JIWA Group Obtains Funding, Changing the Local Coffee Industry Landscapet with Grab & Go Concept

Many coffee chain players currently focus on digital system development to increase user retention and product distribution

Coffee chain startup "JIWA Group" or known as one of its products, Kopi Janji Jiwa, announced funding from Openspace and Capsquare Asia Partners. The nominal investment is undisclosed, however, the fresh funds would be focused on increasing business expansion. Moreover, the two investors are considered to have the best practices in the local and regional value-chain markets.

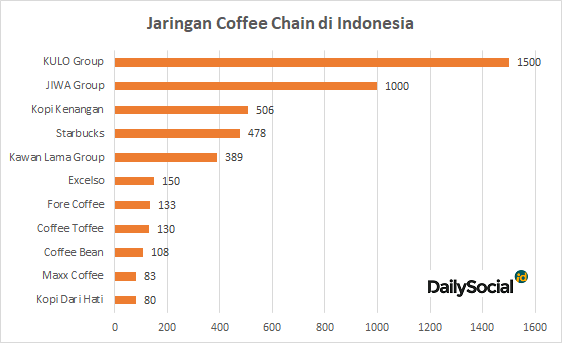

Was founded in 2018, the company has overshadowed 3 product brands. Aside from coffee, it also offers Jiwa Toast and Jiwa Tea. In total, there are around 1000 outlets operated in 100 cities in Indonesia. Throughout 2021, it is said that the company has sold 40 million products, increased by two times compared to the same period the previous year.

"We believe JIWA's strong brand, unique product offerings, 1000 strong offline locations, equipped with the increasing use of technology across all business elements will continue to solidify its position as a market leader," Openspace's Executive Director Jessica Huang Pouleur said.

Technology development and omnichannel strategy

Based on the explanation of JIWA Group's Founder, Billy Kurniawan, the impressive growth obtained also influenced by the digital channels. Including the use of social media for engagement with customers, and integration with online marketplace and food delivery platforms.

They also launched the JIWA+ application to support the "grab & go" model as a signature of Kopi Janji Jiwa since day one. Users can order menus and pay through the application, they also offer options to pick up at the nearest outlet or have it delivered to the location. In the application, a loyalty system is also created to increase customer retention.

Aside from improving operations by adding outlets, products, warehouses, and logistics, with the investors support, JIWA intends to accelerate the use of technology. They're focus on several areas, such as improving customer experience, supply chain, and reducing carbon footprint. The founders also have a mission to become the industry leader for the technology-enabled F&B segment, to further enter the Asian market.

"Innovation and customer satisfaction have always been part of Jiwa Group's DNA, ensuring we remain relevant and sustainable in the dynamic F&B industry," Billy added.

F&B level up through digital

According to research (MIX, 2020), 40% of Indonesian coffee consumers are switching to grab & go outlets. This is supported by a shifting demand from instant coffee, as consumers want a higher quality drink -- pairing it with complementary snacks. According to a report compiled by Statista, revenue from the coffee business (roast coffee) will reach $9.5 billion this year. It is estimated to experience a CAGR growth of 9.76% until 2025.

In maintaining the growth trend, industry players have started to take advantage of digital channels. This strategy was performed along with the increase in several outlets. The grab & go concept alone is very dependent on the outlets, although not a few are only used as production sites (without dine-in).

Apps are designed to connect consumers with outlets, shifting them from online to offline – or vice versa. This model is quite efficient, because companies can use the data obtained from consumer habits recorded in the application, therefore, they can offer products and services in line with the market share. On the consumer side, the convenience and value added make them willing to use the application.

Coffee chain brand owners continue to invest in developing technology. In addition to utilizing the existing platforms, they also create their own applications. Some applications even rank quite significantly. Based on our observations of Google Play statistics as of November 5, 2021, we got this data from the Food and Drink category:

| Rank | App | Download | Rating |

| 6 | Kopi Kenangan | 1 million+ | 4,6 |

| 13 | Boba Ceria | 100 thousand+ | 4,3 |

| 17 | Chatime Indonesia | 500 thousand+ | 4,5 |

| 21 | JIWA+ | 100 thousand+ | 4,7 |

| 22 | ISMAYA | 100 thousand+ | 4,4 |

| 24 | Fore Coffee | 100 thousand+ | 4,6 |

| 61 | Flash Coffee | 50 thousand+ | 4,6 |

| 92 | KULO | 10 thousand+ | 1,7 |

Backed by tech startup investors

The technology adoption in the coffee chain business model is a special concern for investors. With the existing roadmap, players are able to provide impressive evidence and business projections – not just the coffee business, but F&B in general. Many food tech-based services are born from innovators. The opportunity to use the technology is comprehensive, starting from the supply chain of raw materials, for operational and transaction efficiency, and distribution.

With their respective hypotheses, several venture capitalists in Indonesia are entering the industry, including:

| Venture Capital | Portfolios |

| Alpha JWC Ventures | Google, Hangry, Kopi Kenangan, Lemonilo, Mangkokku |

| East Ventures | Fore Coffee, Greenly, Legit Group |

| AC Ventures | Coffee Meets Bagel, Fore Coffee |

| Vertex Ventures | Dailybox |

| Openspace Ventures | JIWA Group |

| SALT Ventures | Hangry, Shiru |

However, the coffee business model are developing in Indonesia. In 2020, Jago Cofee introduced the mobile coffee chain. Instead of using outlets, they use partners to distribute products around with carts that have been provided and specially designed. Likewise, Jago uses the application to make it easier for its customers to find partners and place orders.

This industrial landscape is becoming interesting, especially Kopi Kenangan as one of the coffee chain market leaders has the potential to become the first unicorn in the near future. It is known that the company valuation has crossed nearly $900 million. This means that the market share is already that big and the business model adopted can be well received and scaled up even more.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium