Lippo Group's John Riady Takes on the Conglomerate Investment in the Technology Landscape

Under John's leadership, the Lippo Group is passionate about developing the digital economy, including transforming the group as a whole.

This article is a part of DailySocial’s Mastermind Series, featuring innovators and leaders in Indonesia’s tech industry sharing their stories and point of view.

Based on a journal entitled, "The Conglomerate Corporation" published on the digital library JSTOR, Conglomerate is defined as a business corporation producing products or services of several industries that are unrelated with respect to raw material sources, product development, production technology, or marketing channels.

Lippo Group is one of Indonesia's largest and most diversified conglomerates. Dr. Mochtar Riady, Founder of the Lippo Group, transformed a small family business as a proprietor of a bicycle shop into one of Asia’s leading conglomerates with an ever-expanding global footprint. It is now a strategic and active investment holding company with investments in property, malls, hospitals, school and university, supermarket and department stores, hotels, food retailing, banking, media, broadband internet, and digital technology.

John Riady, the group's successor, is currently leading the business as the Director of Lippo Group. He holds a number of positions within the group's subsidiaries. Apart from being a licensed attorney in the State of New York, he also holds degrees from several top global universities in business and political majors.

Under John's leadership, the Lippo Group is passionate about developing the digital economy, including transforming the group as a whole. In that case, Lippo Group made PT Multipolar Tbk. (MLPT) as the investment arm in the digital sector, considering that at least 40 technology companies have been backed by this fund.

However, John Riady does not necessarily let go of the conventional business tentacles that are the foundation of the Lippo Group. One of the four digital business strategies that John pioneered is to marry digital business entities with the Lippo Group ecosystem to strengthen the business in a sustainable manner. DailySocial had an amazing opportunity to be able to virtually discuss the phenomenon of Indonesian conglomerate's investment in the tech scene and translated it into below paragraphs.

Lippo Group is considered as one of Asia's largest and most diversified conglomerates. With various business sectors under its auspices, why deciding to focus on the technology landscape?

Let's begin with some background story. Lippo Group has started to invest in the technology sector since 2013. Eight years ago, our ex-Google friend introduced us to several unfamiliar names of early-stage companies, which today have become the leader in its respective industries. Back then, these companies have made an effective use of Google Ads, have good traction, and are rapidly growing.

Since then, we've started to invest in this type of business, including OVO, RuangGuru, Fave, Carro, TADA and others. We called them the first generation startups, including Grab, we were already part of them long before the company finally went public on NYSE.

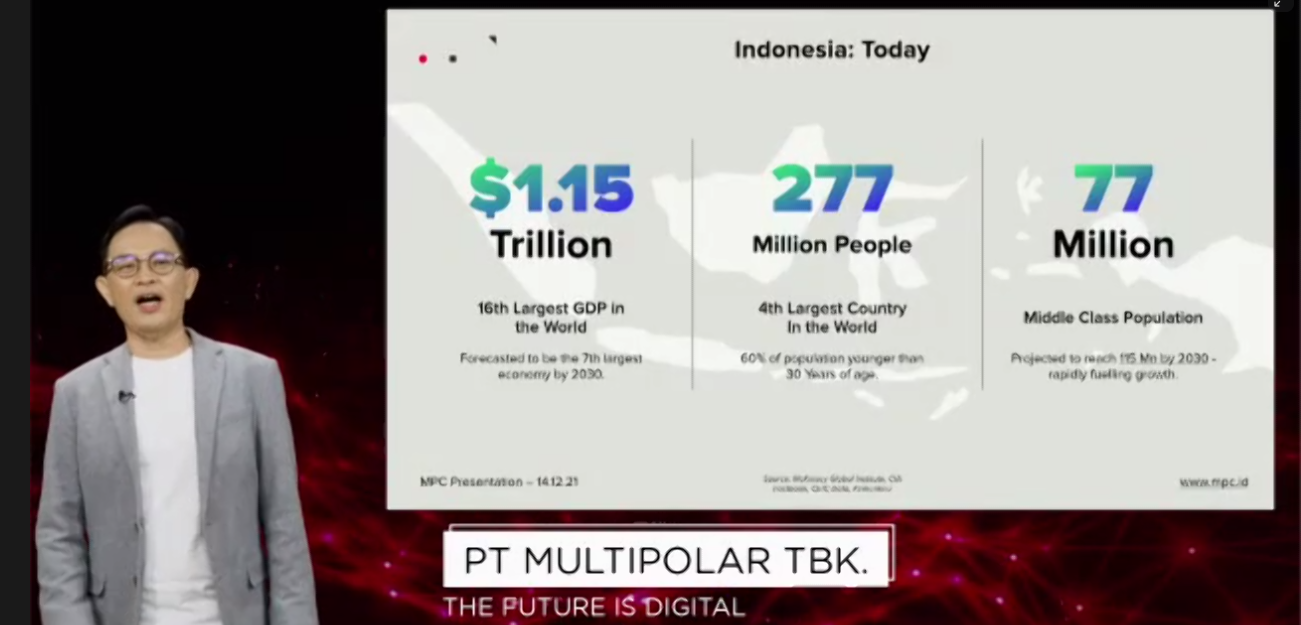

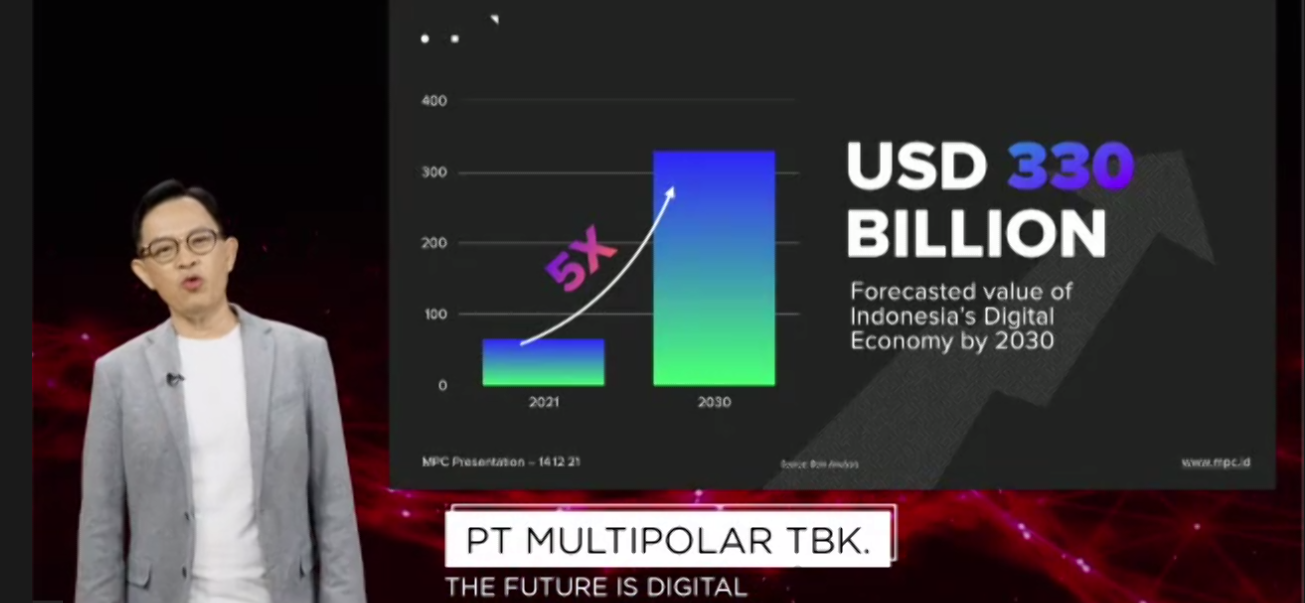

Fast forward seven years later, all of these early-stage companies have become giant techs. In our early investment, the total valuation of all the startups in Indonesia should add up to 1 trillion Rupiah. To date, with all the funding and growth, Indonesia's tech scene has multiply a dozen times at around $60 billion or almost a thousand trillion Rupiah. It is all happen within less than 10 years.

We believe this is just the beginning of this sector. The number can still multiply. As we see from China's exchange, there are around 25% tech companies already listed. Indonesia, on the other side, is only at 1% or 2%. There is still room to grow.

In terms of Lippo, this is an industry where we should penetrate and explore further. Therefore, we came up with four strategies to keep up with the emerging market, which are early-stage investment, late stage, partnership, and collaborations.

First, we invest in early-stage companies. We focused on investing in digital companies from the start. That way, we can learn together with the founders. Second, late-stage strategy, we invest in digital companies with pre-IPO (Intial Public Offering) status. Because after all, digital companies that have reached this phase have managed to survive, and subdue the dominance of hundreds of similar companies.

Third, we also partner with investors and global tech players. Especially the companies that have plans to expand to Indonesia. China's biggest insurance company, Ping An, for example. We became local partners and created joint ventures. It is a similar case with Luno, US-based crypto exchange, we support their expansion to the country.

Finally, collaboration with other great tech companies to open new opportunities and value creation for our business. In addition, we're undergoing digital transformation within our organisation, all three pillars would have positive impact on our development.

With various business sectors under Lippo Group's auspices, and you holds a number positions within the group's subsidiaries. How can you manage?

This is more likely about organization. Here's an outline, we divided Lippo Group's business into two. First, is Core Operations, where we have become the market leader. We have extensive knowledge and keep tabs on the operational excellence. Especially around medical and property business like malls, hotels, and hospital.

The other tribe is more like a strategic investment. The mindset that goes operational is important, but we need to get strategic. This space is for investment and partnership with founders, creating joint venture with overseas partners. Therefore, at the right time we are also ready to make asset divestment. We need to keep the cycle going in order to make our portfolio optimal and futuristic.

I, personally, am doing day-to-day work as the CEO of the first tribe, also being the Commissioner for several companies under its auspices. Unlike the operational-base job, the second tribe is more strategic.

But at the end of the day, it is people that determine our success. We aspire to be a talent-driven organization, and I am grateful for my colleagues and all the people who dedicate their lives each day to ensuring that we achieve our objectives and serve our customers well.

Have you ever encountered any challenges along the journey?

Our businesses are human-centered. We managed lots of companies in various sectors and different maturity stages. It takes a big effort to make this work. The only way to make sure this run well is investing bigger in the human capital management. This is frankly become the key of success for any organization. We often called as a talent-first organisation since we're getting deep-serious about talent issues.

Take a hospital for example, with all the doctors and nurses. The same goes to property and hospitality business. Without people to design a well-being community and marketing, it is just an empty lot. These talents are building a better infrastructure. That is the key to a great organization.

Previously you've mentioned about Lippo Group's first and second tribes? How can you explain the linkages between the two tribes?

There are some differences but there is also a connecting line. It is tricky, with companies in different maturity stages. There are opportunities and risks. The management would be different. At the early stage, the company's growth might be hindered with too many regulations. However, as it started to grow, it requires good governance to maintain the company's growth.

The thing is, all these companies are all providing solution to certain problems. Ultimately, these organizations are also generating profit by answering the challenges or issues of its consumers. The key is to stay true to the purpose. What will become the function and benefit for the environment and community around.

In terms of investment, Lippo Group has Multipolar and Venturra, can you elaborate on the positioning of each entity? How far the Lippo Group's involvement to the portfolio companies?

Venturra is a part of Multipolar that focus on investment to the early stage business. Multipolar is more likely the holdings of all the Lippo Group's investment.

In terms of involvement, it's different for each portfolio. There are companies where we are deeply involved due to ownership portion or the company's preferences. We may be act as Venture Builder with portfolios, such as OVO. However, there are companies where we only need to maintain and observe since they already an independent entity.

More Coverage:

In a way, we believe in the open ecosystem principal. In order for a tech company to outgrow itself, it has to be open for collaboration. What Lippo Group does to its portfolio is all the way supporting, we'll help with networking and positioning in the market.

What is your perspective about impact investment?

We did not distinguish impact with non-impact. I believe that every investment have to be impact investment. The key is to merge the purpose of our core organization and the profit. There used to be a dichotomy, an organization can make money in any way possible, and part of the profit will be shared for CSR, it could be related to business or not at all. Today, we are challenged to connect the two dots, purpose and profit. I think that is the tea, what is important is to stay committed to the core purpose.

I believe a successful company is a company that can make an impact in the life of community and environment. There is no such business without an impact. All investments should be impact investment.

As we already discovered that Lippo Group has been involved in various sectors in the digital landscape. What is your projection on the continuity of this industry for the next 5 years? What could possibly be the next rising sector? And how would you position the company in this scene?

There is still a huge opportunity lies ahead. Lippo as a Group will always look for the good founder with the full grasp of the industry, a good investment deal, and potential exit. For the next rising industry, from the early disruption is media company, then it goes to online shopping (e-commerce). Previously, we had ride-hailing in transportation, also in the health sector. I believe all of these sectors will reach the transformation and it is a positive thing. We need to support and optimize the potential.

Have you ever long for any other interest beyond the family business?

In business, I think people would be more likely to focus. We are still growing in the health business or property business, however, we need to maintain not only the growth but also the operational excellence. Growth can be many things. We expect to optimize growth in each of our companies and portfolios. The way to make it happen is to invest and collaborate with all the great men. According to our business concept, stewardship, we aspire to be a good stewards of what has been entrusted to us.

Sign up for our

newsletter

Premium

Premium