Discovering the Prospect of Securities Crowdfunding for Startup Ecosystem

Four operators are already submit for SFC license

OJK's act to expand alternative capitals for SMEs from equity crowdfunding (ECF) to securities crowdfunding (SCF) should be appreciated as the previous regulation had many cracks that did not accommodate SMEs, which were most are yet to be a form of limited liability companies.

The detailed regulations are contained in POJK 57/2020 concerning Securities Offerings through Information Technology-Based Crowdfunding Services, replacing POJK 37/2018 which has a limited concern to stock-based crowdfunding services and Islamic stocks.

The regulation, which contains 13 chapters and 92 articles, contains the detail of licensing, business activities, obligations and prohibitions, reporting, practice of securities offering and trading, also sanctions.

The extension does not necessarily eliminate the presence of the ECF. Chairman of the Indonesian Association of Crowdfunding Services (ALUDI) Reza Avesena, who is also the Co-Founder and CEO of Santara, emphasized that the ECF function still exists and remains an alternative that can be of interest to publishers and investors.

"With SCF, organizers can issue securities not only based on equity but also based on debt or sharia-compliant stocks (will be referred to as sukuk). It is spelled on Article 91," he explained to DailySocial.

Avesena explained that the issuance of sukuk has now adopted what is applied by the capital market regulator. The requirements used by the IDX for issuing sukuk, such as the role of DPS (Sharia Supervisory Board) or ASPM (Capital Market Sharia Expert) recommended by DSN MUI, the role of sharia custodian banks, and the role of KSEI as custodian.

Furthermore in this SCF service contains several important points:

A. Bidding duration: 12 months (one time or more) B. Securities offered: Equity securities, debt securities, and sukuk C. Bidding value: Up to IDR10 billion D. Offer period (each offer): 45 days E. Offer is null and void: If the minimum fund is yet to fulfill, the offer is null and void. F. Equity Securities: It is prohibited to use more than 1 provider G. EBUS (Debt Securities and/or Sukuk): It is prohibited to raise new funds through the LUD before the Issuer fulfills its obligations to investors (except for EBUS progressive offers) H. Cancellation offer: Issuers can cancel offers of securities before the end of the offering period by paying a penalty to the operator

CORE Indonesia's economist, Yusuf Rendy Manilet said that the presence of SCF is a positive step for the domestic capital market because it can increase the amount of raising funds from the capital market. In addition, SCF has deepened the variety of instruments in the capital market as there are many financing instruments that have not been fully explored.

"This is a good thing, especially for the small and medium enterprise sector which is often hampered by capital issues. The impact will certainly be in line with the government's efforts to deepen ownership of domestic investors,” he explained as quoted from Bisnis.com.

Bank Permata's VP Economist, Josua Pardede agreed on this. He said the emerging SCF will have a positive impact on the capital market in line with the increasing demand for shares from domestic investors. This is clearly visible as the increasingly limited impact of foreign investors' entry and exit on stock movements.

"SCF will deepen the stock market and encourage the empowerment and corporatization of SMEs," he said.

Source: Depositphotos.com

Source: Depositphotos.com

The story behind ECF to SCF

Amvesindo's Chairman, Edward Chamdani said that OJK's reason for issuing POJK 37/2018 was due to the regulator's decision to issue an ECF that is yet to fully understand the coverage. After issuing the POJK, the association provides insights from venture capital, for example, mandatory convertibles (mandatory convertible bonds) count as equity. Meanwhile, in the capital market, it is still considered a loan as long as it's not the due date.

The concept differences occur as the regulations in the capital market are stiffer in regards to the regulations at the Ministry of Law and Human Rights. Also, after the issuance of POJK 37, there's still a crack which finally completed by OJK through POJK 57. He saw OJK's concern to the insights from Amvesindo that securities such as bonds or KIK participation units could be secured.

"Instead of making a circular, OJK finally made POJK 57, which is embedded with POJK 37. Therefore, securities instruments with a more open characteristic can be crowdfunded, not just equity," he said as contacted by DailySocial.

Source: Amvesindo

Source: Amvesindo

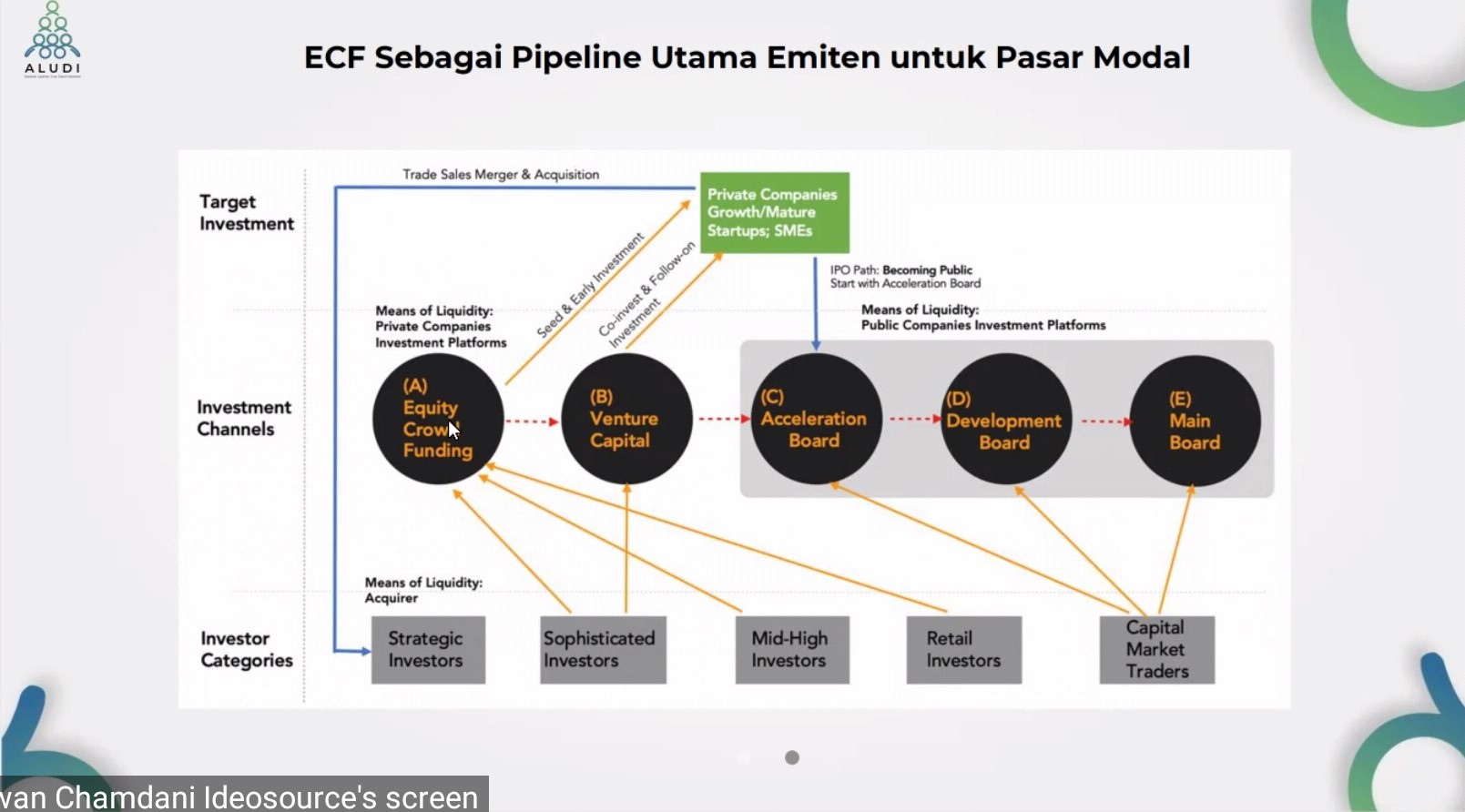

He continued, the thing about SCF is it can be a new breakthrough for the startup ecosystem because it can be an attractive medium for angel investors, VCs, or accelerators expecting to collaborate with SCF organizers and fund SMEs.

There are many possibilities, for example, creating a joint venture company that functions as a pool of funds with a more open characteristic to invest in companies that are included in the SCF platform. Next, to be empowered by the accelerator players for a class upgrade and enter the accelerator board on the IDX. It could also be an angel investor or VC who directly injects funds for these SMEs.

Venture capital that does not adhere to a growth mindset can also invest. The SME businesses that enter the SCF platform are curated, not haphazard, and have stronger business fundamentals than most technology startups oriented towards "burn money" strategies.

Growth mindset-oriented venture capital companies also present. The misconception that VC is only interested in entering technology startups can also be suppressed as they start to look into many sectors. These possibilities can occur because there is a wider range of investors involved.

In terms of regulations, OJK is being more strict for SCF players than p2p lending, which still finds fraudulent investment because some players are foreign and have no representative offices in Indonesia. In fact, OJK does not enforce any provisions for registered status, the operator must have a new license to operate.

The requirements to obtain a license are very serious, not limited to understanding the business model, but must be ISO 27001 and audited by a committee that is a member of the IDX. "Because this is a mini stock exchange for private investors, we have to be strict from the start."

Upgrade to SCF

OJK recorded issuing four operating licenses to four companies until the end of last year. They are Santara, Bizhare, Crowddana, and LandX. In total, these four companies have raised IDR185 billion in funds.

Meanwhile, OJK has noted that there are 16 prospective operators still in the ECF licensing process and three prospective organizers in the SCF licensing process. Two of the three referred to are Santara and Bizhare. "It's in the final stage, hopefully, it can be issued [permit] this February," Avesena said.

Santara has prepared a number of plans, for instance, for the issuance of sukuk, it has obtained a recommendation regarding the TAS (Sharia Expert Team) from the MUI DSN. However, even if the permit has been issued, the company will not immediately focus on SCF this year as it has first chosen to focus on issuing ECF.

"Because the ECF business model is very mature in our internal. However, that does not mean we will not issue sukuk, it is more necessary to educate the market and the audience first."

Bizhare's Founder and CEO, Heinrich Vincent said to DailySocial that the company chose to transform into SCF, not a pivot, in order to develop a pre-existing business model.

"Indeed, it is intended to make it easier for the community, especially SME businesses, to obtain capital with a more diverse choice of schemes. To be able to support Indonesia's economic development and open up wider employment opportunities."

Soure: Bizhare

Soure: Bizhare

He continued, Bizhare's SME business that received funding through the ECF scheme will continue to run and the company alone delivers innovations for the category in this service product by releasing Secondary Market services which will be released in early February 2021.

This service is a strategy to increase the liquidity of the issuer's shares, as well as an exit strategy for investors. In an official statement today (3/2), Heinrich explained the benefits of the Secondary Market for SME publishers, to buy back their shares in the Secondary Market, if there are investors who want to sell their shares.

This way, a mature financial service system will be democratized, such as the capital market, which was initially only accessible to the upper-middle class, now accessible to SMEs throughout Indonesia. Investors can conduct transactions (bidding) and offer (shares) safely and conveniently.

“Bizhare Secondary Market is available for publishers operating at least a year, have been registered with KSEI, and/or are in accordance with the resolution of the GMS of Issuers. The Secondary Market will be opened every 6 months with the Secondary Market opening for 10 working days,” Vincent said.

Vincent is optimistic that SCF will make it easier for SMEs to choose the type of funding that suits their preferences, whether it's in stocks, bonds or sukuk. In terms of requirements, the issuers are not only for limited liability companies, but also for cooperatives, CVs, and so on.

"We'll continue to provide stock offerings for an increasingly attractive and diverse array of SME businesses. Currently, Bizhare is opening funding for various businesses that can be invested starting from IDR 50,000 per share. We are optimistic that there will be many businesses of Indonesian youth to grow rapidly thanks to our services as SCF, therefore, the development of Indonesian economy will be even more extraordinary."

Bizhare is targeting more than 200-300 UKM to open funding through Bizhare this year. In terms of investor, the total investment value is expected to grow between 5-10 times. This target is to achieve with company innovation not only through expanding services to SCF but also additional types of businesses besides SMEs and franchisees, including technology startups.

"In terms of product, we will soon launch a new feature, it's the business profile for prospective publishers can easily apply for funding and list their profile on Bizhare. In addition, the application for Android and iOS are targeted to launch this year."

Vincent continued, "There are various strategic partnerships with various parties to be announced in the near future. In terms of funding, we're to start discussing with various investors and VCs to join Series A funding by the end of 2021. "

Massive education is necessary

The SCF market potential can be measured from the 60 million estimated number of MSMEs. In order to pursue this, ALUDI has a lot of homework to do. Industry optimism needs to be followed by massive education from all stakeholders in order to create a healthy ecosystem as the opportunities will get wider.

Avesena said financial literacy, integrity, legality, and understanding of the capital market have to be improved from an SME business perspective. Meanwhile, as the investors, literacy in understanding investment risk should be enhanced. It is considering each investment instrument has a different level of risk and level of understanding.

Another thing that needs to be upgraded is a public trust and lack of talent in the financial industry. Chamdani emphasized that in terms of educating investors, they should not be mistaken because this is a new investment instrument, such as stocks but not as liquid as stocks and the issuing company is relatively new.

"However, this is attractive because it contributes to SMEs, they have a fundraising route where banks or other financial institutions cannot be involved. That is an opportunity."

He expects that if this instrument becomes more attractive to SMEs, the costs for listing securities in KSEI will be cheaper. Moreover, KSEI is currently promoting scriptless securities registration with ongoing system updates.

"KSEI's potential could be a scriptless pattern for private companies to become a breakthrough, but the cost issue could be a burden on the platform, this becomes a concern."

In terms of the perpetrators, Vincent said that the company prepares various programs every week to provide information about SCF online for investors. "We are actively working with the seller community, starting from the SME business community, seller marketplaces, and many others to educate business people in terms of strategies to develop their business through Bizhare funding," he concluded.

–Original article is in Indonesian, translated by Kristin SiagianHeader: Depositphotos.com

Sign up for our

newsletter

Premium

Premium