Intudo Ventures Announces Its Third Managed Fund of 1.6 Trillion Rupiah

In total, the current funds has reached $200 million; already invested in 22 Indonesian startups

Intudo Ventures, the Indonesian market-focused venture capitalist, closed its third managed fund "Intudo Ventures Fund III". The value has reached $115 million or equivalent to IDR 1.6 trillion, in less than three months of fundraising. In total, the company has managed funds of approximately $200 million.

Various fund managers and organizations are involved as limited partners, from the United States, Europe, and Asia. Some of these include Black Kite Capital, Koh Boon Hwee's family office; Wasson Enterprises, the family office of former Walgreens' CEO, Gregory Wasson; PIDC, an investment arm of a Taiwanese conglomerate, and others. There were also 10+ tech unicorn founders and 30+ Indonesian conglomerates involved.

The mission remains, the funds will be focused on investing in Indonesian startups. Moreover, today is a good momentum with the increasing middle class and digital services consumption.

"Acting as a domestic 'herder', Intudo Ventures supports founders through a mix of hyperlocal and global best practices, which enables us to consistently create more profitable results for founders," Intudo Ventures' Founding Partner, Patrick Yip said. "Seeing the founders' growth, we are more optimistic in Indonesia than ever before; and excited to work with the next generation of Indonesian entrepreneurs."

Investment hypothesis

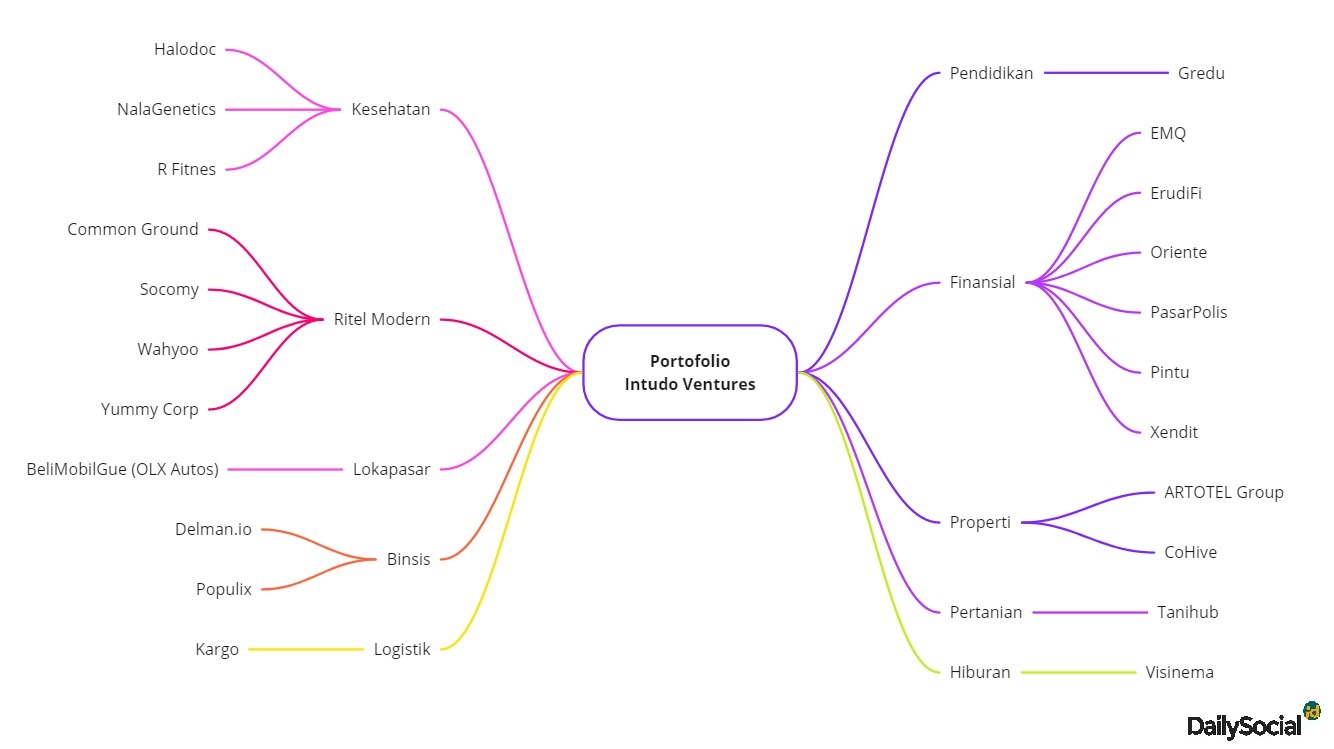

Intudo Ventures Fund III will be channeled to startups in agriculture, B2B solution developers, education, finance, insurance, health, logistics, new retail, and entertainment. It is to build a concentrated portfolio of 12 to 14 local startups. The ticket size will be around $1 million to $10 million.

From a business perspective, Intudo invests in three categories of companies. First, early-stage companies in not-very-popular sectors -- most of them having difficulty in raising fund. Second, invest in new business verticals that demonstrate breakthrough potential and strong profitability pathways. And third, a leader in a business vertical that has been validated by the market.

"Over the past five years, the market has validated our 'Indonesian-only' investment approach, demonstrating the importance of a single-country-focused managed fund [...] In Indonesia, Intudo has consistently stepped up to deliver value to founders before and after investment. We proud to play a role in making Indonesia the next emerging market success story," Intudo Ventures' Founding Partner, Eddy Chan added.

In addition, there are many factors to consider in investing, from commercial distribution (including the startup's product prowess and intellectual property), regulatory compliance, and specialization in deep technology.

Intudo investment

Intudo Ventures debuted in June 2017, in partnership with local and global investors. There are already 22 local startups that have received investment from the two previously managed funds, with the list as follows:

Intudo has also carried out several initiatives to help the ecosystem growth. They recently launched a fellowship program "Pulkam S.E.A. Turtles" aimed at Indonesian students studying abroad, to 'go home' and present solutions to grow the Indonesia economy.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium