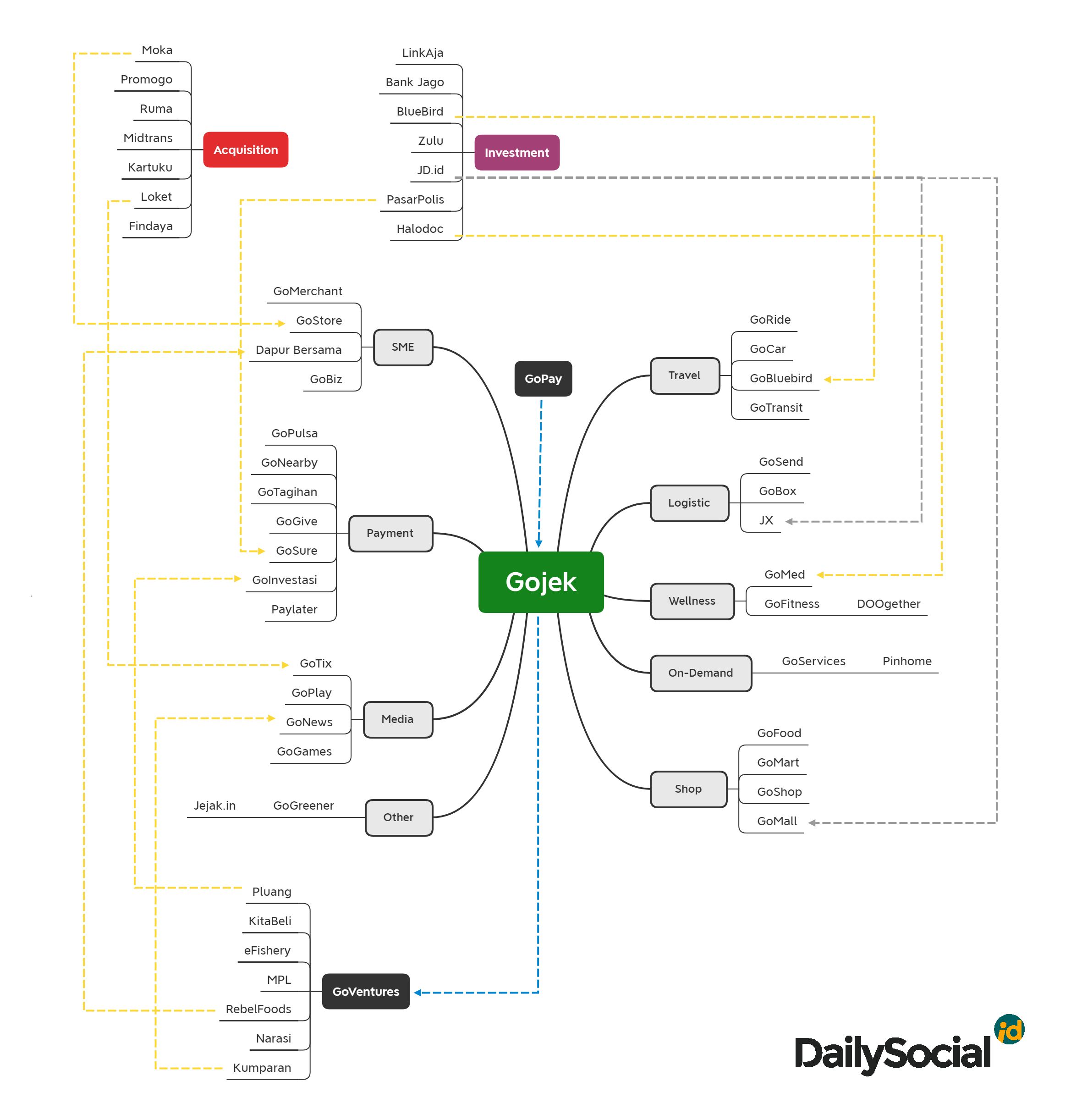

Debuting as an on-demand transportation service, Gojek currently has a fairly complete service to empower its partnership ecosystem. Some of the sub-features are an integration with third parties, especially startups from acquisitions or those included in the portfolio of venture units.

In terms of business structure, Gojek consists of four main lines, which cover Gojek, GoPay, GoPlay, and Go-Ventures services. Meanwhile, in terms of consumer, it is divided into two separate units, between Gojek and GoPlay. From our in-depth observation into the application and public information, following is a map of Gojek's ecosystem services:

Tokopedia's ecosystem

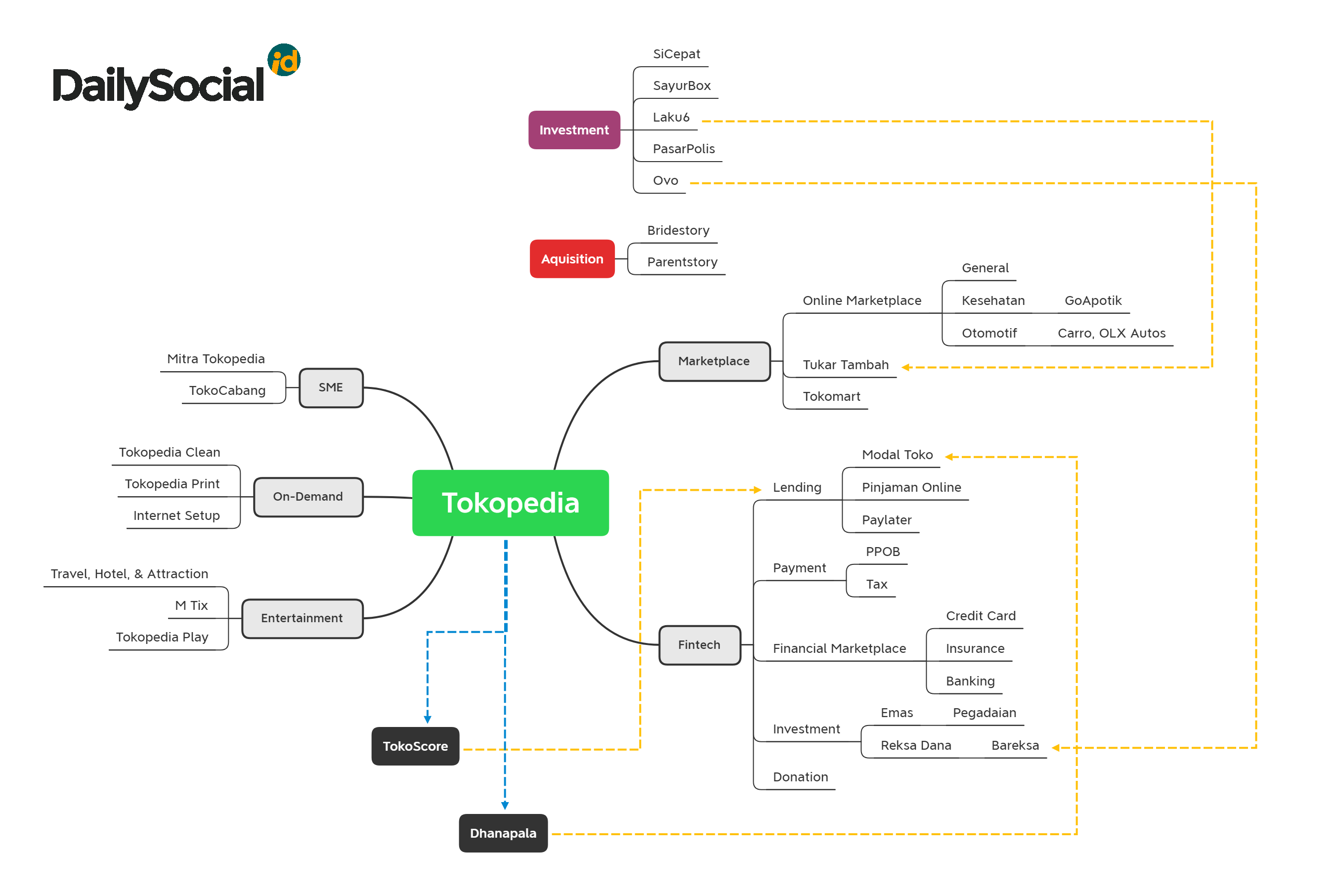

Meanwhile, Tokopedia's core service is an online marketplace, which is a bridge between goods/service owners and end users. Its role in the midst of making innovation is focused on aspects that can provide transaction effectiveness. This is align with the mission of becoming IaaS to facilitate MSMEs to go digital.

Apart from its core services as a marketplace, there are some strong support services, including financial lines, empowerment of SMEs, entertainment, and on-demand services. Some of the services are supported by strategic partners, some of which are by subsidiaries and their investment portfolios. Based on observations on the applications and public information, the following is a map of Tokopedia's ecosystem services:

Potential synergy

Based on the map, if it's going to happen eventually, Gojek-Tokopedia merger, and become a joint company, there are some potential synergy that could happen.

- SME Empowerment

Both services have a significant concentration of MSMEs, gathering business partners. Gojek with restaurant owners, while Tokopedia with merchants. It is different segments, therefore, it is likely to remain a separate entity with a more integrated service model. For example, for the fulfillment of raw materials, GoFood partners can have direct access to shops on Tokopedia.

The unity allows the creation of hyperlocal services - nearby MSMEs serving the closest market share. For example, when Tokopedia Partners (grocery shop owners) can be integrated with Gojek delivery services, they can speed up the fulfillment process for each customer. In other way, to optimize the Gojek driver partners to be more connected with the TokoCabang fulfillment center to speed up the process of delivering goods.

- Financial

For the past few years, the two unicorns have a clear mission to become "fintech" as one of their main business models, it's no doubt each application has a quite rich financial-based service. The thing is that the merger of the two companies will certainly allow Tokopedia users to have a more comprehensive Gopay payment option. On the other hand, they can work on many areas by combining each capability.

For example, integrating Moka-Gopay [Findaya]-Tokopedia, enabling F&B merchants to get fulfillment of basic ingredients on credit to help them improve their cash flow. As it is deeply examined, this scheme will require a lot of support systems such as credit scoring and disbursement infrastructure - which both companies can complement each other.

The big data is quite a treasure that will be very valuable for various business scenarios, including to help financial inclusion. Especially now that Gojek is starting to enter the digital banking - transaction data is a strong fuel for various decisions related to consumers.

- Logistics

The logistics challenges are in the first-mile, mid-mile and last-mile areas. The merger of the logistics infrastructure owned by the two companies allows Tokopedia's IaaS mission to be realized faster. As the company continues to expand its fulfillment center, delivery service has become an essential. With the strategic affiliation of Gojek Logistic, JX, and SiCepat, deeper integration is possible to bring new breakthroughs in the logistics industry.

- Core business

Mobility and trade services are the main capabilities of Gojek and Tokopedia. It is indeed projected to keep going, considering the many users involved. The work lies in how to balance each service - especially if it really becomes one brand - therefore it makes consumers feel comfortable, not the other way around, to get more confused due to fragmented service ecosystem.

Conflict possibility

The fact is, the strategic partnerships has an objective to form mutualism. The merger of the two companies also brings the potential for "conflict" between Gojek and Tokopedia's important partners. Let's assume with independently developed service will be easily merged. However, when other players are involved, this consolidation will become a more complicated discourse.

For example, how the investment service will work at Goto - while there are three other startups affiliated in each platform through share ownership. From the service ecosystem mapping, listed some services as the result of partnerships that can create conflict possibility whether the business merger happen:

| Gojek | Tokopedia | |

| Pembayaran | GoPay | Ovo |

| Pinjaman | Findaya | Dhanapala |

| Investasi | Pluang | Pegadaian, Bareksa |

| E-commerce | JD.id | - |

| Online Grocery | AlfaMart, LotteMart | SayurBox |

| Logistik | JX | SiCepat |

| Kesehatan | Halodoc | GoApotik |

Gojek and Tokopedia are the two Indonesian startups with the largest valuation and user base with the biggest MSME partners. The unity of two companies should help Indonesia achieve its dream of becoming a leader in the digital economy.

Sign up for our

newsletter

Premium

Premium