Indonesia's Digital Economy is Now at $40 Billion, E-commerce as the Biggest Participant

An observation to the “e-Conomy SEA 2019” report by Google, Temasek, and Bain & Company

Google and Temasek have published another annual report on Southeast Asia's digital economy. Titled as e-Conomy SEA 2019, there are some issues worth highlighting. Since 2015, the internet user has exceeded 100 thousand people-increased by 10% in the past year. In 2019, SEA's total internet user has reached 360 million. New users are mostly at the age of 15-19 years old.

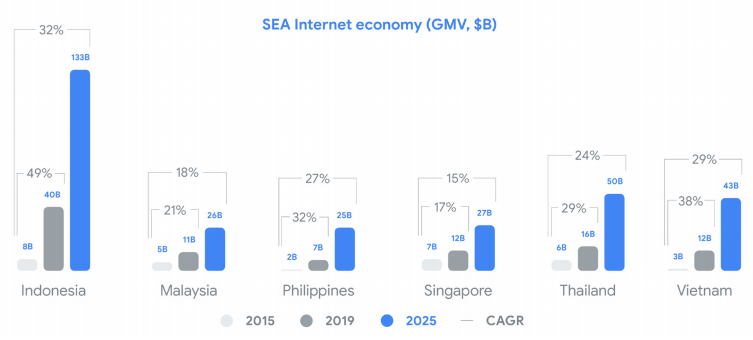

The increasing number has an impact on the internet/digital economy. The number has reached $100 billion in 2019, projected to reach $300 by the year 2025. The estimated number increased after last year's report prediction at $240 - in 2018 the value reached out to $72 billion.

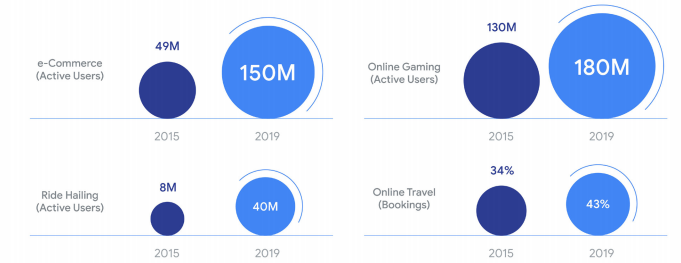

As seen from the internet industry's sub-sector, most of the internet users are in the online game category (180 million active users), followed by e-commerce and ride-hailing. The number is getting higher as esports trend arises in the region - still exploring the true identity with business models that keeps changing, more than just a game.

The ride-hailing demand also gives quite an impact. Since 2015, the report shows increasing internet users five times up. In terms of industry players, Grab and Gojek are still competing for the regional market. Both are consistently raise funding for expansion.

Indonesia is leading

Indonesia's digital economy is predicted to reach $130 billion by 2025, it's already at $40 billion this year - 49% growth in average per year. E-commerce and ride-hailing become the main industry; as the digital payment dominating all the app-based services. The related growth is supported by endless investment. It includes funding for Indonesian unicorns, the value is at $4 billion in 2018.

Indonesia, compared to six other countries with the rapid-growing internet economy, is more significant in terms of value. Based on its geographical condition and total population, it's far indeed. Vietnam is projected as the second biggest market after Indonesia. The digital players start eyeing the region to settle. Some of Indonesian giant digital companies - such as Gojek and Traveloka - has its debut there.

In its report, Google-Temasek always highlighting e-commerce, online travel, online media, and ride-hailing. The four main sectors are playing great roles for business transformation in Southeast Asia - as the locomotive and gate to the digital economy. In fact, the e-commerce and ride-hailing sectors in Indonesia has opened new opportunities, particularly to encourage SMEs to level-up and create more job offers.

Indonesia is getting momentum, for at least 152 million internet users, has exceeded the total population. The online travel sector leads the last year achievement, this year is for e-commerce to rise. The growth has reached 88% since 2015, the number (GMV - Gross Merchandise Value) this year has reached $21 billion. While online travel is still at $10 billion. Ride-hailing on the other side is at $6 billion.

Centralized area

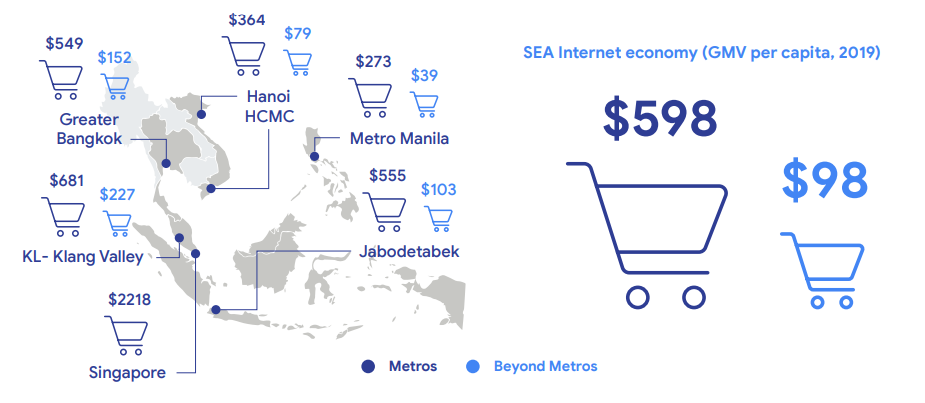

One of the highlighted issues in the report is the internet economy distribution in the region. Research has compared the economic cycle that occurs in the metro or urban areas, has outperformed the other regions. Take Indonesia for example, the GMV per capita for the internet economy in Jabodetabek is $555 while the other region is at $103.

Meanwhile, only 15% of the total Southeast Asia population living in the urban area. Some digital startups have a "holy mission" to reach the rurals. As in Indonesia, the digital payment app penetration aims for the unbankable. It includes some e-commerce trying to accommodate SMEs from the rural area.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter