What Later-Stage Startups Expect When They're Expecting Investors

From DailySocial mini survey, investors' track records and global investment networks are the most expected keywords

Aside from capital, there are many other inquiries and criteria that startup founders look for in investors. It particularly happens for later-stage startups in Series A, B, and C. This is the finding that DailySocial obtained from a mini survey of some startup founders in the particular stage. We also conduct short polls on this topic on Twitter and LinkedIn.

Why do we narrow it down to Series A, B, and C startups? It is because the startups in this phase have gained traction, secured customer base, and are starting to plan for scale-up or business expansion. It means that they will have more complex criteria along with business growth, and are no longer glued to capital alone.

A different hypothesis might arose as it is compared to the early-stage startups, where capital is necessary to develop products/services. The goal is to get customers and find out whether the product/service has been accepted by the market (market-fit).

The following are the summarized results of our mini survey.

Global investment network

Some startup founders participated in our mini survey, including those engaged in e-logistics, edtech, agritech, and musictech. Apart from capital, their expectations lie down for access to global network (85.7%), technology advisory (42.9%), business advisory (28.6%), and mentoring for founders (14.3 %).

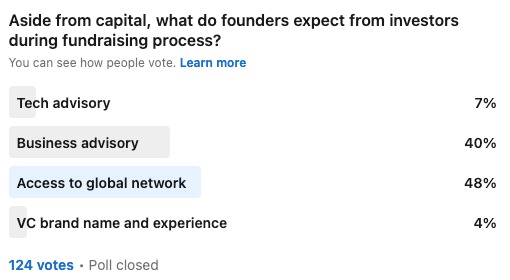

In line with the above statement, as many as 48% have high expectations for access to global investor networks, followed by business advisory (40%), technology advisory (7%), as well as VC brand name and experience (4%)

LinkedIn polling regarding startup expectations towards investors / DailySocial

LinkedIn polling regarding startup expectations towards investors / DailySocial

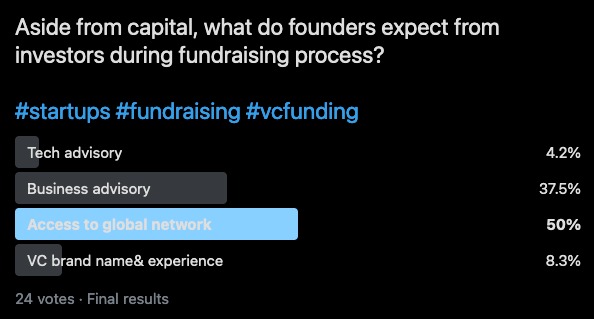

Twitter polling regarding startup expectations towards investors / DailySocial

Twitter polling regarding startup expectations towards investors / DailySocial

In this survey, Shipper's Co-founder, Budi Handoko said that investors already have a lot of experience in managing a business. The role of investors is very important in providing input regarding trends and business models to be explored in the future.

In the context of VC as an investor, eFishery's Founder, Gibran Huzaifah added that they can help with the access to global investor network, especially for funding in the next round with a bigger size check.

Track record as the main factor

Next, what are the criteria that respondents looking for in investors? The partners' track record is at the top of 85.7%, followed by personalities and portfolio ranks with 57.1% respectively, managed funds 42.9%, also portfolio feedback and aligned vision and mission 14.3%.

Budi said, it is important to know the track record and positive feedback of the portfolio before accepting an investment. This is because some investors may act persuasive during the 'approach', then turn into controlling moed as they made the investment.

Gibran agreed to the statement, it is important to know how investors work ethic and how they determine the funding hypothesis. These criteria can be the key to considering whether investors and startups can collaborate together.

"Another important consideration is the track record of investors' managed funds, regarding the fund cycle in what year and the total fund size in particular. This will affect their exit expectations and how strong they can continue in the next funding round," Gibran said.

For Zenius' Co-founder, Sabda PS, another equally important criterion is finding investors who have an understanding of how to sustainably create a deep and broad impact. This point becomes very relevant to the extend of the Indonesian education with all the great challenges.

Struggling for investors

All respondents stated that it is difficult to find investors who understand the startup business in certain sectors, the intricacies of the Indonesian market, along with work ethics. According to respondents, it is not easy to find investors with the same value and believe that there are lots of other things besides numbers.

"We believe that good product sells itself. The agreement of time to pocket a return on investment (ROI) is tough if it is forced. This is as long as we prefer to [seek funding] through bootstrapping," told one respondent.

Gibran added that it was difficult for him to find investors as few people understood the business model he was running in the agritech sector. Due to this condition, he admitted that he had experienced difficulties in convincing investors, especially in appreciating progress. The benchmarks in the agritech sector was not really build then, therefore, it was difficult to find a round size comparison and valuation.

VCs set more focus on managing business growth

Regarding startup funding sources, Venture Capital (VC) is the investor category most chosen by respondents at 71.4%, followed by Corporate Venture Capital/0CVC, private equity, corporations with 28.6% each, and the rest was angel funds at 14.3%.

One respondent said, corporations are considered to be more mature, calm and stable in terms of business. However, there are also respondents who think that VC is more suitable for long-term, lighter, and generic investments.

On the other hand, Gibran believed that VC is more focused on business growth, there is no takeover and strategic collaboration efforts like CVC. In addition, VCs with experience and a strong team can provide insight into strategy, organizational design, and business models.

"From technology support, some VCs provide channels to tech talent and best practices. Some also have internal teams that can support development. As a startup, technology becomes defensibility. VCs who can provide this support will bring a lot of value to the company," Gibran explained.

Most of our respondents also have a high tendency to seek foreign investors (42.9%), especially investors who have networks or specific interests in more niche industries, such as sustainable innovation. There are also those who are interested in trying to invest through crowdfunding (14.3%).

When you get investors, founders has other expectations include business advisory by 85.7%, then participation for the next round and to be linked to a global investor network of 57.1% respectively, and for investors get into the advisory ranks of 14.3%.

"I don't think there is a 'certain type' of investor that is sought after, it's rather the person and what is the best funding strategy for the startup. Therefore, it can be a match between goals and long-term relationships as a whole. For example, SME enabler startups will be very strategic to join Sembrani and received investment from BRI Ventures," Kuassa's Co-Founder, Grahadea Kusuf said.

– Original article is in Indonesian, translated by Kristin Siagian

Sign up for our

newsletter

Premium

Premium