Pluang Adds Crypto Asset Instruments for Investment Portfolio Diversification

Collaborate with Zipmex as a strategic partner

Entering the end of the year, Pluang released another new investment product on its platform. This time with crypto assets trading, starting with Bitcoin and Ethereum as digital currencies with the largest capitalization value today. The company cooperates with Zipmex as a partner in the transaction.

There are two reasons why Pluang chose Zipmex to integrate into its platform. First, because it has been registered with BAPPEBTI as a crypto exchanger. Second, Zipmex uses BitGo as custodian, with protection (insurance) issued by Lloyd.

Pluang's Co-Founder, Claudia Kolonas said, "The objective for Pluang to launch this product is to open wider access for Indonesian people into the financial products worldwide." She also said that one of the priority is to make the transaction/investment process more practical.

"Crypto sales on the Pluang application can be done in real-time. Pluang users can buy, sell, and store crypto tokens in the application comfortably because they are protected by insurance. Currently, deposits and withdrawals can only be made in Rupiah, but we will consider crypto withdrawal features at a later date," Claudia explained.

Previously, Pluang was known as a gold investment platform. In September 2020, they released the S&P 500 futures investment instrument, allowing Indonesians to invest through a public company in the United States.

Crypto asset is not a popular investment instrument

The decision to add crypto assets into its investment product line tends to be "brave" amid the so-so public interest to invest in digital currencies. It was validated by research we conducted with Populix last July 2020. From a survey of 209 respondents who used digital investment services, mutual funds (67%), gold (62.7%), and stocks (44.5%) were the most chosen instruments.

Research by Pluang involves a larger number of respondents, around 5500 people, has discovered almost the same results. Gold (32%), stocks (15%), and mutual funds (16%) were the most popular. Meanwhile, very few respondents choose crypto assets for their investment.

Regarding this matter, Claudia said that her main objective was asset diversification. "Having an investment allocation in Bitcoin or other cryptocurrencies can provide broad diversification against traditional portfolios, which are usually stocks or bonds," she said.

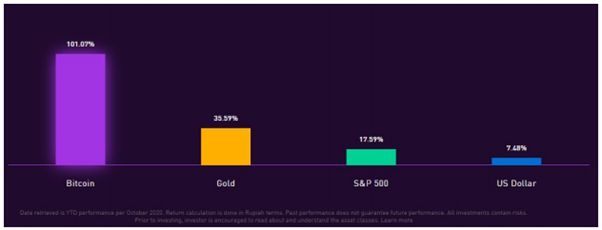

Research by Pluang suggests that Bitcoin is the asset with the highest yield in the past year - compared to gold, the S&P 500, and the US dollar. The data obtained is from the beginning of the year to October 2020. The yield is calculated in the conversion of rupiah currency.

Comparison of the investment products in the past year / Pluang

Comparison of the investment products in the past year / Pluang

Crypto assets such as Bitcoin have fairly high market volatility, the up and down is based on public confidence in the digital currency. If you look at the trend in recent times, the price even dropped to $3000.

On that basis, Claudia also suggested that crypto asset products are suitable for long-term investment. "We do not recommend buying Pluang cryptocurrency if there is an urgent need for funds in the short term. So apart from having a moderate to high-risk profile, this product is also recommended for investors who already have investment experience," he explained.

– Original article is in Indonesian, translated by Kristin SiagianHeader: Depositphotos.com

Sign up for our

newsletter

Premium

Premium