Same Day Delivery Gets Hyped, Logistics Competition Went Tight

Food delivery is one thing that drives this same day delivery trend

The growth of the logistics market in Indonesia is predicted to get better in 2021. This has taken into account the current situation in Indonesia as the implementation of social restriction policies in some areas.

Indonesian Logistics Association's (ALI) Chairman, Zaldy Ilham Masita revealed several predictions and trends in logistics to occur in Indonesia this year. First, he observed that logistics service players had started to adapt during the pandemic. This is visible as the emerging new services and collaboration between startups and large logistics companies, especially to accommodate the needs of instant courier services (on-demand).

"In the fourth quarter of 2020, logistics will get more popular due to increasing public spending. In the first quarter of 2021, it is a bit worrying as the implementation of social restrictions. However, we are optimistic because during the last six months, [logistics players] have been trained to adapt. We predict that the logistics peak [increase] will occur in the third and fourth quarters of 2021 as more people get vaccinated," he said in recent contact with DailySocial.

According to Ken Research's report, Indonesia's logistics market is estimated to reach $200.3 billion with a CAGR of 7.9% in 2024. This value includes goods transportation, freight forwarding, warehouse, express and parcel (CEP) and cold chain logistics businesses.

Second, he estimates that the increase in the logistics business this year will be boosted by the same day delivery service. With the current situation, he estimates that this trend can spur logistics industry players to evaluate whether the current duration of same day delivery times has met customer expectations and is business competitive.

Zaldy, who is also the President Director of Paxel, even admitted that he would consider the findings. Moreover, Paxel, which is a technology-based logistics delivery service platform startup, started a same-day delivery service with a duration of up to 10 hours.

Service | Ja(bo)detabek rate | Duration |

| GoSend | Rp,.815/km (0-6km), Rp 18,000 (6-15km), Rp1,200/km (>15km) | Up to 4hrs since the pick-up |

| Grab Express | Start from Rp15.000 (0-5km) | Up to 6hrs (motorcycle) since the pick-up |

| Paxel | Flat s/d 5kg Rp8.000 (dalam kota), Rp15.000 (luar kota) | 6-8hrs (within city), 10-12hrs (inter-city) |

| MrSpeedy | Rp8.000 for the first 4km | Up to 90 menit |

Source: Official website of Gojek, Grab, Paxel, MrSpeedy / Organized by DailySocial

"Currently, Same day delivery within the city is only 2 hours. Over the last few years, customer expectations have increased significantly. [Paxel] is even evaluating whether the same delivery with a duration of 8-10 hours can compete. In addition, there is something more extreme at a lower cost. It means that the industry needs more innovation," he added.

Same day delivery trend is driven by food delivery

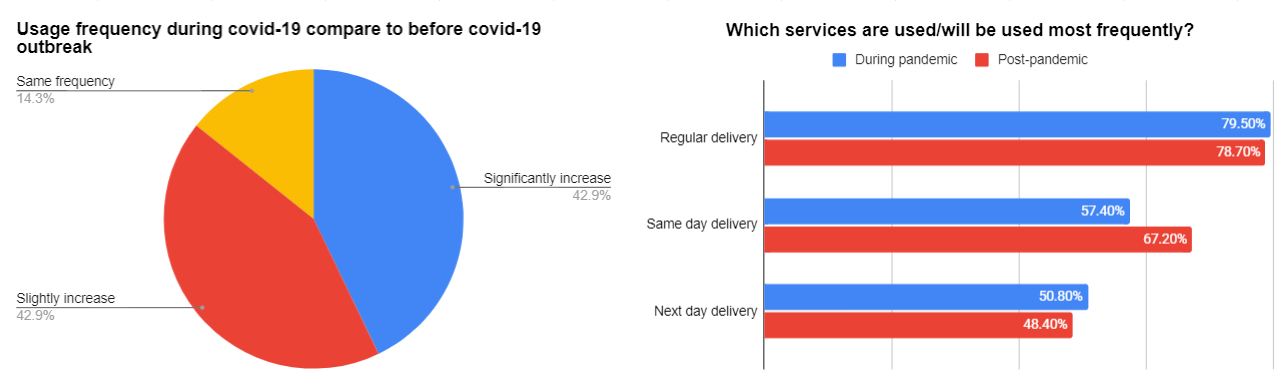

Referring to the report The 2nd Series Industry Roundtable: Logistics Industry Perspective released by MarkPlus Inc in October 2020, the frequency of courier services increased rapidly during the pandemic. This increase was triggered by a number of main factors, including online shopping activities, prices, and delivery times.

Source: MarkPlus Inc / Organized by DailySocial

Source: MarkPlus Inc / Organized by DailySocial

In addition, same day delivery services are expected to get rapidly increased after the pandemic (67.2%) compared to regular delivery services (78.7%) even it has a larger portion. The research was done with 122 respondents from the Greater Jakarta area (59.8%) and non-Jabodetabek (40.2%).

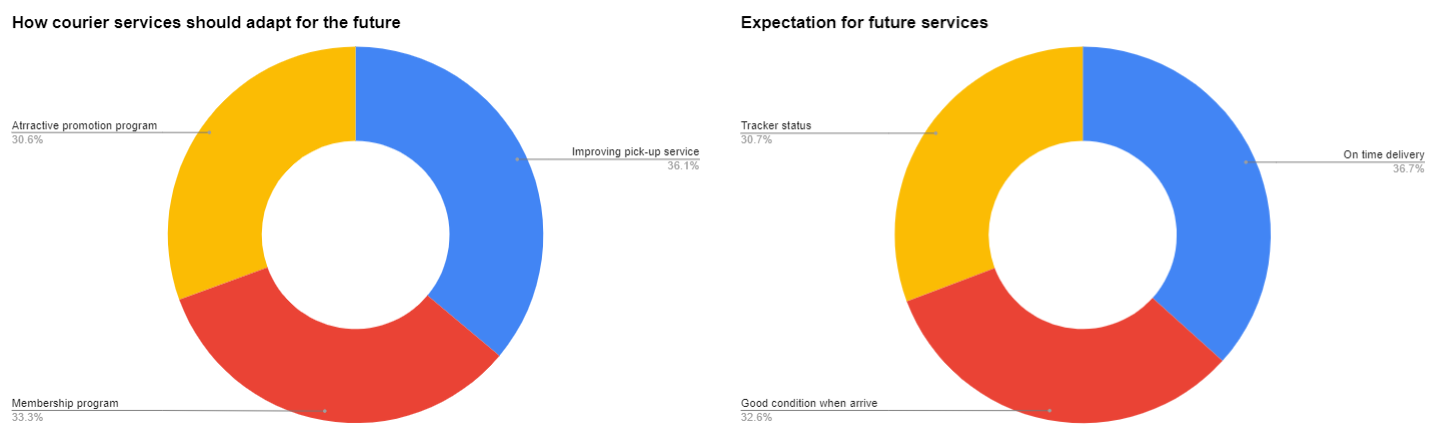

Then, respondents have a main expectation for the delivery of services on time (36.7%) and logistics service providers are considered to need to improve pick-up services in the future.

Source: MarkPlus Inc / Organized by DailySocial

Source: MarkPlus Inc / Organized by DailySocial

Third, in Zaldy's observations, the B2B logistics market is getting decrease due to the shifting of shopping behavior from offline to online. The effort is getting stronger as the pandemic and increasing customer expectations are considered increasingly extreme. He estimates that the composition of the logistics business in the B2C segment will increase from 10% to 25% this year.

"Fourth, this year is also a proving ground to see which logistics business models are successful and which are not. New business models may emerge because many new markets are yet to open, such as food delivery services," Zaldy explained.

Several giant startups, such as Gojek (GoFood), Bukalapak (BukaFood), and Shopee (ShopeeFood) are started to tighten its position in the market segment. The large logistics company SiCepat also acquired 51% shares in the DigiResto food delivery platform to boost revenue contribution from the food delivery market in Indonesia.

Quoting Momentum Works' research, GMV food delivery services experienced accelerated growth during the pandemic. The report noted the GMV of food delivery services in six countries in Southeast Asia reached $11.9 billion in 2020.

In terms of the Indonesian market, the number has reached $3.7 billion or equivalent to Rp52 trillion, dominated by two big players, Grab and Gojek, with a share of 53% and 47% of the total market share, respectively.

Challenges for legacy logistics

Fifth, Zaldy continued, he said that older conventional logistics companies would find it difficult to catch up with future trends. This is because it is not easy for companies to transform or build infrastructure in a short time. The key is in collaboration.

At least, throughout 2020, there will be many collaborations between startups and corporations. For example, Ninja Xpress partners with Grab and Gojek partners with Paxel. The partnership was due to strengthening inter-city freight forwarding services (intercity).

According to Zaldy, the pandemic is an eye-opening experience, therefore, conventional logistics companies are willing to collaborate. "Many conventional legacy companies find it difficult to catch up with business as customer expectations getting higher now. We see some conventional companies, their service may be threatened by the same-day delivery," Zaldy said.

In fact, he also saw an emerging new trend due to the pandemic, non-logistics companies entering the logistics sector. Blue Bird is one of which that executed this idea.

The company has made maneuvers in logistics since the second quarter of 2020, powered by the fleets. Blue Bird has started to expand its logistics services by partnering with Paxel for large package shipments with a same-day delivery service.

"We are using the existing fleet for cost-efficient. In essence, we want to contribute to logistics services during a pandemic, regarding hygiene in particular, we apply protocols according to our standards," Blue Bird's Chief Strategy Officer, Paul Soegianto said to DailySocial.

Zaldy also gave an example of how this will be a challenge to PT Pos Indonesia. He said the infrastructure is no longer possible to catch up with logistics service providers, SiCepat, for example.

"However, [models such as] PT Pos Indonesia can take advantage of infrastructure from other platforms, such as Anteraja. This means that the first and middle miles can collaborate with each other, while the competition is in the last mile," he added.

Gojek and Tokopedia's Merger to affect logistics industry

Sixth, he estimates that the plan of Gojek and Tokopedia's merger can have a big impact on the Indonesian logistics industry. Also, he added, conventional logistics companies will be significantly affected.

"The merger of the two will struck the legacy companies. Why? It's hard to get legacy companies to change their business models, especially those that already have thousands of courier fleets and hubs. Unless they have good IT systems or technology, this will be difficult. Blue Bird is an example of a legacy company with a ready system. The question is have they done the 'homework'?" Zaldy said.

In a separate article, DailySocial Founder and CEO Rama Mamuaya said that the merger of the two can have a big impact on consumers and the industry. Rama said, cross-breeding of complementary products would be fantastic for consumers. Moreover, both of those have integrated e-commerce, transportation, and financial infrastructure in one application.

"Today, we have same-day delivery which works most of the time. The integration between Gojek and Tokopedia can produce something even better, Amazon Prime-style instant same-hour delivery, helping push e-commerce transaction and customer satisfaction even more while increasing driver utilization rate making it more economical as a business," he explained.

– Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium