Insurance Companies Strategy to Tighten Distribution Channels by Collaborating with Startups

There are eight partnerships of startups and insurance companies in 2020

Last week, Home Credit announced collaboration with PT Asuransi Harta Aman Pratama to launch an insurtech product called "MyLifeCOVER" on the fintech platform. Users can now register, pay, and process claims through the Home Credit application.

Earlier this month, Grab has also announced PT PFI Mega Life Insurance as its partner. The collaboration is formed through the "Sobat Proteksi" feature on the superapp, making it easier for users to get insurance products for critical illness protection.

In 2020 we recorded a total eight launching of similar collaboration, between digital platforms and insurance companies - apart from platforms developed by startups that specifically work on insurtech businesses - including:

| Platform Digital | Perusahaan Asuransi |

| DANA | AXA Financial Indonesia, Mandiri AXA General Insurance |

| Traveloka | FWD Life Indonesia |

| Grab | Asuransi Simas Jiwa |

| Good Doctor | AXA Financial Indonesia |

| JD.id | Asuransi Jiwa Sequis Life |

| Modal Rakyat | Adira Insurance |

| OYO | Asuransi Simas Insurtech |

| Halodoc | Avrist Assurance |

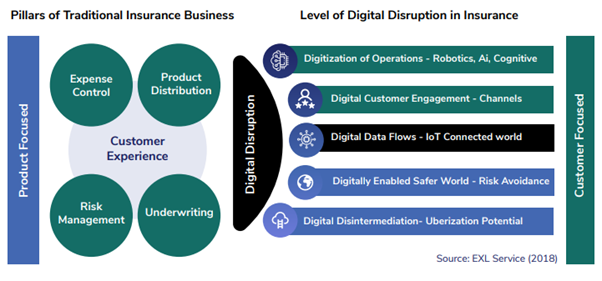

Quoting from 2020 Corporate Digital Transformation Report, digital innovation for insurance products and services is divided into several aspects. Nearly all collaboration models are focused on "digital customer engagement", or as a channel to connect insurance products and services to their users. The question is: how effective is that?

Grab Financial (a unit of Grab that focuses on financial and insurance platforms) recently announced that during its two years of operation in Southeast Asia, their insurtech unit has successfully sold 100 million insurance policies. In the release, Tokopedia also said that micro insurance products such as "Gadget Protection" had experienced an increase in transactions of up to 70 times by the end of 2020. These two examples are obviously extraordinary.

The potential is there; according to Nielsen's research in 2020, public awareness of having life insurance products in major cities in Indonesia during the pandemic has increased to 24%. Previously, it only stuck in single digit. Although in Indonesia, insurance ownership in average is relatively low, with insurance penetration (total premium/GDP) of 3%.

Industry player's perspective

In the launching of its collaboration with insurance company partners, Home Credit Indonesia's Head of Payments & Value-Added Services, Randy Pragustio Priantoro said, "It takes innovation through digital technology, therefore, insurance can reach the widest possible range of Indonesian people and is able to provide a good understanding of the importance of soul protection."

In his observation, consumer applications like the current products are indeed the right approach to reach these groups. Moreover, one of the fintech missions is to protect those who have not been fully served by banking services while helping to improve financial literacy.

Grab Financial Group's Head of Insurance, Tom Duncan said similar thing when launching the partnership with Mega Life Insurance, "This product [Sobat Proteksi] is an extension of our micro and fractional pricing approach, therefore, more underserved people can benefit from insurance products that is accessible and arrived in a transparent manner."

In terms of insurance company, Niharika Yadav as President Director of AXA Financial Indonesia also said at the launching of the collaboration with DANA, that product accessibility is a priority to develop with digital application developers. "We strive to always innovate and present life and health insurance solutions that focus on customers and provide easy access for everyone to have and experience the benefits of insurance protection."

Education through product relevance

The best way to provide education is to provide practical experience. This model seems relevant in relation to the proliferation of microinsurance products currently integrated with services from digital startups. The microinsurance product referred to here is protection for something of relatively smaller value, for example gadget insurance, short-distance travel insurance, etc. The price is quite affordable.

For instance, OVO charges a monthly fee ranging from IDR 15,000 to IDR 65,000 for insurance to cracked screens on smartphone - in (1) 100% guarantee for new screen replacement; (2) repair warranty whether the screen have another damage within 90 days; (3) flexible protection period ranging from 3 to 12 months; (4) claim free pick-up and delivery service from the user's residence to the service center and vice versa; (5) new and original spare parts.

Gojek offers similar product, in collaboration with its portfolio, PasarPolis. Gopay's Chief Risk and Compliance Officer, Budi Gandasoebrata said the focus of GoSure (insurtech unit) is to facilitate public access to affordable insurance products. In addition, products or services must also be ensured with daily needs. "[As an example] In presenting this product [gadget insurance], we fully understand the importance of protecting gadgets, which currently have almost become a primary need in a society that has become increasingly digitalized since the Covid-19 pandemic."

With a more mature understanding of insurance products / services and how they work - especially by experiencing the direct benefits - it is not impossible that the penetration of insurance products (including life insurance) will increase in the future.

Quoting from the DSResearch report, Indonesian people still reluctant to gent insurance because of some reasons. Related to the procedure to get it (33.62%); prices that are considered too expensive (24.15%); do not understand about the product and its benefits (20.76%). There are some respondents (13.56%) who associate it with the prohibition of religion.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium