Koinworks to Cast More Institutional Lenders, Focusing to Serve SMEs

As of the second quarter of 2021, KoinWorks has disbursed more than 1 trillion Rupiah of productive loans to 300 thousand SMEs

Lendable pours another debt funding to KoinWorks. In 2020, the funds given were worth $10 million (equivalent to 149 billion Rupiah), the nominal has currently increased to $30 million or around 435 billion Rupiah. In Indonesia, Lendable also disbursed a similar loan to Amartha in February 2021 valued at 704 billion Rupiah.

Previously in April 2020, KoinWorks also announced the debt funding from two Europe-based financial institutions. As we contacted, the company refused to reveal its identity. In an interview, KoinWorks' Co-Founder & CEO, Benedicto Haryono did say that collaboration with institutional lenders is one of his strategies, both from domestic and foreign institutions.

He explained that the company had obtained institutional lenders since early 2018, marked by the entrance of Saison Modern Finance. Furthermore, Bank Mandiri followed in the middle of the year. In 2019, Sampoerna and CIMB Niaga also joined.

Focused on SMEs

For the company's next plan after receiving the fresh funds, KoinWorks' CFO Mark Bruny said that his team will still focus on serving the SME market which has great potential in Indonesia. This strategic collaboration is also said to be a success thanks to the transparency and good communication that exists between KoinWorks and Lendable.

"We believe that digital SMEs that have become borrowers on our platform will be able to survive and even seize the opportunity to thrive from this pandemic. Lendable agrees and they believe in the ability of Indonesian Digital SMEs and KoinWorks' ability to carry out this vision," Mark told DailySocial.id .

Regarding a change in approval or additional requests from Lendable to KoinWorks through this second collaboration, Mark emphasized that the approval is likely remain. Through the 300% increase of loan amount, KoinWorks is expected to be able to accelerate the distribution funds to Indonesian SMEs.

The current number of KoinWorks' disbursed funds in the second quarter of 2021 is exceed 1 trillion Rupiah to 300 thousand SMEs in Indonesia, a threefold increase compared to 2020. This indicates a significant development in this pandemic with many SMEs attending and pivoting to digital.

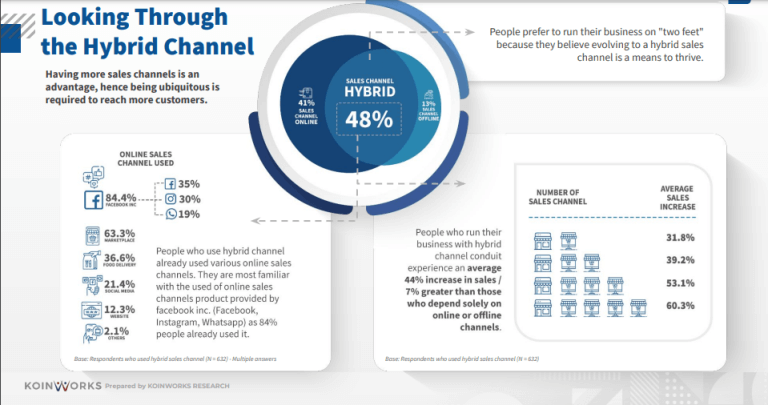

In a research by KoinWorks, it was revealed that SMEs using conventional and digital channels actually dominate the market with a share of 48% compared to SMEs that only use digital channels (40%) or conventional channels (12%). This digital transformation has succeeded in helping Digital SMEs not only survive but are able to thrive during the pandemic.

This transformation was also a major factor in the rise of the Digital SME Confidence Index to the level of 2.49 from the level of 2.37 at the end of last year and pushed us closer to the normal level, at the level of 3.00.

Potential of foreign investors in Indonesia

Mark also said, the high interest of foreign investors, in this case those who provide funds in the form of debt funding such as Lendable to Indonesia, is due to the large business growth in Indonesia, especially among SMEs. Indonesia has become the investors target, seen from the potential and incoming investment.

Was founded in 2015, Lendable Inc through fintech has channeled a lot of capital to people around the world. This is a good way to be able to provide access to financial services to the public. The direct entry of companies like Lendable to Indonesia has had a multiply effect on funding. By introducing foreign investors to Indonesia, it opens up opportunities for other fintech services in Indonesia to raise fresh funds.

"As the current most advanced platform, we are lucky to be able to make this deal and help the ecosystem by introducing strong players while introducing Indonesia globally," Mark said.

–Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium