Women and Investment: The Essentials of Being Financially Independent

Featuring one of the female leaders in the Indonesian tech industry, Pluang's Claudia Kolonas

For one so-called reason, financial matters are often positioned as a male sole responsibility. As more women join the workforce today, the world is shifting towards gender equality even in the realms of investments. In this modern era, lots of women have been supporting [or at least making money] for their family or simply themselves. And now, they are planning their investments in order to be financially independent.

Based on the Global Gender Gap Report 2021 conducted by the World Economic Forum, Indonesia is said to close 68.8% of its overall gender gap, corresponding to a rank of 101st globally, although this year's gap is 1.3 percentage points larger than in the previous edition.

This decline has resulted mainly from wider Economic Participation and Opportunity gaps. The reason is said to be the sharp drop in the share of women in senior roles. Beyond the performance of this indicator, women participate in the labor market significantly less than men (55.9% of women and 84% of men) and wage and income gaps remain large (69.7% and 51.7%, respectively). In addition, 81.8% of the women’s employment is in the informal sector (compared to 79.4% of men).

Claudia Kolonas is one of the few women founders in the Indonesian tech industry. She founded an investment platform, Pluang, with a goal to promote financial inclusion in Indonesia. As a woman in the fintech industry, it's impossible to go through without facing any challenges. However, during her mission, Claudia tried to dodge all the negativity that blanketing her potential and put on the confidence as people might throw doubt for her as a woman leader.

Being a financially independent women

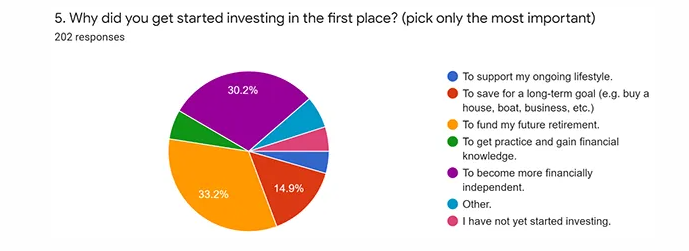

Based on the Women and Finance: The 2019 Rich Thinking Quantitative Survey by Barbara Steward, CFA, most women understand the importance of being financially independent. In the survey, more than 200 women from 24 countries were asked the most important reason why they invest, the second most popular answer was “to become more financially independent,” and occupying the top of the table, “fund my retirement.”

In a patriarchal-demand society such as Indonesia, women usually have less contribution in terms of financial support for the family. Especially when they're married, the rule often applied that she's become her husband's responsibility. It may sound like a relief while in fact, the expression is kind of terrifying, to give up yourself in return for what? nobody can really guarantee anybody's safety.

Claudia said, “I think that investment is very important for women. Because it is very important that women can be financially independent, especially if their husbands leave them. When women are married, these women usually have a greater burden of expenses, therefore, it is very important to save for emergency funds. This emergency fund will be very useful when there are unexpected events such as loss of work, etc.”

Financial independence is a critical theme for women. A financially empowered woman is not just more confident but also more productive and capable of a perfect work-life balance. This is one of the main factors that can measure the prospect of a woman's success.

"The most important thing is to provide support for women, especially those engaged in a family, who want to break into the tech industry. It's essential to have an equal platform to work for both men and women," she added.

In terms of investing capabilities, studies also show that women spend more time researching their investment choices. And while they do take on less risk than men when it comes to investing, it doesn't automatically translate into avoiding risk. Rather, they’re simply more likely to take on appropriate levels of risk with their investments than men. Both of these findings make for better investing outcomes.

Investing in a time of the pandemic

There are several common investment objectives in the public. Some people invest to ensure safety [post-retirement], generate income [for daily purposes], or gain revenue from their capital asset. In fact, investment platforms are harvesting amid this pandemic. Especially since people spending a lot more on the internet during WFH and investing gets easier as powered by technology.

In Indonesia, some platforms are existed to accommodate these objectives, including Investree, Pluang, Bibit, etc. It enables people to invest in gold, capital market, mutual funds, and many other forms of investment, easier through clicks.

Based on the Indonesian Central Securities Depository (KSEI), in the first four months of this year, the number of capital market investors increased 31,11% to a total of 5.08 million. Meanwhile, mutual fund investors increased 38.85 percent to 4.40 million investors.

The demography paper also implied that women are narrowing the investment gap to 38,45% with an estimated asset value of Rp208,84 trillion. This information is backed by the fact that Pluang, one of the leading investment platforms in Indonesia, claimed that the majority of its investor are women. Following the investment statistics and trends, the company also plans to add more products this year.

"This year, my personal focus is on the purchase of government debt products, such as SUN or ORI, as well as investing in mutual funds and also in state-owned bonds. In my opinion, there are still many opportunities to increase the value of fixed-income products in Indonesia, and the risks are quite moderate," Claudia explained.

Despite all the convenience to plant money in the digital platform, the internet is not immune to fraud. There are several cases involving fraudulent investment that spreading across devices. This is a very complicated issue that requires the whole ecosystem to contribute. The market needs more education, to fathom the investment product and not to violate basic morals.

The good news, the financial literacy index and financial inclusion index in Indonesia had increased since 2019. OJK reported the value has reached 38.03% for the financial literacy index, while the financial inclusion index has reached 76.19% in 2020.

Claudia also mentioned that many investment products become more volatile during a pandemic, resulting in risk increases. "We think it is very important to be able to educate our users about investment risks, especially when there is economic uncertainty," she added.

Investing is not a game. As fun as it sounds, will you bet the money you can't afford to lose? Just because most of your colleagues are constantly bragging about the excitement of the market. Investment is indeed fundamental to reach financial independence. However, it's very important to invest in something you can fathom.

Sign up for our

newsletter

Premium

Premium