Red Carpet for Startup on the Stock Market

The IDX has prepared some relaxation rules to embrace three unicorns. The Indonesian stock exchange is expected to get more exciting

The rhetoric of unicorn startups' going IPO has been heating up since the beginning of this year considering it's "time" for early generation's VC investment startups to reach the mature stage, aka cash out to be returned to the LPs.

Therefore, it is only natural that the Indonesia Stock Exchange (IDX) openly announced that the three Indonesian unicorns are to get a dual listing. At least Gojek, Tokopedia, and Traveloka have been widely reported about its IPO this year. IPO is a way of exit for investors, apart from mergers, acquisitions, or issuing new shares.

Regardless of the technology startup status, the company's ambition to go public is a very strategic decision as it requires a commitment to obeying stock exchange rules with good governance.

To date, technology startups that have gone public is not quite many. The IDX racked the brains to make IPOs friendly to disruptive types of companies and chose to focus on pursuing growth rather than looking for profit. Establishing acceleration boards, simplifying regulations, and creating the IDX Incubator program are some of the efforts.

IDX Incubator was first started in Jakarta in 2017, next to Surabaya and Bandung a year later. It is said to gather 114 startups, 62 startups from Jakarta, 24 startups from Bandung, and 28 startups from Surabaya.

To date, there are three startups that have successfully go public. Those are PT Yelooo Integra Datanet Tbk (YELO), PT Tourindo Guide Indonesia Tbk (PGJO), and PT Cashlez Worldwide Indonesia Tbk (CASH). The stock exchange officials said that there will be two startups to follow in this first semester.

Separately, DailySocial reached the Head of IDX Incubator Saptono Adi Junarso regarding the IDX Incubator evaluation. There's no significant answer for the stock exchange study. He said his team will continue to learn and improve, therefore, the current program will be upgraded.

It requires support from various parties in order to prepare the company for an IPO. Not only from professional institutions, but also from other stakeholders such as investors, the government, and the community.

"We seek to cooperate with institutions that can support more startups and small and medium-scale companies to go public," he said.

One of the adjustments by IDX Incubator was changing the curriculum to be more focused on helping companies with small and medium scale assets to list their shares on the IDX. This curriculum is called "Road to IPO" which has been effective since 2019.

Road to IPO has a curriculum that contains training and mentoring. With this distinction, IDX Incubator is claimed to be in a more strategic position in the ecosystem. Nor does it overlap with other incubator/accelerator programs.

"There are already some existing players for the incubation program that emphasizes business development. Therefore, we want to be a follow-on incubation program for IPO preparation," IDX Incubator's Operational Manager, Aditya Nugraha said.

This curriculum adjustment affects the tightening requirements for advanced startups to join. One requirement is a startup that with one step below the IPO process. However, those who join do not have to be tech startups. Conventional SMEs have the same opportunity.

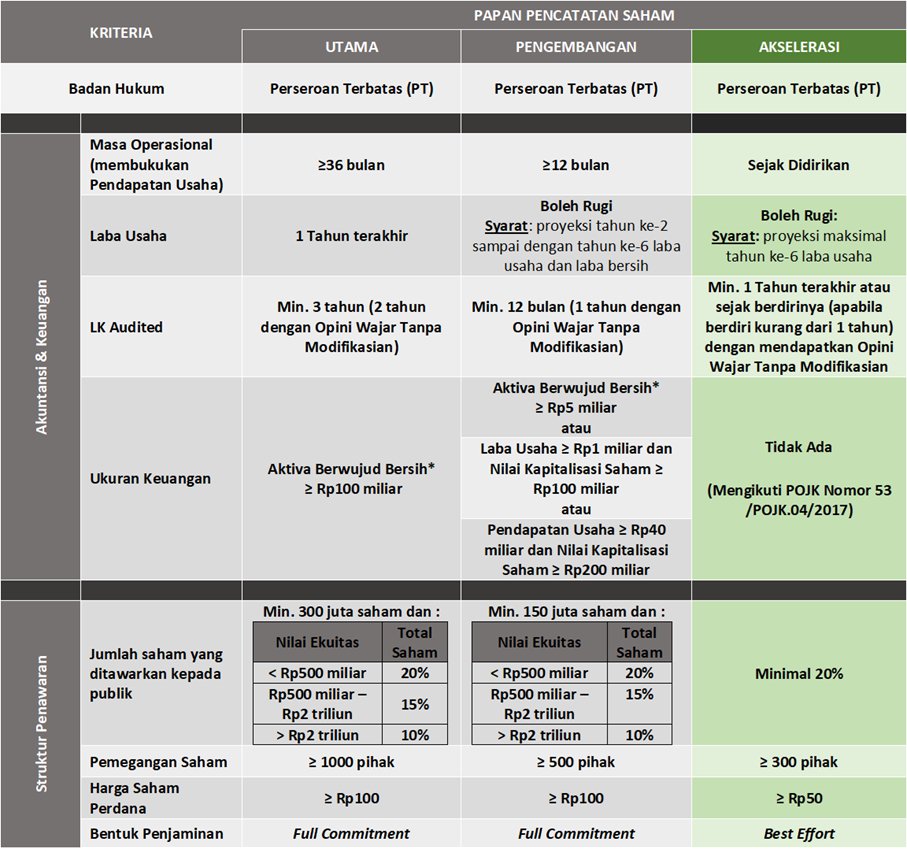

Source: BEI

Source: BEI

Lack of enthusiasm

Apart from the three IDX Incubator graduates who made it to go public, there are 20 technology companies have run the IPOs, citing the IDX website. Five companies have been listed on the existing acceleration board. Two of those are Cashlez and Pigijo. Other technology companies are listed majority on the development board, then the main board. The acceleration board itself has been officially announced by the IDX since 2019, cited in the Regulation Number I-V.

Source: BEI

Source: BEI

Source: BEI

Source: BEI

IDX Development Director, Hasan Fawzi explained, although there aren't many companies on the acceleration board, it does not necessarily mean that IDX missed the target. In fact, he said that the IDX remains prudent in performing its duties. Not just any company can pass the selection.

"We take a deep view of the company's condition and its concerns about the future growth prospects. There is a mini expose for us to see from the company management perspective and whether it has confirmed business plan prospectus,” he explained.

The IDX tends to be more strict in assessing companies to enter this board as there is a responsibility to protect investors. The IDX makes different monitoring parameters because of its own board. On one side, investors are expected to fully understand all the risks of buying shares, apart from seeing the potential business being offered.

"We have required stock exchange members to submit a disclaimer for each share on the acceleration board, the interface will be different, especially for the transactions. This has been done by all stock exchange members."

Fawzi said that the stock exchange has positioned itself as an inclusive place by offering alternative sources of funding through IPOs. "It's possible because it is still small [the scale of the business] is still difficult to obtain conventional [financial institutions] funding sources."

According to Indef's economist and researcher, Nailul Huda, the stock exchange still needs a long time to grow enthusiasm for startups to go public. Basically, IDX Incubator is only a means. The success or failure of an IPO depends on the ability of the company itself.

"Currently, there is equity crowdfunding as an alternative to IPO besides the IDX. This is more possible as it is a very complicated process with the IDX and you have to deposit standardized financial reports. It's tough for those who may not have capable financial staff."

Another thing that may be burdensome for startups is maintaining share prices. There are many US-based tech companies which stock prices went down after the IPO. On average, they do not have a strong pathway to ascertain how the company will be profitable in the future.

"[Because] the aim is valuation. As calculated from the GMV and the number of subscriber coverage. The business model is yet to explain how the future profits will be."

Huda also said that the concept of stock prices does not always reflect company performance.

“High stock prices with bad fundamentals will surely be a hit and irrational buyers, it'll be brief. However, if the company's performance and fundamentals are good, the stock price will tend to increase. One interesting example [that does not reflect the company's performance] is Gamestop."

When the three unicorns successfully enter the market, Nailul is not certain that other startups will immediately be motivated to follow the same steps. They definitely monitor the listing results. If it makes a good share price at the beginning, that means they are only looking for money at the beginning. After that, the stock price is no longer matters.

"It will indeed be a standard for other technology companies not to be listed early. However, if it makes a good result, it will definitely become a benchmark for other companies to list."

Source: Traveloka

Source: Traveloka

Separately, at a media gathering held by East Ventures (19/2), East Ventures' Co-Founder & Managing Partner, Willson Cuaca said that all startups must eventually be listed on the stock exchange, but not all startups can do because each is in a different stage. Moreover, IPO is only part of the cycle of a company.

For startups, the advantages are having additional liquidity and having very good compliance as they have to comply with stock exchange rules. Meanwhile, being a public company is the valuation validation for investors that have been measured before investing in the startup, whether it is a good deal or not.

"Which startups do I think should list? All startups must be listed because there is validation of valuation, liquidity, and increased compliance. But can all startups be listed? No, because it takes time to get to that point. If the early-stage startup is busy taking that step, they will not be able to make products," Cuaca said.

Significant groundwork

The stock exchange is getting serious about encouraging unicorns to enter the capital market by making a number of adjustments. Their presence is considered to motivate other startups for listing.

Fawzi explained that his team had intensive meetings with unicorn stakeholders to discuss the obstacles. First is the demand to enter the main board because it provides more added value for its investors, than a development or acceleration board.

This makes sense given that the valuation of each company deserves to be aligned with a public company with large capitalization in Indonesia.

Source: Tokopedia

Source: Tokopedia

Therefore, the IDX is finalizing the change to regulation number I-A, this rule will later accommodate various characteristics of issuers, including technology companies for IPOs. "We really want to [enforce the rules], but now we are in the process of discussing it to get approval from the OJK."

According to the current stock exchange regulations, there is an obligation for companies attempting to enter the main board to have tangible assets (net worth). Meanwhile, the characteristic of startups is intangible assets are larger than tangible assets. Therefore, the stock exchange will provide other measurement aspects, such as revenue and market utilization.

"We can't deny the fact that we had not been prepared for companies which strategy development was different from companies in general."

Second, that is a concern and currently being prepared by the stock exchange is the classification of the sub-sectors according to the business of the unicorns. The stock exchange launched the IDX Industrial Classification (IDX-IC) on January 25. This classification changes the stock exchange classification used previously since 1996, the Jakarta Stock Industrial Classification (JASICA). The transition process was run for three months.

IDX-IC uses a grouping method based on market exposure for the final goods or services used by listed companies, aiming to provide guidance for users regarding groups of companies with similar market exposure.

The categories are more detailed into four levels, sector, sub-sector, industry, and sub-industry. Currently, JASICA has classified issuers by sector based on the principle of economic activity, therefore, it is only divided into two levels, sector and sub-sector.

Fawzi explained, the IDX-IC uses benchmarks of global exchanges, similar to the index published by private parties such as Bloomberg.

Global investors will be happier if they can compare company shares to similar industrial groups in other countries. As compared by sector, it is more apple-to-apple to see the growth or performance of its peers.

"In fact, it is more comparable now. Companies that have been listed can also benefit as they were previously included in the general category, some have entered services or trading, now there is a sports to entertainment sub-sector which is more suitable in their field."

The final request is related to the potential implementation of several rules, such as the special right of the founders to conduct dual class shares by giving different voting weight to the founding shareholders and public shareholders. Next, the multiple voting share scheme or one share owned by the founder has more rights than ordinary shares in terms of decision making.

Junarso added, in finalizing this framework, IDX will not only focus on increasing the supply side, but also on investment demand from sophisticated investors for technology companies, such as venture capital, private equity, and other investors by engaging and inviting them to enter the Indonesian capital market.

Dual listing

Dual listing is not a new thing in the global exchange world, however, this strategy is rarely chosen by most companies in Indonesia. Global tech companies, such as Alibaba and Sea Group, choose the United States stock exchange as it is the largest stock market in the world. NYSE (New York Stock Exchange) is the largest, followed by NASDAQ, which consists of technology companies.

For example, millions of shares can travel fast [per second] between buyers and sellers on the NYSE. Due to the high volume of exchange, the transaction process is relatively easy. In other words, the U.S. stock market is very liquid with low transaction costs.

To date, only a few local companies going public on the global stock exchange. Quoting from Bisnis.com, a number of state-owned companies that are making dual listings were Indosat, Telkom Indonesia, Aneka Tambang, and Timah. Telkom and Antam are the only ones still implementing this strategy.

Telkom has been listed on the NYSE since 25 years ago. The journey has not always very smooth along the way. They were threatened with delisting as they failed to meet the submission deadline of the 2002 financial report audit.

Samuel Sekuritas Indonesia's (SSI) Head of Research, Suria Dharma believes that dual listings have a positive impact on companies in general because they can have access to bigger sources of funding. However, there is a price to pay, that regulations and reporting are often more strict than at home.

Meanwhile, for unicorns, because they are predicted to have a large market capitalization, this dual listing scheme is expected to make a broader penetration for potential investors. It will result in a chunk of fresh funds.

He described the stock price movements for the dual listing companies to adjust to one another. "Previously, it only follows the global price but now vice versa, it's often to follow Indonesian price. It might be because Indonesian investors are getting more of the latest information."

Willson added that the dual listing to be performed by local unicorns can combine the two best things, entering the US and local exchanges. "This is related to nationalism. If it can be dual, of course the local market will be more excited. We have to go to the US because there is a huge capital market, this is the perfect combination."

– Original article is in Indonesian, translated by Kristin SiagianHeader: Depositphotos.com

Sign up for our

newsletter

Premium

Premium